Research Report | In-Depth Overview of SOON Network & $SOON Market Analysis

1. Project Overview

-

30,000+ TPS

-

50ms latency

-

Transaction costs under $0.01

-

Over 27.63 million transactions

-

$15.63M in TVL

-

1.4M+ active addresses

Architecture

-

SOON Mainnet

-

SOON Stack

-

InterSOON Cross-Chain Protocol

Token Economics

2. Key Highlights

1. Decoupled SVM Brings Solana-Grade Performance to Multiple Chains

2. Modular Design with Flexible DA Layer Support

3. Proven On-Chain Performance

-

Processed over 27.63 million transactions

-

Reached 1.4M+ active addresses

-

Accumulated $15.63M in TVL

4. Fair and Decentralized Tokenomics

5. Strong Cross-Chain Interoperability

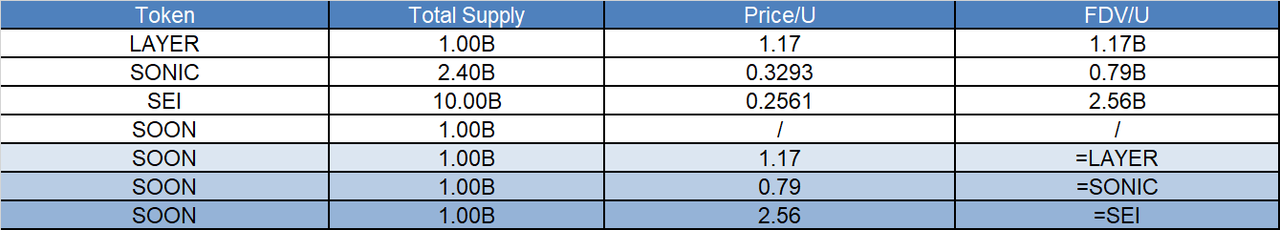

3. Market Valuation Outlook

4. Tokenomics

Allocation Breakdown

-

Community: 51% (510M) Distributed through fair launch mechanisms, NFT-based participation, and on-chain activities.

-

Ecosystem Fund: 25% (250M) For developer incentives, integrations, partnerships, guild subsidies, grants, and core infrastructure deployment.

-

Team & Co-Builders: 10% (100M) Reserved for core contributors and early builders to ensure long-term alignment and execution.

-

Airdrop & Liquidity: 8% (80M) Used to incentivize early users, provide initial liquidity, and fuel community momentum.

-

Foundation / Treasury: 6% (60M) For long-term reserves, protocol upgrades, R&D, operations, and security.

Unlock Schedule

-

Community incentives: Released in phases via on-chain activities, NFT engagement, and contribution-based airdrops

-

Team / Advisors: 9-month cliff, 36-month linear vesting

-

Ecosystem / Foundation: 12-month cliff, gradual release tied to ecosystem milestones

-

Airdrop & Liquidity: Partially released at launch, remainder allocated based on market conditions and AMM setups

Token Utilities

-

Governance: Participate in governance decisions for SOON Mainnet and SOON Stack

-

Native Asset: Pay gas fees, deploy contracts, and bridge assets across chains

-

Ecosystem Incentives: Reward developers, infra providers, and content creators

-

Staking: Future implementation of "Fast Finality" mechanism with 3% APY for validators staking $SOON

5. Team & Fundraising

Team

Notable Team Members

-

Jiwon Park – Former Global Content Director for MapleStory (SVP at Nexon), driving the IP’s Web3 expansion

-

Steve Chae (Heung Suk) – Nexon’s Web3 Strategy Lead, spearheaded Avalanche subnet integration and NXPC tokenomics

Fundraising

-

January 2025 Round: Raised $22M, led by Hack VC

-

Investors Include: SNZ Holding, MH Ventures, ABCDE Capital, Anagram, ArkStream Capital, GeekCartel, PAKA, IDG Capital

-

Notable Angels:

-

Kartik Talwar (Co-founder, ETHGlobal)

-

Mable Jiang (ex-Multicoin Partner)

-

Jonathan King (ex-a16z)

-

Alex Pruden (CEO, Aleo)

-

Victor Ji (Co-founder, Manta Network)

-

6. Risk Factors

-

Sustainability of On-Chain Metrics Despite impressive TPS (30,000+), low latency (<50ms), and 27M+ transactions, current application depth remains limited. Some activity may be incentive-driven. If ecosystem development stalls, TVL and activity could see short-term volatility.

-

Competitive Pressure from Other Modular Chains With the rise of competitors like Eclipse (ZK + EVM) and Movement (MoveVM Rollup), the long-term defensibility of SVM modularization is debated. Without strong ecosystem stickiness or dev adoption, SOON may face narrative dilution in a crowded field.

7. Official Links

-

Website: https://soo.network/

-

Twitter: https://x.com/soon_svm

-

Discord: https://discord.com/invite/soon-svm

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hotcoin Research | Fusaka Upgrade Approaching: Analysis and Outlook on Ethereum Long and Short Positions

This article will review Ethereum's recent performance, provide an in-depth analysis of the current bullish and bearish factors facing Ethereum, and look ahead to its prospects and trends for the end of this year, next year, and the medium to long term. The aim is to help ordinary investors clarify uncertainties, grasp trends, and provide some reference to support more rational decision-making during key turning points.

Crypto Market Surges as Bitcoin Rebounds and Privacy Coins Shine

In Brief Bitcoin rebounded over the weekend, testing the $86,000 mark. Privacy-focused altcoins Monero and Zcash showed notable gains. Total market value surged, crossing the $3 trillion threshold again.

Crypto Markets Rebound as Traders Signal Seller Fatigue

In Brief Crypto markets rebounded amid significant liquidations and oversold RSI signals. Weekend trading conditions with thin liquidity influenced rapid price shifts. The rebound's sustainability remains uncertain, prompting scrutinous investor attention.

Cardano : Network security questioned after a major incident