Bitcoin Price Prediction: The Stock Market Just Sent a Major Buy Signal — Time to Buy?

Bitcoin Price Prediction: The Stock Market Just Sent a Major Buy Signal — Time to Buy?

Bitcoin Price Prediction: The Stock Market Just Sent a Major Buy Signal — Time to Buy?

Bitcoin (BTC) is trading just below $97,000, and traditional markets may be signaling further upside. After bouncing off $96,244 support, BTC has held firm—even as macro volatility lingers. The S&P 500’s recovery from its April lows is now being interpreted as a broader green light for risk assets, including crypto.

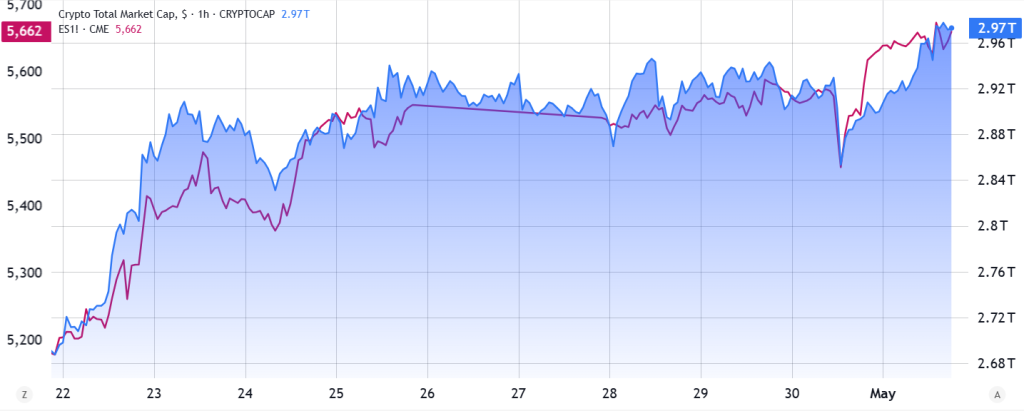

Since March, the total crypto market cap has climbed 29%, while the S&P 500 is down 2%. Bitcoin is consolidating just under $97,500 resistance. A breakout could open the door toward $98,500 and $99,438.

Source: TradingView/Cointelegraph

Source: TradingView/Cointelegraph

Key levels to watch:

- Immediate support: $96,244

- Key resistance: $97,500 → $98,500 → $99,438

- 50 EMA (2H): $95,407

- MACD: Bullish but moderating

Nasdaq Lags, Bitcoin Leads

The divergence between Bitcoin and the Nasdaq is drawing attention. As of early May, BTC is up 2.7%, while the Nasdaq is still down 4.5%.

The Nasdaq continues to face pressure from interest rate uncertainty and fading tech momentum. In contrast, Bitcoin has been buoyed by ETF-driven flows and the prospect of easier monetary conditions.

BTC has reclaimed its 50-day EMA, while the Nasdaq remains below—a potential sign of shifting market leadership. This divergence is fueling renewed conversation about a long-awaited decoupling.

Liquidity Shift May Keep Crypto in Play

Wall Street earnings have exceeded expectations, with Microsoft reporting a 13.2% YoY revenue gain and Meta delivering a strong beat. The S&P 500 has climbed from 4,835 to 5,635 in less than a month. Meanwhile, the Federal Reserve is now considering resuming asset purchases, a move that typically lifts liquidity-sensitive assets like Bitcoin.

Trade tensions between the U.S. and China have also eased slightly, with new waivers and tariff adjustments suggesting both sides are stepping back from escalation.

What’s driving the bullish outlook:

- ETF demand and liquidity backdrop improving

- Strong earnings from Microsoft, Meta

- Fed signaling more dovish policy tools

- Bitcoin outperforming tech stocks

Conclusion: A Decoupling in Progress?

Bitcoin hasn’t fully decoupled from equities—but it’s leading. Over the past six months, crypto has risen 29%, while the S&P has lost ground.

Source: TradingView/Cointelegraph

Source: TradingView/Cointelegraph

With BTC holding above key technical levels and macro conditions turning more favorable, the risk-reward appears to favor the bulls—at least for now.

BTC Bull Token Crosses $5.22M as Flexible 78% Staking Yield Draws Investors

BTC Bull Token ($BTCBULL) continues to gain traction, crossing $5.22 million in funds raised as it nears its $5.96 million presale cap. Priced at $0.00249, the token has positioned itself as more than just a meme coin—offering real utility through flexible, high-yield staking.

Utility-Driven Tokenomics Fuel Demand

Unlike typical meme tokens, BTCBULL blends crypto culture appeal with tangible staking rewards. Investors can currently earn an estimated 78% APY while keeping their tokens fully liquid—unstaking is allowed at any time without penalties or lockup periods.

This model has resonated with investors who seek yield without sacrificing access, especially in a volatile crypto environment.

Current Presale Stats:

- USDT Raised: $5,226,067.3 of $5,963,550

- Current Price: $0.00249 per BTCBULL

- Staking Pool Total: 1,342,549,903 BTCBULL

- Estimated Yield: 78% annually

With less than $750K left before the next milestone, the presale window is narrowing fast. For investors chasing high yields with exit flexibility, BTCBULL is becoming an increasingly compelling contender in the 2025 crypto cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Cysic Network (CYS)

Decoding 30 Years of Wall Street Experience: Asymmetric Opportunities in Horse Racing, Poker, and Bitcoin

A horse race, a poker book, and the wisdom of three legendary investors led me to discover the most underestimated betting opportunity of my career.

Fed cuts rates again: Internal divisions emerge as three dissenting votes mark a six-year high

This decision highlights the unusual divisions within the Federal Reserve, marking the first time since 2019 that there have been three dissenting votes.

Antalpha highlights strong alignment with industry leaders on the vision of a "Bitcoin-backed digital bank" at Bitcoin MENA 2025

Antalpha confirms its strategic direction, emphasizing the future of bitcoin as an underlying reserve asset.