Bitcoin Stuck in a Bear Trap? Why Analysts Believe a Surge Is Coming

Bitcoin may be in a classic bear trap, a phase seen in past cycles. Experts debate whether it will hit new highs or if the bull run has ended.

Bitcoin’s (BTC) price has historically experienced multiple bear traps. Depending on market conditions, these traps have appeared in short-term phases or larger timeframes.

Some analysts believe that Bitcoin is currently in such a bear trap and that a bull run will begin after the current phase ends.

What Does Bitcoin Bear Trap Cycle Mean?

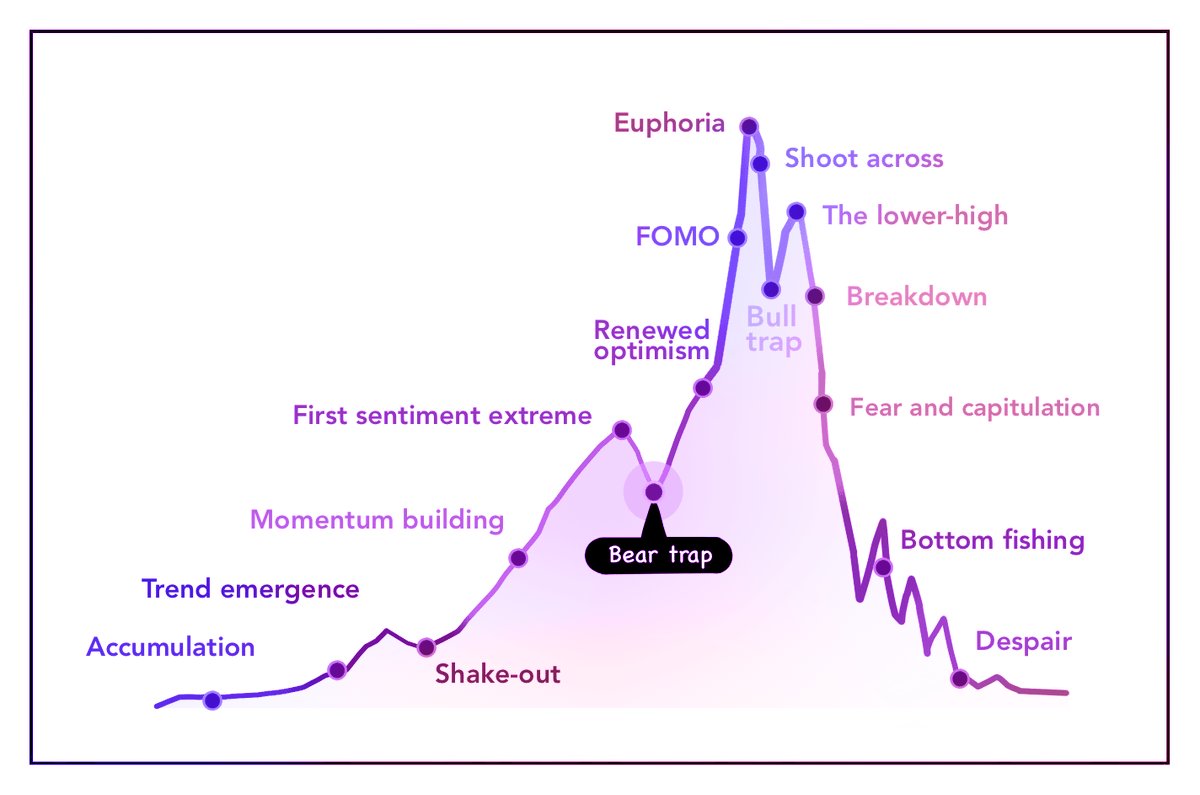

A bear trap occurs when an asset’s price (such as stocks, cryptocurrencies, or indices) shows a sharp decline. This drop convinces investors that a bearish trend is starting. However, the price soon reverses and rises again, “trapping” those who sold short or exited their positions, expecting further declines.

