Bitcoin’s Bullish Pattern Might Be a Trap, Warns Veteran Trader

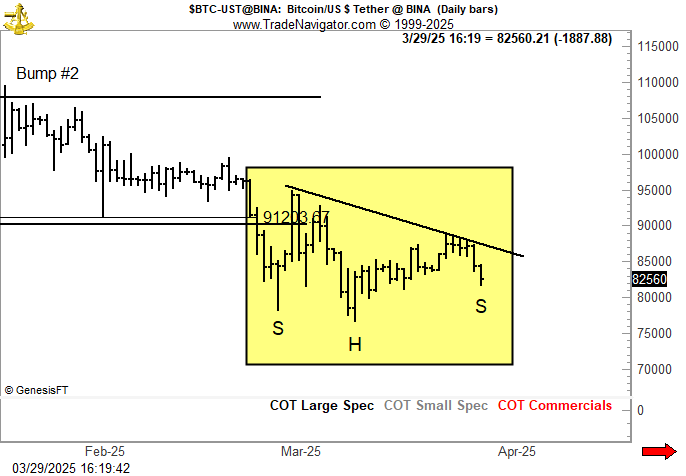

A widely recognized bullish formation in Bitcoin’s price charts might not be as promising as it appears, warns veteran trader Peter Brandt. The cryptocurrency has developed an inverse head-and-shoulders pattern, typically seen as a sign of a potential upward reversal. However, the structure presents a complication—the neckline is sloping downward.

Brandt, who has spent over 40 years in commodities trading, favors head-and-shoulders formations with horizontal necklines, considering them far more dependable.

The downward angle of Bitcoin’s current setup suggests weakening buying pressure, raising the possibility that any breakout attempt could be short-lived, sending the price tumbling instead of rallying.

READ MORE:

Bitcoin Could Hit $150,000 by Year-End, Says Financial ExpertTrader Josh Olszewicz also pointed out the pattern on Bitcoin’s daily chart, suggesting that this may be a crucial moment for bulls to regain control. Should they fail to push the price higher, Bitcoin could slip back into the $60,000-$70,000 range.

As of now, CoinGecko data shows Bitcoin trading at $83,091, down 0.7% in the past day. The asset briefly hit an intraday low of $81,769 earlier on Sunday, struggling to regain momentum amid heightened global economic uncertainty.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Loan Carnival round 26: Borrow USDT, USDC to enjoy an APR discount of up to 40%

Crypto Loan Carnival round 26: Borrow USDT, USDC to enjoy an APR discount of up to 40%

Announcement on the increase of borrowing limit coefficients for Bitget spot margin VIP levels

Bitget x DGRAM Carnival: Grab a share of 49,500,000 DGRAM