Ethereum Tries to Recover After Capitulation, But $2,000 Remains Unlikely

Ethereum's recovery effort is under pressure as short-term holders look to sell for profits. Despite recent gains, a breakout toward $2,000 remains unlikely unless sustained support emerges.

Ethereum has recently shown an attempt to recover from the significant losses it sustained toward the end of March. The altcoin, often considered the leader in the smart contract space, is currently trading at $1,774.

While this reflects an effort to regain momentum, Ethereum’s recovery might be hindered by short-term holders (STHs) looking to capitalize on any immediate profits.

Ethereum Investors Are Prone To Selling

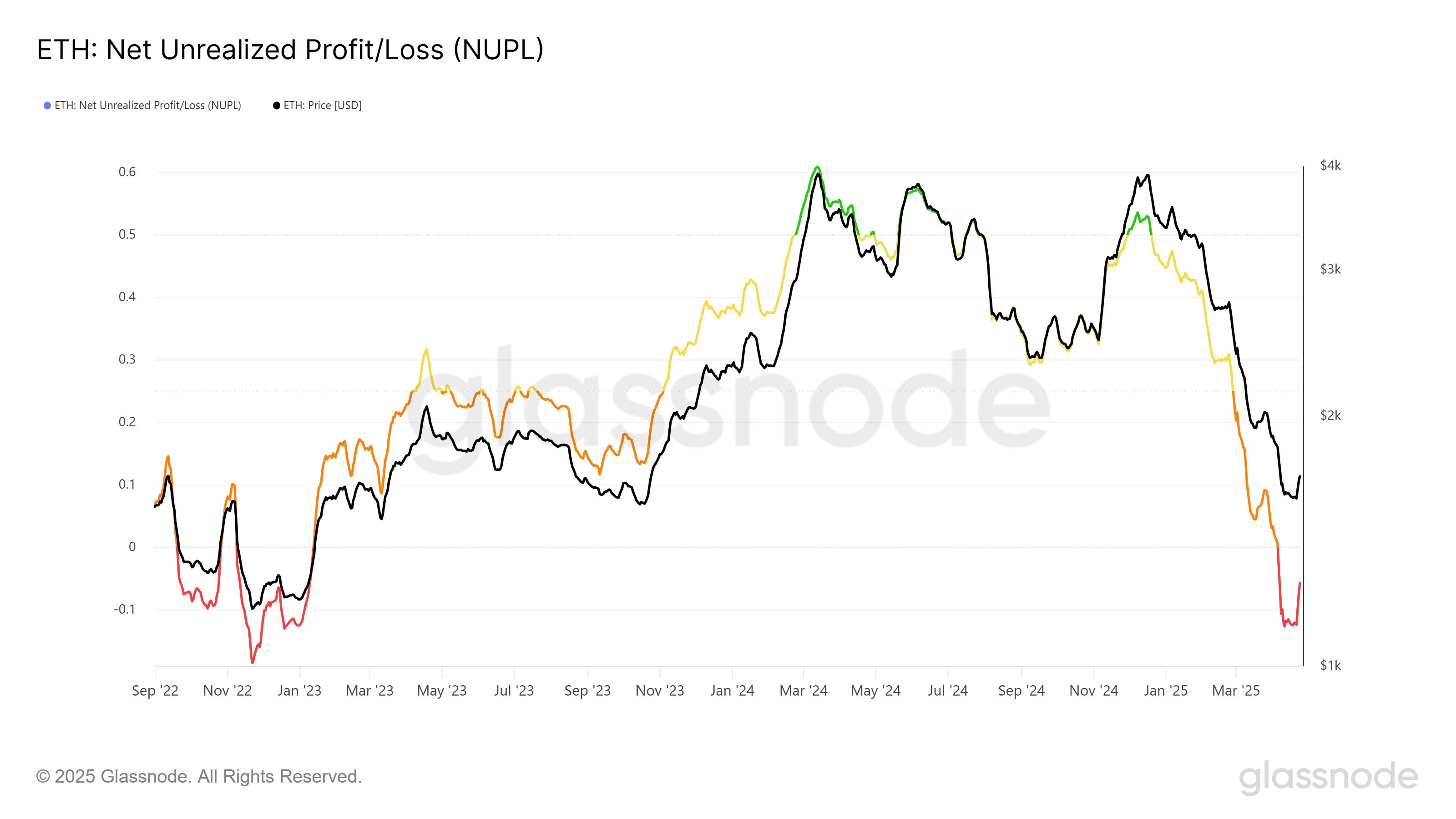

Ethereum’s network value and user activity are showing signs of a possible recovery, but its current market sentiment remains under pressure. The Net Unrealized Profit/Loss (NUPL) indicator, which gauges the overall profit or loss of coins in circulation, has entered a phase of capitulation.

Despite the uptick in Ethereum’s price, the underlying sentiment remains cautious. The increase in the NUPL could quickly reverse if short-term holders (STHs) decide to liquidate their positions.

Ethereum’s recovery hinges on investor confidence, with those holding onto their assets being the key to avoiding another sell-off. If more STHs choose to HODL instead of selling, Ethereum could see sustained upward momentum in the coming weeks.

Ethereum NUPL. Source:

Glassnode

Ethereum NUPL. Source:

Glassnode

On a broader scale, Ethereum’s macro momentum presents mixed signals. The Market Value to Realized Value (MVRV) Long/Short Difference indicator is currently deeply negative at -30%. This suggests that the market may face additional resistance in its recovery efforts.

The indicator highlights the disconnect between long-term and short-term holders, with the latter showing profits at a two-year high. The last time this occurred was in January 2023, when Ethereum experienced significant sell-offs, pushing the price lower.

