XRP correction may be ending as bulls watch $2 breakout zone

According to analysts, XRP is trading close to a key accumulation zone, which could strengthen its case for an upward rally.

In an April 8 X post , Analyst Dom pointed out that XRP is now filling a “liquidity void”, essentially correcting an inefficiency in price action from back in late November. That puts the asset in a tight range between around $1.50 and $2.00.

The analyst noted that the $2 mark serves as a critical resistance level and key accumulation zone. A clean break above it would signal a potential structure shift that could officially end the current downtrend.

At press time, XRP ( XRP ) was down 3.3% over the past 24 hours, exchanging hands at $1.80, while its market cap was seated at over $104 billion. Its daily trading volume had also dipped 42% to $6.3 billion.

Bullish catalysts for XRP

Nevertheless, a number of positive XRP-related developments are leading many traders to believe that XRP could be gearing up for a bullish rally.

First, the launch of Teucrium’s leveraged XRP ETF (XXRP) marks the first XRP-linked ETF in the U.S., offering double daily returns on XRP. This sets a major precedent for institutional involvement and legitimises Ripple-based investment products in traditional markets.

This milestone comes on the heels of the SEC dropping its appeal and settling the Ripple case with a $50 million penalty, effectively removing longstanding regulatory uncertainty around XRP. The legal clarity has sparked renewed institutional interest, with firms like Franklin Templeton, Bitwise, and 21Shares now pursuing spot XRP ETFs.

Excitement is also growing around the potential launch of a spot XRP ETF by the end of 2025. According to Polymarket data , approval odds have climbed back to 77%, recovering from a dip to 72% recorded on April 7.

Second, Ripple has announced the acquisition of prime brokerage firm Hidden Road in a $1.25 billion deal, one of the largest in the crypto industry’s history. The move expands Ripple’s institutional footprint by leveraging Hidden Road’s established client network, positioning Ripple as a more dominant player in global finance.

Third, on-chain metrics support a bullish outlook.

Data from Santiment reveals a steady accumulation by wallets holding 100,000 to 100 million XRP, typically considered smart money. This buying activity during the dip suggests strong conviction among larger investors, often seen as a precursor to upward price movement.

