Quant Analyst PlanB Says Bitcoin Correction ‘Normal Bull Market Dip’ After 30% Drop for BTC

Widely followed on-chain analyst PlanB says that Bitcoin’s ( BTC ) current correction is part and parcel of regular bull market conditions.

The pseudonymous analyst tells his 2.1 million followers on the social media platform X that the indicators he watches are still signaling bullishness for the flagship crypto asset.

Says PlanB,

“Even with today’s low bitcoin prices my on-chain indicators still signal bull market. So in my opinion this is a normal bull market dip and not a transition from bull phase to distribution phase (and then bear phase).”

Source: PlanB/X

Source: PlanB/X

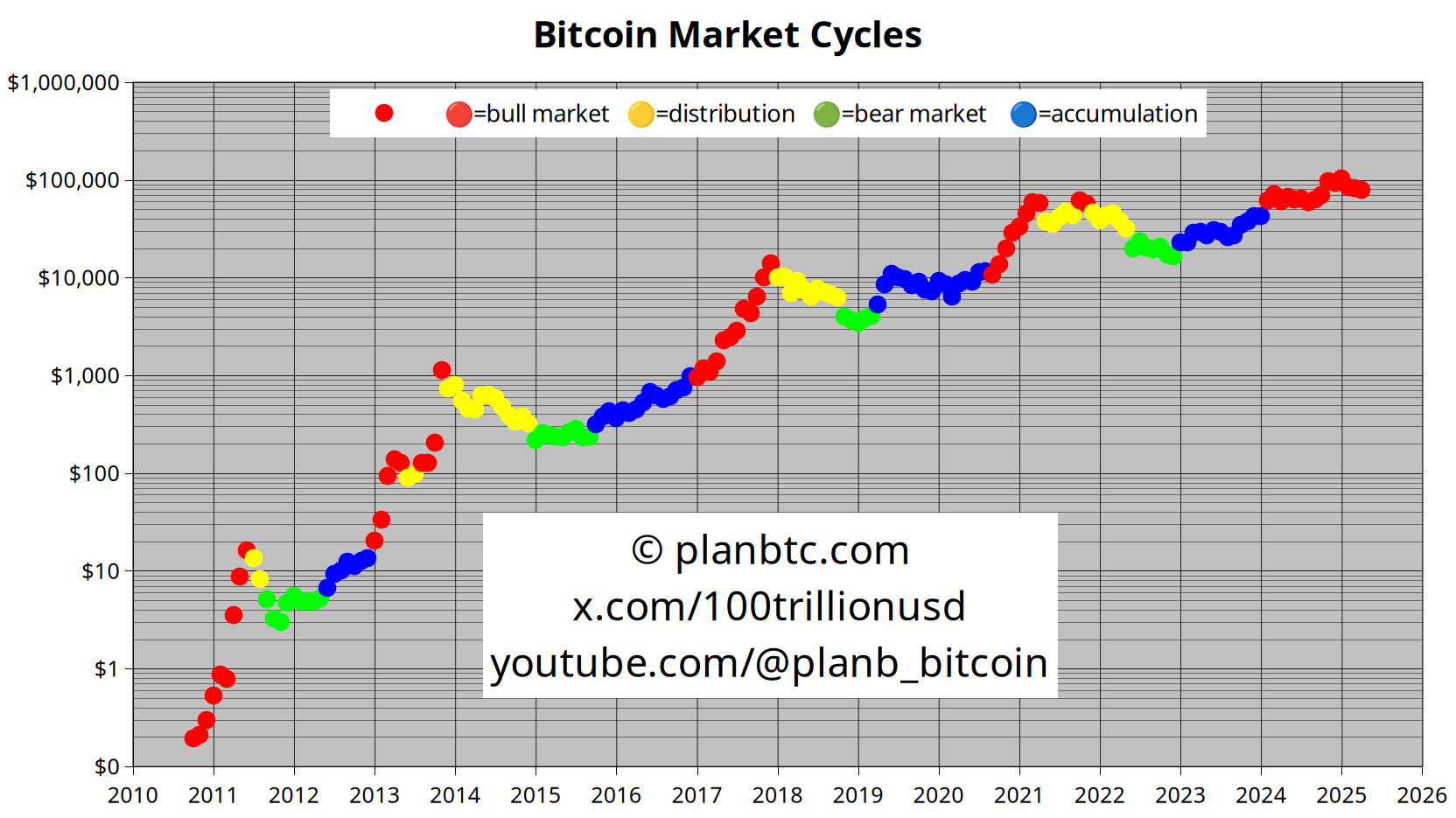

PlanB’s color-coded dot chart indicates the number of months until each halving – when BTC miners’ rewards are cut in half – with the red dots representing the beginning of the halving cycles.

In a recent video update, the analyst told his 209,000 YouTube subscribers that a combination of 200-week means suggests Bitcoin may soon enter an explosive uptrend based on historical precedent.

The analyst says that the 200-week arithmetic and the 200-week geometric are currently running close together on the chart, signaling a possible Bitcoin breakout.

“It might be that the bull market is still forming and that the [arithmetic mean] will separate again, will diverge again, from the geometric mean.

One more thing on those two lines. Notice that you can’t have a bear market or a big crash when the 200-week [arithmetic mean] and the geometric mean are together. The big crashes here [in 2021 and 2022] are happening when there’s a diversion between the two lines. Also, here in 2018, there was a big gap between the two [means]. Same here in 2014 and 2015.”

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Top Executives Accumulate ETH and BTC During $1.1B Sell-Off, Highlight 100x Growth Opportunity