The presence of STHs in a profitable position increases the likelihood of further selling pressure on Ethereum. As these investors are more likely to liquidate at the first sign of profits, the recovery could face challenges.

Ethereum’s price could struggle to maintain upward momentum, especially if short-term holders capitalize on their gains, pushing the altcoin back into a downtrend.

Ethereum MVRV Long/Short Difference. Source:

Santiment

Ethereum MVRV Long/Short Difference. Source:

Santiment

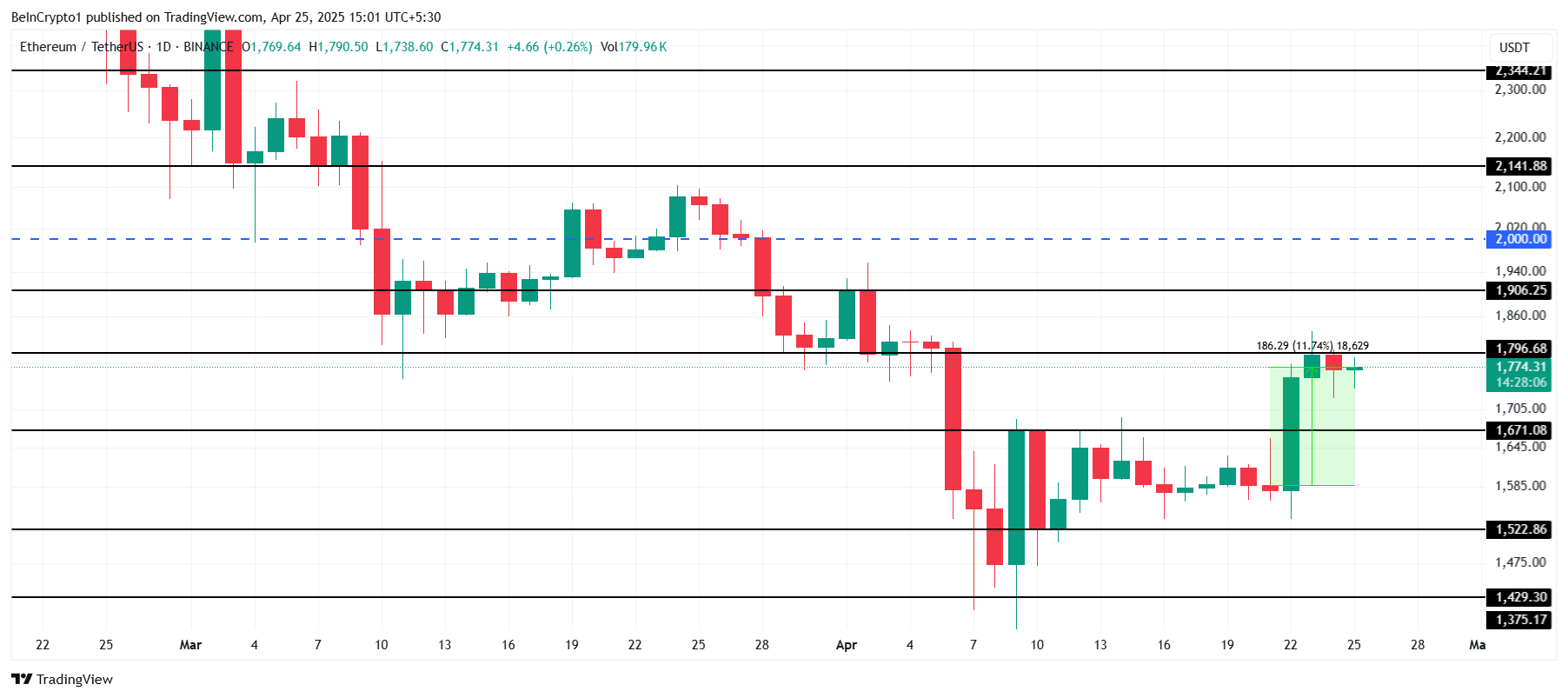

ETH Price Needs Support

Ethereum’s price has risen by 11% in the past week, currently trading at $1,774. It is now testing the resistance at $1,796, and breaching this level is crucial for Ethereum to continue its recovery toward the $2,000 mark. A successful breakout above this resistance would signal a continuation of the recovery trend, pushing Ethereum closer to its previous high.

However, considering the market sentiment and the current indicators, Ethereum’s chances of reaching $2,000 in the short term seem unlikely. Ethereum is at risk of falling below the $1,671 support, which could trigger a deeper pullback to $1,522. This bearish outlook suggests that the recovery may be short-lived unless strong buying support materializes.

Ethereum Price Analysis. Source:

TradingView

Ethereum Price Analysis. Source:

TradingView

If the broader market conditions remain strong, Ethereum could manage to breach the $1,796 resistance and even push past $1,906. A move above these levels would set Ethereum on track to reach $2,000, invalidating the bearish outlook and signaling a more sustainable recovery for the altcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

On the eve of Do Kwon's trial, $1.8 billion is being wagered on his sentence

Dead fundamentals, vibrant speculation.

Space Review|When the US Dollar Weakens and Liquidity Recovers: Cryptocurrency Market Trend Analysis and TRON Ecosystem Strategy

This article reviews the identification of macro turning points and the capital rotation patterns in the crypto market, and delves into specific allocation strategies and practical approaches for the TRON ecosystem during market cycles.

30-Year Wall Street Veteran: Lessons from Horse Racing, Poker, and Investment Legends That Inspired My Bitcoin Insights

What I focus on is not the price of bitcoin itself, but rather the position allocation of the group of people I am most familiar with—those who possess significant wealth, are well-educated, and have successfully achieved compounding returns on capital over decades.