Top 5 RWA Tokens to Buy in April 2025 Before They Skyrocket

What Are RWA Tokens and Why Should You Care?

RWA (Real World Asset) tokens are cryptocurrencies that represent tangible assets—think real estate, bonds, commodities, and even equity shares—on the blockchain. They bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi), offering real-world utility, transparency, and fractional ownership.

As tokenization of real assets becomes a trillion-dollar narrative, RWA tokens are gaining serious momentum among institutions and retail investors alike.

Why are they important?

🔗 They bring real-world value into crypto.

🌍 They're backed by physical or financial assets, reducing volatility.

🏦 They unlock new liquidity pools in global finance.

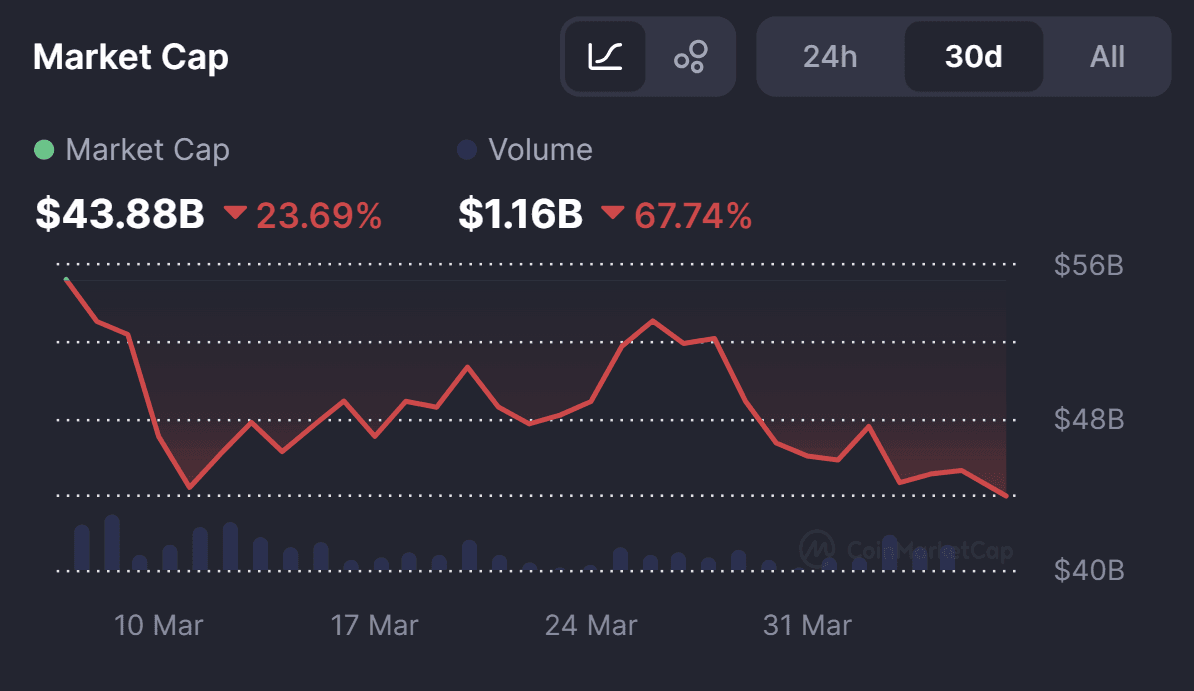

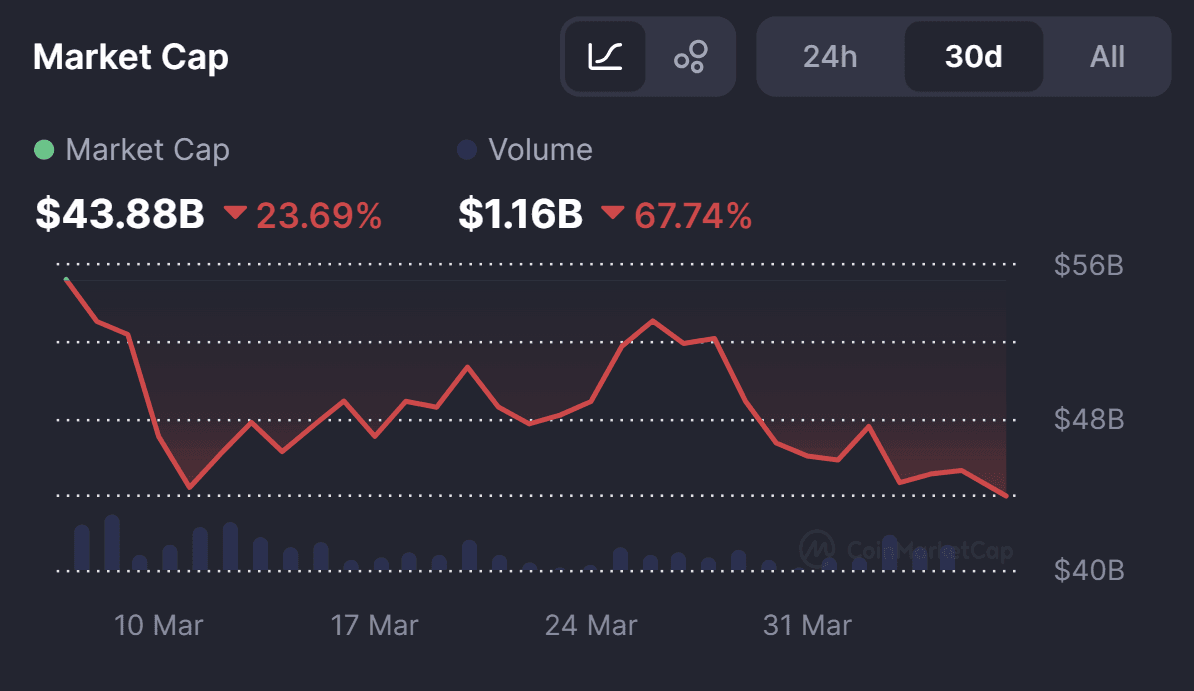

RWA Tokens Are on Sale – But Not for Long

Real World Asset (RWA) tokens have been hit hard in the past few weeks, shedding significant value as risk sentiment cooled across the crypto space. However, this sharp decline has now pushed most major RWA tokens to key support levels, potentially setting the stage for a strong rebound.

Smart investors know that support zones often offer low-risk entry points—and in April 2025, RWA tokens are flashing that exact opportunity.