- Bitcoin fell below $90,000 amid $1.1B liquidations, with BitMine/Bitwise executives predicting long-term "supercycles" for BTC/ETH despite short-term volatility. - BitMine added 54,156 ETH ($170M) to holdings, while Hyperscale Data bought 59.76 BTC via dollar-cost-averaging, signaling institutional confidence in crypto's value. - ETF outflows ($870M in one day) and LTH selling (815,000 BTC in 30 days) highlight bearish fundamentals, with $102,000 as critical support for Bitcoin. - Fed officials' cautious

Bitcoin Updates: MicroStrategy's Bold Bitcoin Investment Stands Strong Despite 57% Drop in Stock Value

- MicroStrategy's CEO reaffirms Bitcoin buying strategy amid market volatility, adding 8,178 BTC for $835.6M. - Despite 57% stock decline, MSTR's Bitcoin holdings reach $61.7B, funded by preferred shares and convertible notes. - Critics question debt-driven model's sustainability, but analysts praise its Bitcoin-per-share growth and $535 price target. - Saylor envisions $1T Bitcoin balance sheet, leveraging appreciation for credit products and reshaping global finance.

Ethereum Updates Today: Buddy Goes All-In on ETH with $13 Million Leveraged Wager Amid Market Slump

- Buddy Huang’s ETH long position was liquidated, prompting a $9.5M reentry amid market turmoil. - Market selloff attributed to macroeconomic pressures, with BTC dropping 28.7% below $90K. - A $1.24B ETH whale added 13,117 ETH despite $1.59M unrealized losses, signaling bullish conviction. - Institutional caution grew as SoftBank exited $5.8B NVIDIA stake, while Coinbase hinted at December 17th product launch. - Buddy’s $13M leveraged bet faces liquidation risk if ETH fails to stabilize above $3,000, highl

The Rapid Drop in COAI Shares: Red Flag or Investment Chance?

- COAI Index fell 88% YTD in Nov 2025, sparking debate over systemic collapse vs undervalued opportunity. - Market sentiment diverges from fundamentals: C3.ai shows 26% YoY revenue growth despite governance crises and $116M Q1 loss. - CLARITY Act regulatory uncertainty, leadership turmoil at C3.ai, and crypto frauds like Myanmar's $10B scam fueled sector-wide selloff. - C3.ai's $724M cash reserves and 69% gross margin highlight resilience, but legal battles and regulatory ambiguity persist as key risks. -