Psychological Stages of The Market. Source:

X

Psychological Stages of The Market. Source:

X

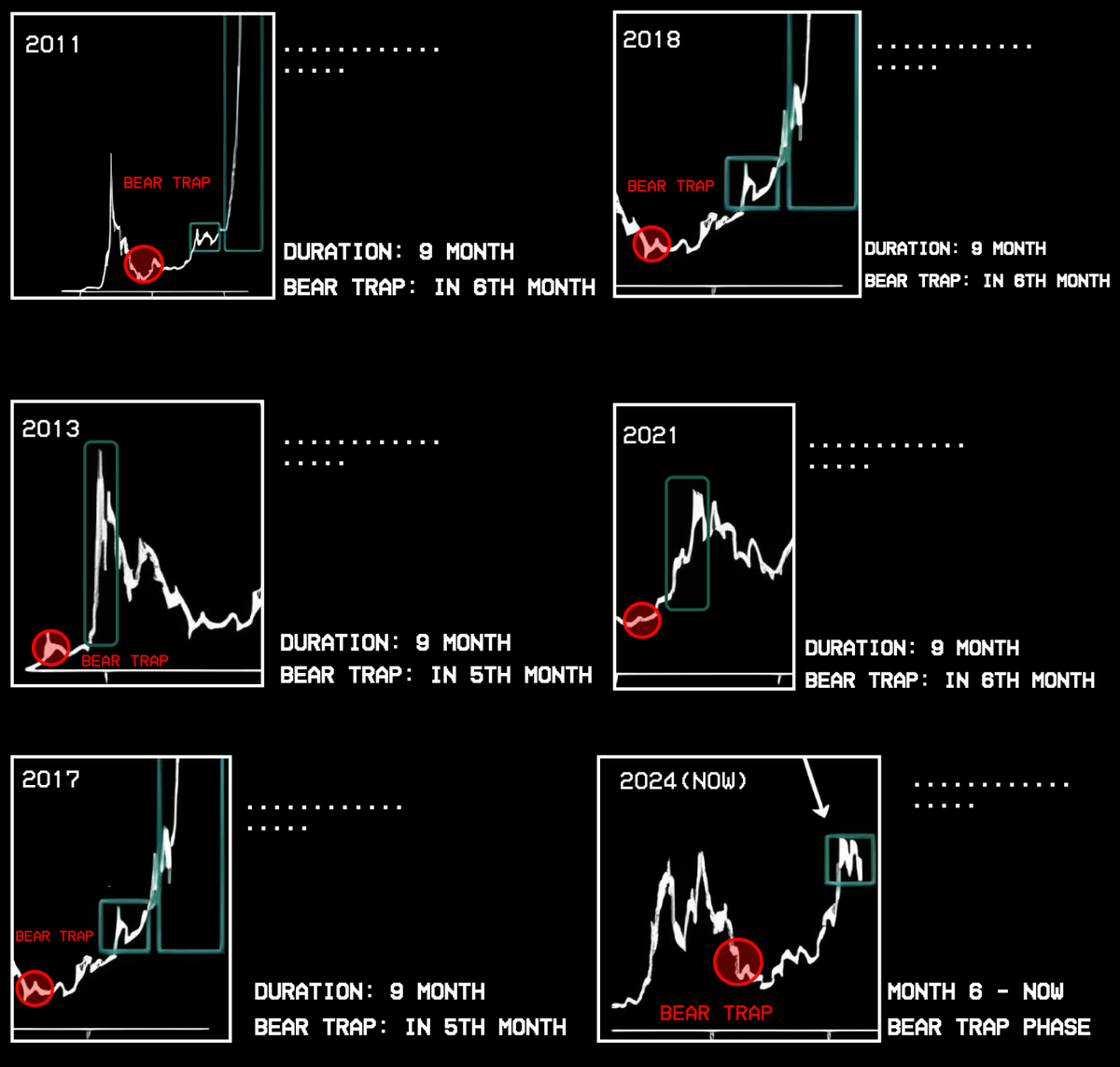

According to pseudonymous crypto analyst Finish, Bitcoin’s bull run cycles typically last around nine months. A bear trap often appears in the sixth month of the cycle. During this phase, Bitcoin’s price drops sharply, causing panic and sell-offs. But after that, the price recovers and reaches new highs.