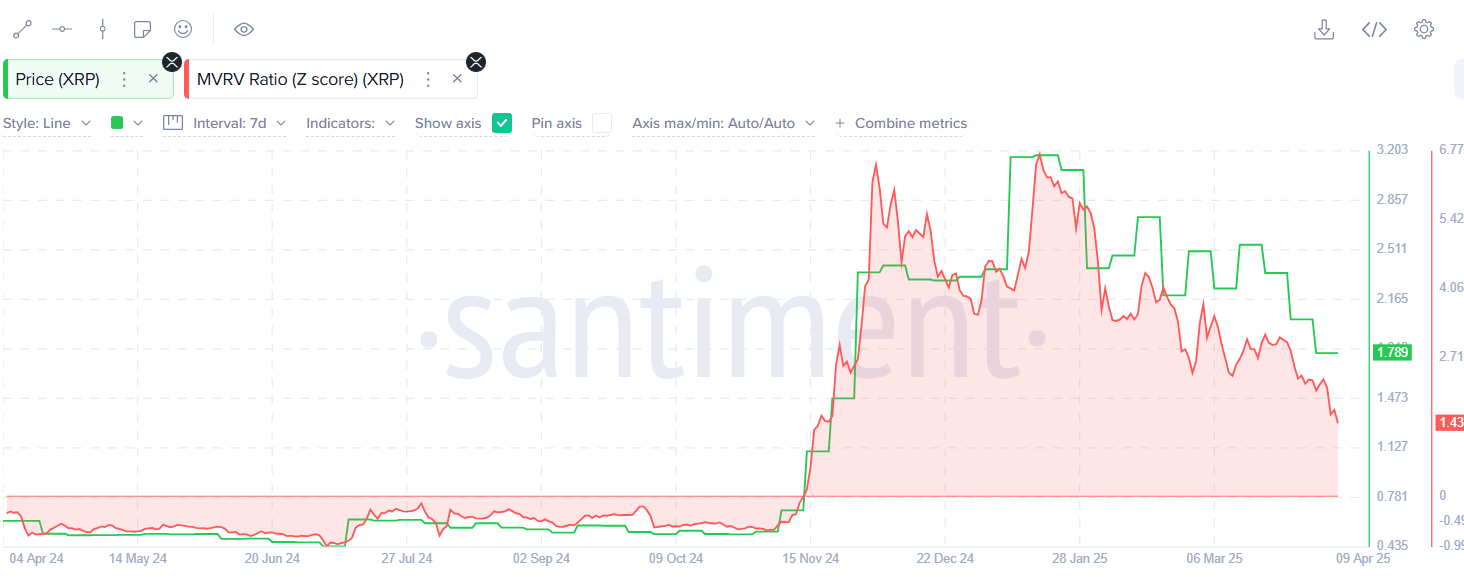

XRP’s MVRV Z-Score has also dropped to 1.43, its lowest level since November of last year. That’s notable because the last time it was this low, XRP kicked off a bull run and eventually hit its all-time high of $3.40.

Source: Santiment

Source: Santiment

A lower MVRV Z-Score usually means the asset is undervalued compared to its historical average, which can be a sign that the market is near a bottom and primed for a rebound.

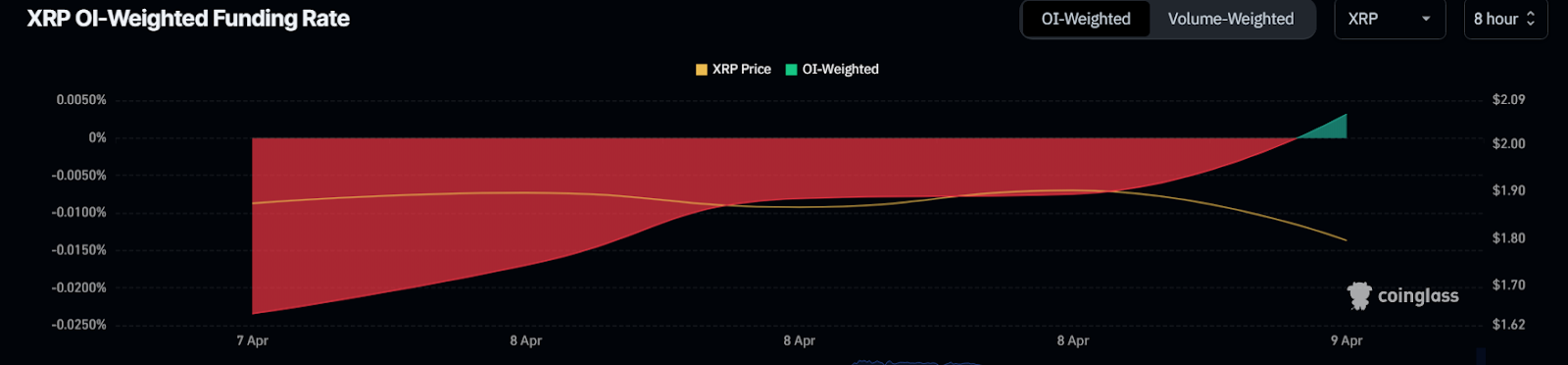

Meanwhile, its weighted funding rate has flipped back to green, indicating improved investor sentiment among XRP derivative traders, as more of them are now placing bullish bets after a period of caution.

Source: CoinGlass

Source: CoinGlass

According to analysts at crypto.news , $2 is the most likely next target for XRP.

On a longer time frame, experts at Standard Chartered have set an even higher price target, projecting $5.5 as a realistic target by the year-end. Their forecast comes after XRP’s 580% rally from November 2024 to January 2025, suggesting there’s room for another 214% move from current levels.

XRP still in correction phase

However, Trader Chetan Gurjar believes XRP is still in its wave 2 correction phase, based on the Elliott Wave theory, a popular trading method where price moves in patterns of five waves up when the market is trending and three waves down when it’s correcting.

Right now, Chetan thinks XRP is in one of those “down” phases, wave 2, which usually happens before the next big move up. He sees this dip as a healthy retracement, with possible bottom zones around key Fibonacci levels: $1.48, $1.1453, and $0.8856.

Chetan has some lofty long-term targets too: at least $8–$12, with the possibility of XRP reaching as high as $23–$30 during the next major cycle. He does note, though, that a breakdown below $0.3823 would invalidate his current wave count.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.