Crypto Whales Bought These Coins in the Second Week of March 2025

Crypto whales have been active in accumulating BTC, PEPE, and ENS this week, signaling potential price movements despite recent market fluctuations.

This week, the crypto market has witnessed a rise in activity, signaling a potential recovery following last week’s decline.

As traders regain confidence, on-chain data reveals that crypto whales have been actively accumulating specific coins, suggesting strategic positioning ahead of a possible uptrend.

Bitcoin (BTC)

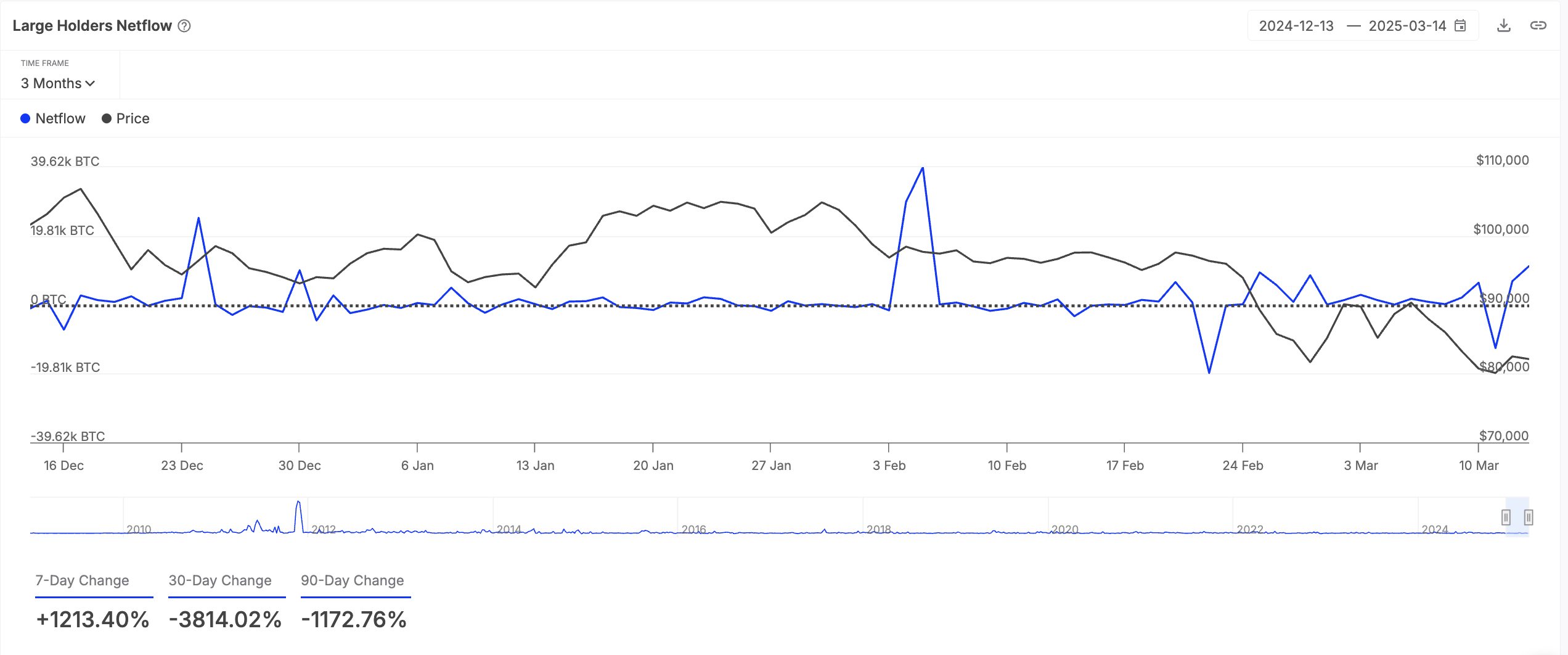

Leading cryptocurrency BTC has attracted significant whale interest this week despite its 7% price dip in the past seven days.

On-chain data indicates that its deep-pocketed investors have increased their BTC holdings, anticipating a stronger rebound when market sentiment improves. According to IntoTheBlock, BTC’s large holders’ netflow has climbed by over 1000% in the past seven days.

BTC Large Holders’ Netflow. Source:

IntoTheBlock

BTC Large Holders’ Netflow. Source:

IntoTheBlock

Large holders are whale addresses that hold more than 0.1% of an asset’s circulating supply. Their netflow measures the difference between the coins they buy and sell over a set period.

When netflow spikes, it signals that major investors are accumulating more coins. This bullish trend could prompt retail traders to do the same, driving increased demand for BTC and putting more upward pressure on its price.

