Lorenzo Protocol Ecosystem Roundup — March 2025

Welcome to the March edition of our ecosystem roundup! This is your quick, monthly update on all key happenings across the Lorenzo Protocol ecosystem.

Let’s explore what’s new!

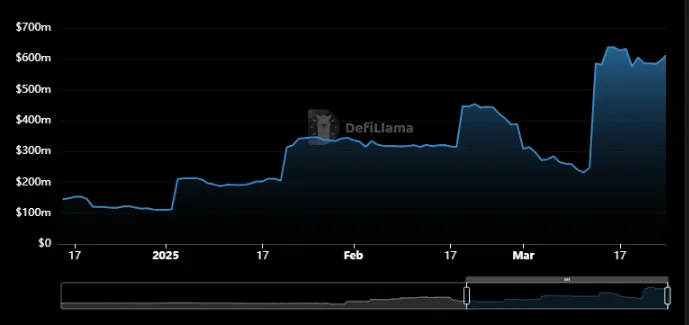

Lorenzo Hits $600M In TVL

We’ve officially crossed a major milestone — Lorenzo has now exceeded $600 million in Total Value Locked, with our latest all-time high reaching $637M, according to DeFiLlama.

This achievement is a testament to the trust our community has placed in us — and the momentum is only building.

Track our growth in real-time: Lorenzo on DeFiLlama

We’re just getting started. Let’s keep climbing!

enzoBTC and stBTC Go Live On Hemi Mainnet

We were excited to support our friends and partners at Hemi for their mainnet launch, with our enzoBTC and stBTC tokens going live on the chain for day 1 of launch.

Please note: The contracts are live, but functionality for the tokens are still to come. Stay tuned for future updates on activating your liquidity with Hemi!

Quietly Building

For team Lorenzo, March has been a month of quiet, intense work across all divisions.

We’re targeting significant expansion, new milestones, and exciting launches.

To everyone supporting us in the Lorenzo Nation, we thank you.

Final preparations are underway…

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BCH Surges 35.88% Over the Past Year as Institutions Embrace It and Network Improvements Roll Out

- Bitcoin Cash (BCH) rose 35.88% in a year amid growing institutional adoption and network upgrades. - Recent protocol upgrades improved scalability and security, boosting transaction speeds by 20%. - Regulatory clarity and increased fintech adoption have enhanced BCH’s legitimacy and investor confidence. - Sustained developer activity in open-source projects highlights ongoing efforts to optimize smart contracts and interoperability.

DOGE slips by 0.52% as ETF enthusiasm rises and Treasury holdings expand

- Dogecoin (DOGE) fell 0.52% on Dec 4 2025 but gained 3.34% monthly amid growing institutional interest and utility-driven developments. - 21Shares advanced its TDOG ETF filing with a 0.50% fee, partnering with BNY Mellon and Anchorage Digital to institutionalize DOGE adoption. - CleanCore expanded its Dogecoin Treasury to 710M tokens ($20M+ unrealized gains) through a $175M private placement to boost utility and market cap. - DOGE developer Paulo Vidal introduced D-IBAN protocol, enabling Dogecoin address

The Enduring Insights of R.W. McNeel and How They Apply to Today’s Cryptocurrency Investment

- R.W. McNeel's 1927 investment principles, mirroring Buffett's value-driven philosophy, emphasize intrinsic value, emotional discipline, and long-term utility—critical for volatile crypto markets. - The 2025 MMT token surge exemplifies behavioral biases like FOMO and overconfidence, aligning with McNeel's warnings against herd mentality and speculative frenzies. - McNeel's framework advocates assessing crypto projects by utility and governance rather than hype, offering strategies like intrinsic value foc

Long-Term Care and Dementia-Oriented Stocks: A Tactical Safeguard Against Rising Healthcare Expenses

- Global aging drives healthcare cost inflation, with U.S. dementia expenses hitting $781B in 2025, straining Medicare/Medicaid programs. - Long-term care ETFs like HTEC and HEAL outperform as health tech innovation addresses rising demand for remote monitoring and AI diagnostics. - Dementia-focused equities (Anavex, AbbVie) show resilience amid $7.7B market growth projections, aligned with aging demographics and policy reforms. - Strategic investments in care-tech and pharmaceuticals offer inflation hedge