Top 5 RWA Tokens to Buy in April 2025

1. Chainlink ( LINK )

- Price: $12.58

- 24h Change: +3.24%

- 7d Change: +8.64%

- Market Cap: $8.27B

Why LINK?

Chainlink is the backbone of the RWA ecosystem, enabling secure and verifiable off-chain data feeds into smart contracts. Its real-world utility and oracle dominance make it a must-have for RWA exposure.

2. Avalanche ( AVAX )

- Price: $17.21

- 24h Change: +5.91%

- 7d Change: +11.72%

- Market Cap: $7.15B

Why AVAX?

Avalanche is becoming a go-to Layer 1 for institutions exploring RWA tokenization. With subnets and enterprise integrations, it’s laying the infrastructure for a tokenized asset future.

3. Hedera ( HBAR )

- Price: $0.1567

- 24h Change: +3.87%

- 7d Change: +8.85%

- Market Cap: $6.61B

Why HBAR?

Hedera offers ultra-fast, low-cost transactions with enterprise-grade scalability. It’s already working with big players in supply chain and asset tracking, making it a strong RWA play.

4. MANTRA ( OM )

- Price: $6.22

- 24h Change: +0.51%

- 7d Change: +2.68%

- Market Cap: $6.01B

Why OM?

MANTRA is built for tokenized real estate and DeFi infrastructure, offering a regulated framework for RWAs. Its steady climb and growing partnerships make it a solid April pick.