Historical data from previous cycles—including 2011, 2013, 2017, 2021, and the current cycle (2024–2025)—show that this pattern repeats consistently.

Bear Trap Phenomenon of

Bitcoin Price from 2011 – 2025. Source:

Finish

Bear Trap Phenomenon of

Bitcoin Price from 2011 – 2025. Source:

Finish

“2025 cycle is the same. Six-month bear trap, then a new ATH,” Finish predicted.

In his analysis, Finish also explains the driving forces behind bear traps in each cycle. For example, the 2013 bear trap was triggered by the shutdown of Silk Road, an online black market, and China’s ban on Bitcoin, which caused market panic.

In 2017, the ICO boom fueled Bitcoin’s bull run, pushing its price to $20,000. However, a bear trap emerged in the sixth month due to the launch of Bitcoin futures on the CME exchange. This was combined with media hype and concerns over Tether (USDT), which faced transparency issues.

Similarly, in 2021, Bitcoin soared to $69,000. But the six-month bear trap was triggered by an overheated market sentiment and Elon Musk’s sudden shift in stance on Bitcoin payments.

For the 2024–2025 cycle, Finish believes Bitcoin is currently in its bear trap phase. Macroeconomic factors, especially policies from US President Donald Trump, play a crucial role.

Trump’s policies—such as interest rate cuts, tariff war, and his pledge to make the US the “crypto capital” of the world—have created optimism but also caused short-term price volatility. This aligns with the six-month bear trap model described by Finish.

