Hedera (HBAR) Bears Tighten Grip as Price Sinks 52% from Year-To-Date High

HBAR bears tighten their grip as the price drops 52% from YTD high. Key indicators signal further downside, with $0.16 support in focus

The price of Hedera’s HBAR has been on a downtrend since reaching its year-to-date (YTD) high of $0.40 on January 17. The altcoin has now dropped to $0.19, marking a 52% decline as bearish pressure continues to dominate the market.

Technical indicators suggest the downturn may not be over, as selling pressure remains high.

HBAR’s Price Woes Continue as Indicators Show No Relief

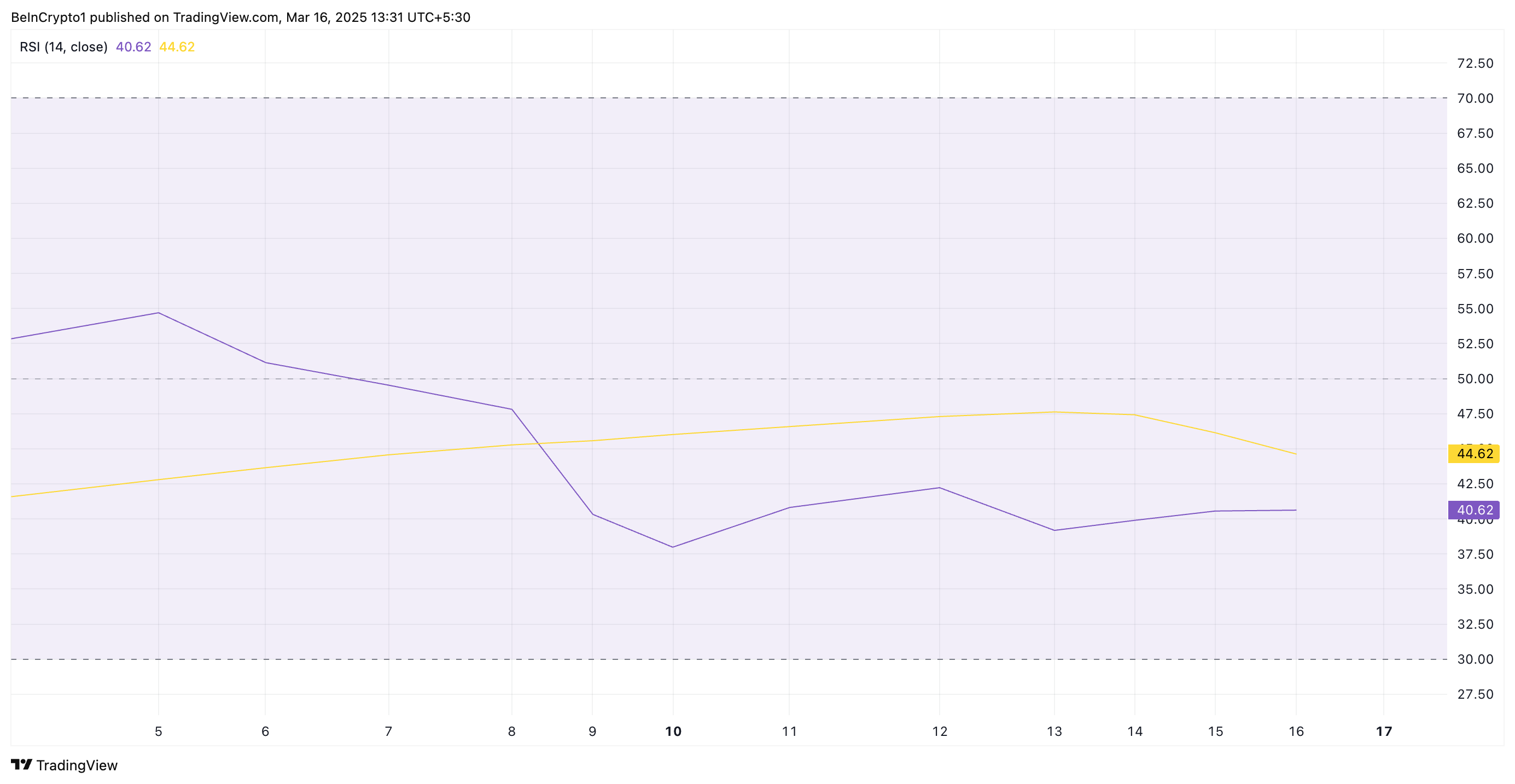

The sustained dip in HBAR’s Relative Strength Index (RSI) confirms the surging selling pressure among its spot traders. As of this writing, this is at 40.62.

HBAR RSI. Source:

TradingView

HBAR RSI. Source:

TradingView

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges from 0 to 100, with values above 70 suggesting the asset is overbought and potentially due for a correction.

Conversely, RSI values below 30 signal the asset is oversold and may be primed for a rebound.

An RSI of 40.62 suggests that HBAR is in bearish territory but not yet oversold. This indicates that selling pressure is stronger than buying momentum, but there is still room for further decline before the token becomes undervalued.

