-

Bitcoin has seen over $1 billion in daily inflows, signaling strong demand and potentially paving the way for a price surge toward $105,000.

-

Investor sentiment remains strong, with consistent capital inflows and positive ETF flows supporting Bitcoin’s momentum toward new highs.

-

Bitcoin is trading at $98,823, just under the critical $100,000 resistance; breaching this level could target $105,000, while failure to break through risks a drop to $93,625.

Bitcoin’s recent inflows suggest significant market strength as it approaches the critical $100,000 mark, with the potential for further growth.

Bitcoin Finds Investors’ Support

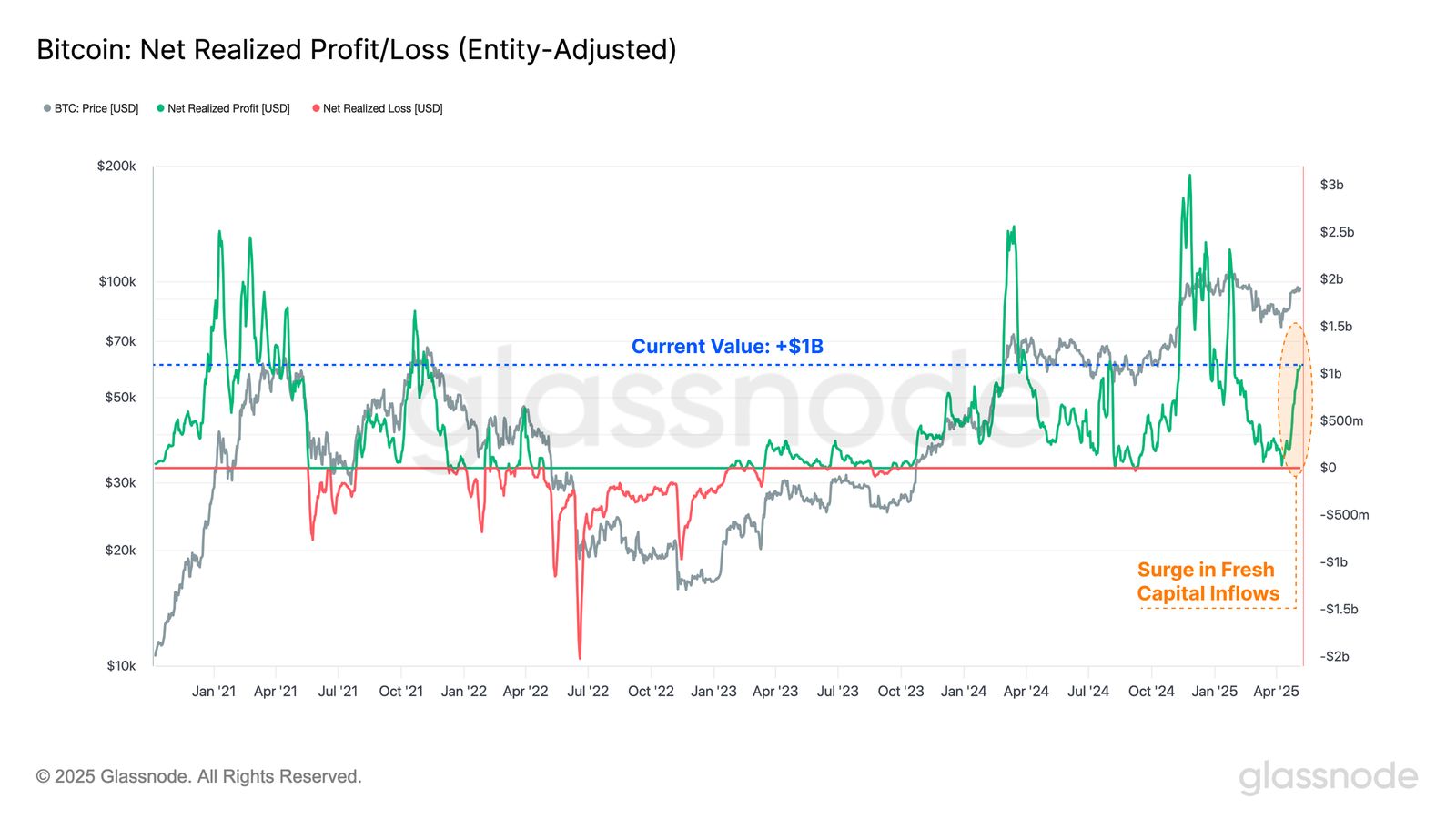

In recent weeks, we have seen over $1 billion in daily net capital inflows, signaling a return of demand-side strength for Bitcoin. The Net Realized Profit/Loss metric reflects these inflows, showing that new investors are absorbing the incoming supply. Sellers are capitalizing on their profits, while buyers continue purchasing Bitcoin at the current market price.

Usually, heavy profit-taking is considered a bearish sign as it tends to lead to a market top. However, in the case of Bitcoin, this point comes when realized profits cross the $1.5 billion mark, which leaves BTC room for growth at the moment.

Furthermore, since October 2023, the market has maintained a profit-driven regime, with capital inflows consistently exceeding outflows. This steady influx of new capital reinforces the positive sentiment in the market and mirrors the bullish momentum seen during the October 2023 rally. This equilibrium between supply and demand indicates strong market sentiment, signaling that Bitcoin is poised for further gains.

Bitcoin Net Realized Profit/Loss. Source: Glassnode

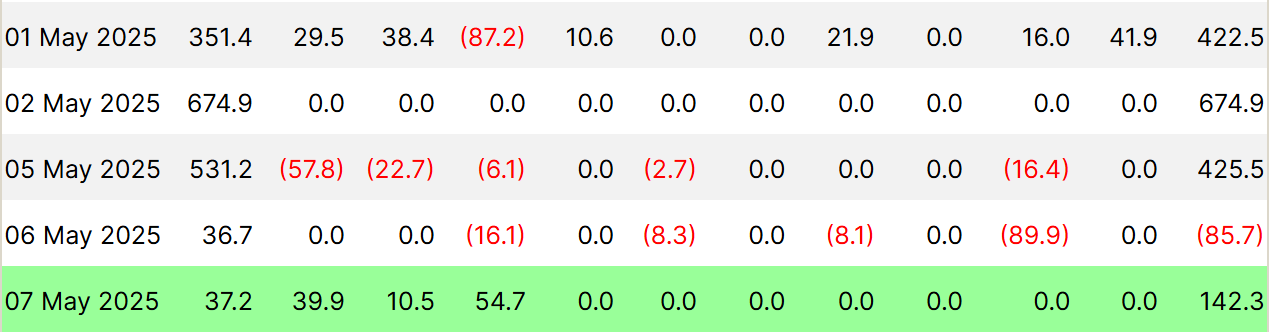