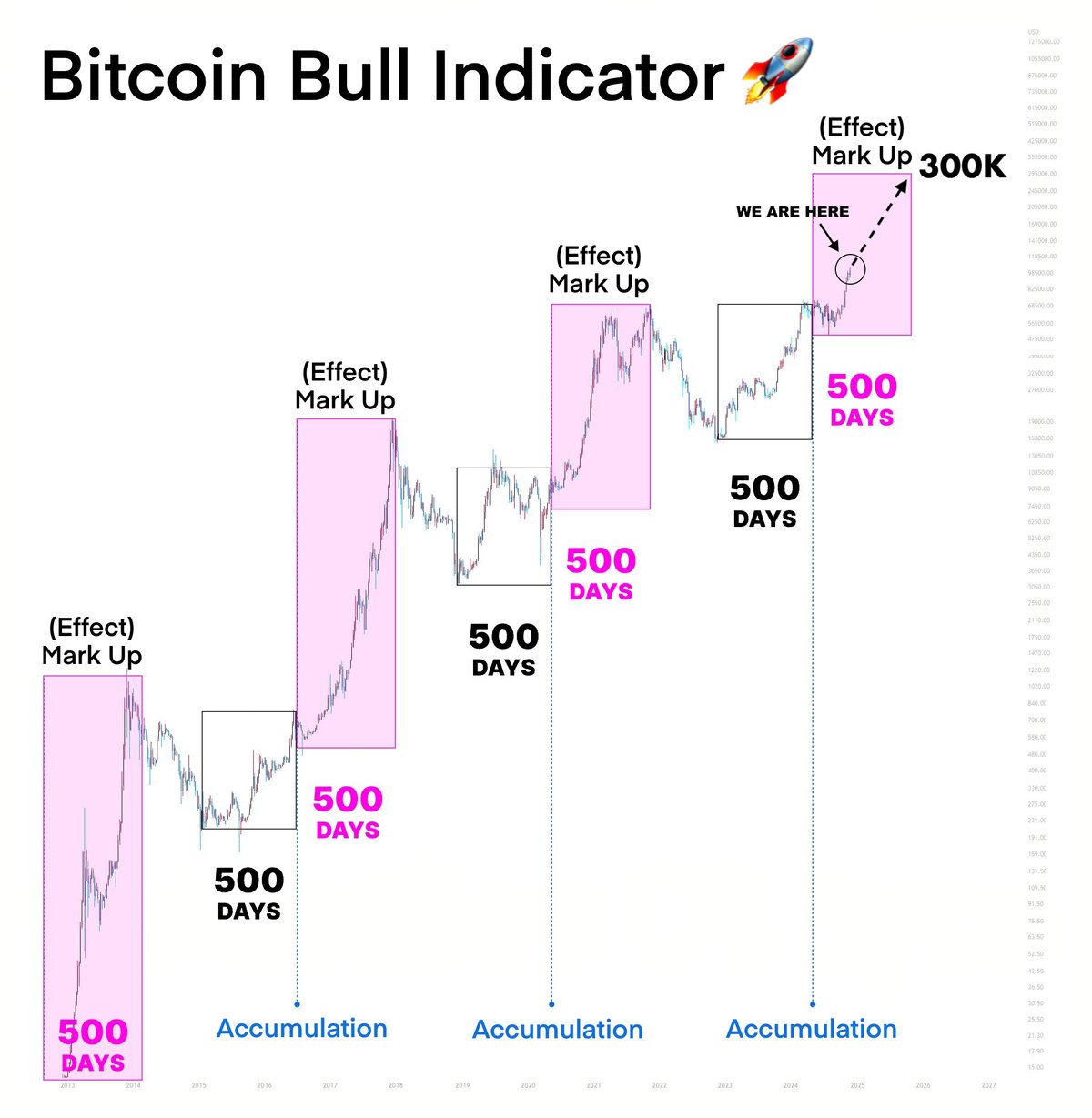

Additionally, analyst Danny agrees with this outlook. He predicts that Bitcoin’s biggest bull run will officially begin in April 2025 once the current bear trap phase ends. Danny suggests that Bitcoin could reach $300,000 by 2026.

Bitcoin Price Performance Prediction 2025 – 2026. Source:

Danny.

Bitcoin Price Performance Prediction 2025 – 2026. Source:

Danny.

“We’re in the Markup phase, just past a classic bear trap. Historically, the biggest gains follow as Bitcoin dominance dips and capital shifts to mid- and low-cap tokens,” Danny predicted.

However, some analysts have lowered their expectations for Bitcoin’s growth. Ecoinometrics observes that Bitcoin’s growth rate in this cycle is significantly lower than in previous cycles. Ki Young Ju, founder of CryptoQuant, has analyzed Bitcoin’s PnL cycle signals and predicts that Bitcoin’s bull run has already ended.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hotcoin Research | Fusaka Upgrade Approaching: Analysis and Outlook on Ethereum Long and Short Positions

This article will review Ethereum's recent performance, provide an in-depth analysis of the current bullish and bearish factors facing Ethereum, and look ahead to its prospects and trends for the end of this year, next year, and the medium to long term. The aim is to help ordinary investors clarify uncertainties, grasp trends, and provide some reference to support more rational decision-making during key turning points.

Crypto Market Surges as Bitcoin Rebounds and Privacy Coins Shine

In Brief Bitcoin rebounded over the weekend, testing the $86,000 mark. Privacy-focused altcoins Monero and Zcash showed notable gains. Total market value surged, crossing the $3 trillion threshold again.

Crypto Markets Rebound as Traders Signal Seller Fatigue

In Brief Crypto markets rebounded amid significant liquidations and oversold RSI signals. Weekend trading conditions with thin liquidity influenced rapid price shifts. The rebound's sustainability remains uncertain, prompting scrutinous investor attention.

Cardano : Network security questioned after a major incident