Date: Mon, March 17, 2025 | 08:54 AM GMT

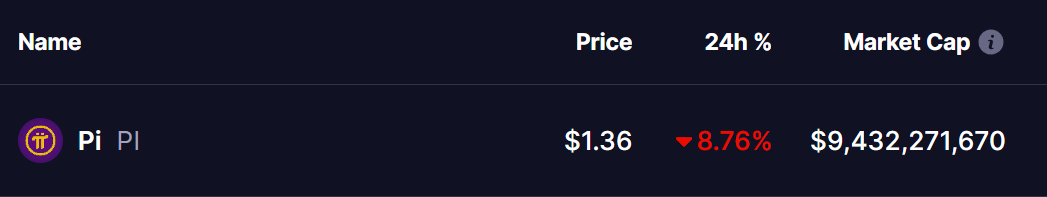

Pi Network (PI) has started the week on a bearish note, declining over 8% in the last 24 hours. Despite the broader crypto market’s attempts to stabilize, PI continues to face selling pressure and is now testing a crucial support zone, which will be decisive in determining whether the altcoin can stage a recovery or extend its downward trend.

Source: Coinmarketcap

Source: Coinmarketcap

Pi Day 2025 Fails to Spark a Rally

March 14 marked Pi Day 2025, a major event for the Pi Network community, where new feature like Pi Domains Auction was announced . However, the celebration failed to trigger a bullish breakout for PI. A key reason for the market’s disappointment may have been the lack of a long-anticipated Binance listing announcement, which many traders were hoping for. Without this catalyst, the price continued to struggle, leading to the current bearish sentiment.

Pi Coin Price Prediction for This Week

On the 4-hour chart, PI recently broke down from a symmetrical triangle pattern, losing key support at $1.51 (marked in red circle). This breakdown led to a sharp drop toward a critical support zone between $1.23 and $1.38 (marked in gray area).

At present, PI is trading near $1.36, hovering around the upper boundary of this key support area. This zone will be crucial in determining the coin’s price movement for the rest of the week.

Bullish Scenario: If buyers successfully defend this support, PI could rebound toward the 20-day MA, followed by the ascending trendline and the $1.79 resistance zone (marked in green). A decisive breakout above this level could signal a trend reversal, paving the way for further upside.

Bearish Scenario: If sellers push the price below $1.23, it could trigger a major decline, with the next significant support resting at $1.14 and $0.75.

Final Thoughts

Pi Coin is at a critical decision point. Holding the current support zone could lead to a short-term rebound, but failure to do so may result in an extended downtrend. Traders should watch for volume confirmation and price action around key levels before making trading decisions.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.