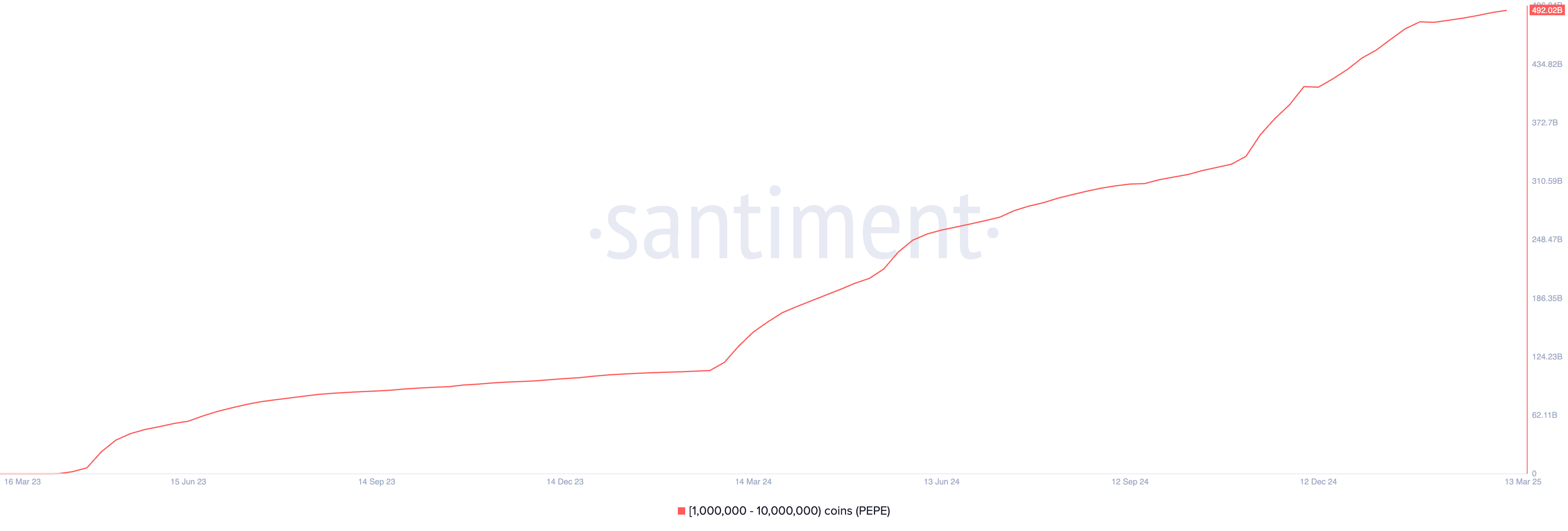

Pepe (PEPE)

The frog-themed meme coin PEPE is another altcoin that the whales have paid attention to this week. On-chain data reveals an increase in PEPE holdings among whale addresses holding between 1 million and 10 million tokens.

PEPE Supply Distribution. Source:

Santiment

PEPE Supply Distribution. Source:

Santiment

Per Santiment, this group of investors has acquired 2.6 billion PEPE tokens over the past seven days. This cohort currently holds 492.02 billion PEPE, their highest token count since PEPE launched.

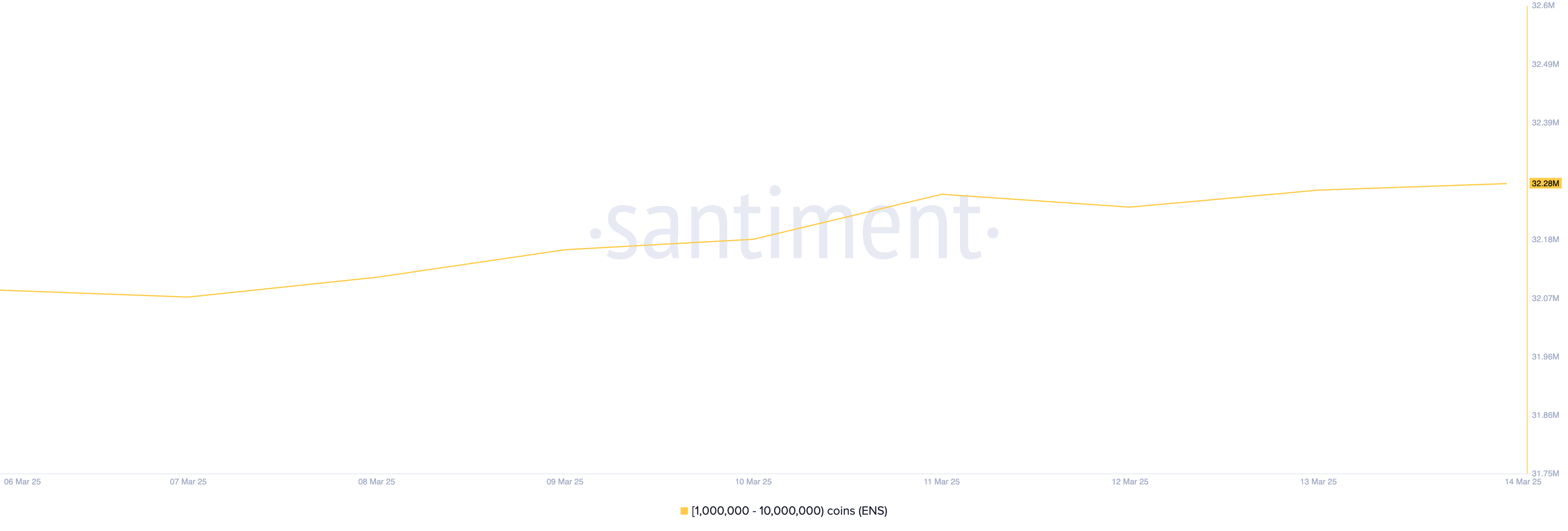

Ethereum Name Service (ENS)

ENS, the native token of Ethereum Name Service (ENS), a decentralized naming system built on the Ethereum blockchain, is another altcoin on the whales’ radar this week.

Data from Santiment shows whale addresses holding between 1 million and 10 million tokens have accumulated 20 million ENS tokens valued above $330 million over the past seven days.

ENS Supply Distribution. Source:

Santiment

ENS Supply Distribution. Source:

Santiment

This has happened amid the altcoin’s 20% price decline during that period. Significant whale activity like this often signals strong confidence ahead of potential price movements. Hence, if ENS demand continues to increase, it may push its price above $17.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Talus (US)

Five charts to help you understand: Where does the market go after each policy storm?

After this regulatory crackdown, is it a harbinger of an impending downturn, or the beginning of a new cycle where all negative news has been fully priced in? Let’s examine the trajectory after the storm through five key policy milestones.

Mars Morning News | The crypto market rebounds across the board, Bitcoin rises above $94,500; The "CLARITY Act" draft is expected to be released this week

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

Federal Reserve’s Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.