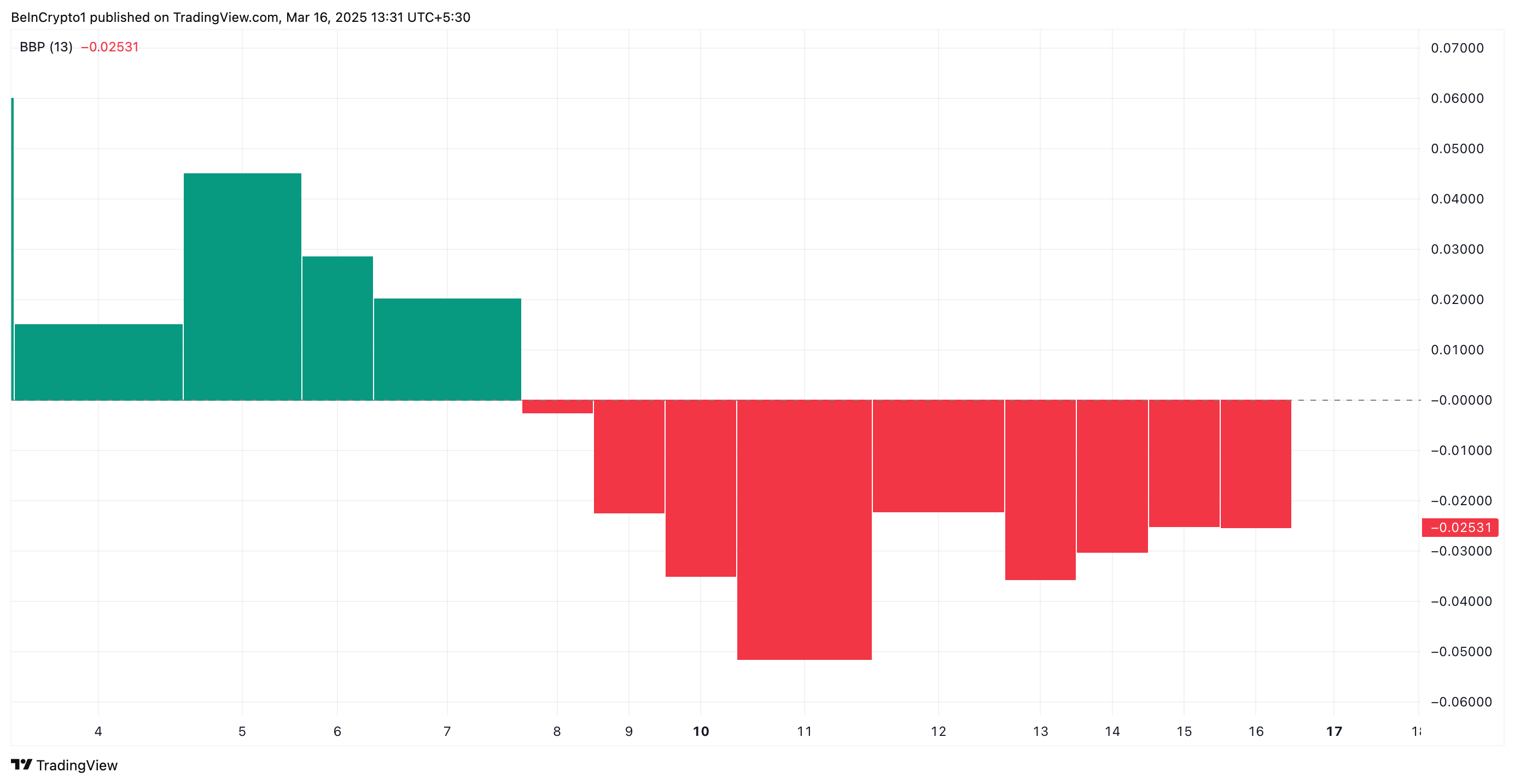

Additionally, readings from HBAR’s Elder-Ray Index support the bearish outlook. It currently sits at -0.02, marking its seventh consecutive day in negative territory.

HBAR Elder-Ray Index. Source:

TradingView

HBAR Elder-Ray Index. Source:

TradingView

The Elder-Ray Index measures the balance of power between bulls and bears by analyzing the strength of buyers (Bull Power) and sellers (Bear Power).

When the index is negative, it indicates that sellers are in control, pushing prices lower and signaling a bearish trend. HBAR’s consistent negative Elder-Ray Index suggests sustained downward pressure, making a price recovery less likely in the short term.

HBAR Bears Dominate as Descending Channel Points to More Losses

Since it reached its YTD high of $0.40, HBAR has traded within a descending parallel channel, confirming the price decline.

This bearish pattern is formed when an asset’s price moves between two downward-sloping, parallel trendlines, indicating a consistent bearish trend. It suggests that HBAR sellers are dominant, which could lower its price even more.

If demand weakens further, HBAR could fall toward support formed at $0.16, a low it last reached in November.

HBAR price Analysis. Source:

TradingView

HBAR price Analysis. Source:

TradingView

However, a positive shift in market sentiment would prevent this. If HBAR sees a surge in new demand, it could drive its price up to $0.24.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.