BlackRock and Five Other Entities Account for 88% of Tokenized Treasury Issuance

Show original

Data from RWA.xyz shows that six entities hold 88% of tokenized U.S. Treasury bonds. The largest tokenized wealth issuer remains BlackRock. The company's tokenized U.S. Treasury fund, BUIDL, has a market value of $2.5 billion, 360% higher than its closest competitor. The top six funds also include Franklin Templeton's BENJI, with a market value of $707 million; Superstate's USTB, valued at $661 million; Ondo's USDY, valued at $586 million; Circle's USYC, valued at $487 million; and Ondo's OUSG fund, valued at $424 million. These six funds collectively account for 88% of all tokenized Treasury issuance. (Cointelegraph)

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

A certain whale has rebuilt a position of 90.85 WBTC at an average price of $87,242.

BlockBeats•2025/11/24 05:53

Economist: December rate cut becomes highly probable again, Williams' remarks set the tone for the market

BlockBeats•2025/11/24 05:53

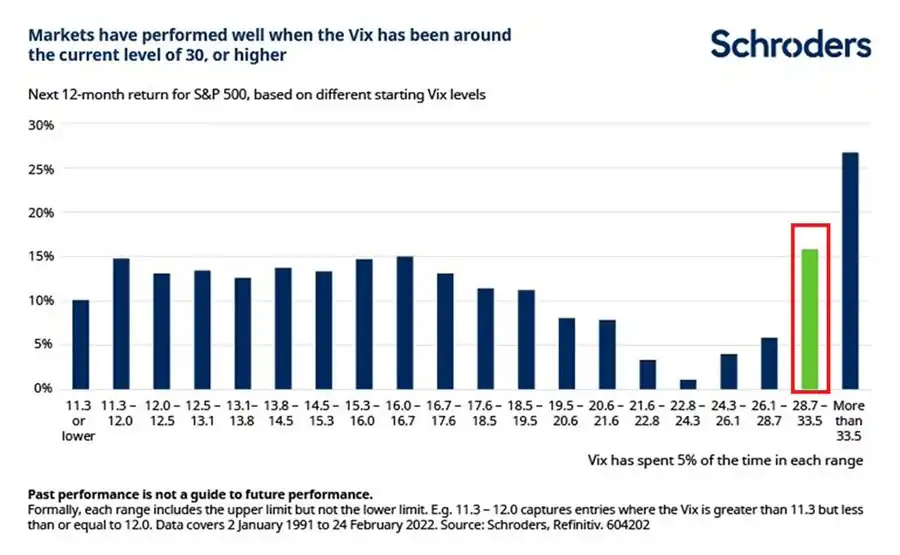

Analysis: When the volatility index VIX exceeds 28.7, the S&P 500 often delivers strong returns

BlockBeats•2025/11/24 05:53

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$87,087.36

+1.12%

Ethereum

ETH

$2,838.79

+0.70%

Tether USDt

USDT

$0.9996

+0.01%

XRP

XRP

$2.07

+1.27%

BNB

BNB

$849.84

+0.67%

USDC

USDC

$0.9998

+0.00%

Solana

SOL

$131.47

+1.31%

TRON

TRX

$0.2768

+0.72%

Dogecoin

DOGE

$0.1465

+2.21%

Cardano

ADA

$0.4138

+0.70%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now