In addition to strong market sentiment, the overall macro momentum of Bitcoin is supported by positive spot ETF flows. These inflows have remained largely positive over the past week, with the exception of May 6, when $85 million in outflows were recorded.

This dip was linked to uncertainty surrounding the US Federal Reserve’s decision on interest rates. However, the overall trend in spot ETF flows continues to suggest strong demand, which could help support Bitcoin’s price movement.

Bitcoin Spot ETF Flows. Source: Farside

BTC Price Is Exhibiting Strength

Bitcoin’s price is currently trading at $98,827 on the daily chart, just under the critical $100,000 resistance level, marking a two-month high. If the market continues to exhibit strength and investor confidence remains solid, Bitcoin may flip $100,000 into support, paving the way for further gains.

The next major target for Bitcoin is $105,000. Breaching this level is crucial for Bitcoin to maintain its momentum and remain firmly in the six-digit range. If Bitcoin manages to secure this level, it could eventually make its way to $110,000, extending the bullish rally.

Bitcoin Price Analysis. Source: TradingView

However, if market conditions take a downturn and investor sentiment weakens, Bitcoin could struggle to break through the $100,000 resistance. In this scenario, the price may fall back to $93,625, invalidating the current bullish outlook and delaying any recovery.

Conclusion

In summary, Bitcoin’s recent performance showcases its resilience, supported by strong inflows and a positive investor outlook. The focus remains on the $100,000 resistance level, which could unlock further price gains if surpassed. As market dynamics evolve, investors are advised to monitor key metrics closely.