5. Ondo Finance ( ONDO )

- Price: $0.7906

- 24h Change: +3.41%

- 7d Change: +2.53%

- Market Cap: $2.49B

Why ONDO?

Ondo Finance specializes in tokenized bonds and Treasuries—bringing TradFi’s safest instruments to the blockchain. As yield-seeking investors return, ONDO is poised for breakout growth.

What Are RWA Tokens and Why Should You Care?

RWA (Real World Asset) tokens are cryptocurrencies that represent tangible assets—think real estate, bonds, commodities, and even equity shares—on the blockchain. They bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi), offering real-world utility, transparency, and fractional ownership.

As tokenization of real assets becomes a trillion-dollar narrative, RWA tokens are gaining serious momentum among institutions and retail investors alike.

Why are they important?

🔗 They bring real-world value into crypto.

🌍 They're backed by physical or financial assets, reducing volatility.

🏦 They unlock new liquidity pools in global finance.

RWA Tokens Are on Sale – But Not for Long

Real World Asset (RWA) tokens have been hit hard in the past few weeks, shedding significant value as risk sentiment cooled across the crypto space. However, this sharp decline has now pushed most major RWA tokens to key support levels, potentially setting the stage for a strong rebound.

Smart investors know that support zones often offer low-risk entry points—and in April 2025, RWA tokens are flashing that exact opportunity.

Top 5 RWA Tokens to Buy in April 2025

1. Chainlink ( LINK )

- Price: $12.58

- 24h Change: +3.24%

- 7d Change: +8.64%

- Market Cap: $8.27B

Why LINK?

Chainlink is the backbone of the RWA ecosystem, enabling secure and verifiable off-chain data feeds into smart contracts. Its real-world utility and oracle dominance make it a must-have for RWA exposure.

2. Avalanche ( AVAX )

- Price: $17.21

- 24h Change: +5.91%

- 7d Change: +11.72%

- Market Cap: $7.15B

Why AVAX?

Avalanche is becoming a go-to Layer 1 for institutions exploring RWA tokenization. With subnets and enterprise integrations, it’s laying the infrastructure for a tokenized asset future.

3. Hedera ( HBAR )

- Price: $0.1567

- 24h Change: +3.87%

- 7d Change: +8.85%

- Market Cap: $6.61B

Why HBAR?

Hedera offers ultra-fast, low-cost transactions with enterprise-grade scalability. It’s already working with big players in supply chain and asset tracking, making it a strong RWA play.

4. MANTRA ( OM )

- Price: $6.22

- 24h Change: +0.51%

- 7d Change: +2.68%

- Market Cap: $6.01B

Why OM?

MANTRA is built for tokenized real estate and DeFi infrastructure, offering a regulated framework for RWAs. Its steady climb and growing partnerships make it a solid April pick.

5. Ondo Finance ( ONDO )

- Price: $0.7906

- 24h Change: +3.41%

- 7d Change: +2.53%

- Market Cap: $2.49B

Why ONDO?

Ondo Finance specializes in tokenized bonds and Treasuries—bringing TradFi’s safest instruments to the blockchain. As yield-seeking investors return, ONDO is poised for breakout growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The covert battle in the crypto industry intensifies: 40% of job seekers are North Korean agents?

The report shows that North Korean agents are deeply infiltrating the crypto industry using fake identities, accounting for up to 40% of job applications. They are obtaining system access through legitimate employment channels, and the scope of their influence far exceeds industry expectations.

Berachain exposed for signing dual contracts with VCs, allowing lead investors to invest without risk

Another VC has already lost $50 million.

Etherscan's Surcharge Scandal Exposes Ethereum Ecosystem's Data Dependency Dilemma

Etherscan's decision to stop offering free APIs across multiple chains has sparked an industry debate, reflecting a deeper contradiction between the commercialization and decentralization of blockchain data infrastructure.

SOL rebounds alongside wider crypto market bounce: Is $160 possible?