Tether Acquires Minority Stake in Juventus Football Club, Spiking Fan Token

Tether's Juventus stake fuels JUV token growth and signals a shift toward blockchain-powered sports investments amid regulatory challenges.

Tether acquired a minority stake in Juventus, a world-famous Italian football club, causing its JUV fan token to spike. Tether is investing in a team with a pre-existing Web3 presence, and it plans to bring more teams on-chain.

The company was recently ejected from the EU market due to stablecoin regulations, but it first took careful preparations to set up alternate revenue streams. This investment may be part of a similar strategy.

Tether Plays Hard with Juventus

Juventus FC is one of the world’s most popular football teams, and it’s been dabbling in Web3 sectors like crypto and NFTs for a few years now. In 2019, it launched the JUV fan token, and it also created a couple of NFT offerings. Tether’s CEO Paolo Ardoino announced today that it bought a minority stake in Juventus, furthering the team’s Web3 connection:

““Aligned with our strategic investment in Juve, Tether will be a pioneer in merging new technologies, such as digital assets, AI, and biotech, with the well-established sports industry to drive change globally. We will explore avenues for innovative collaborations and the potential to revolutionize the global sports landscape.” said Ardoino.

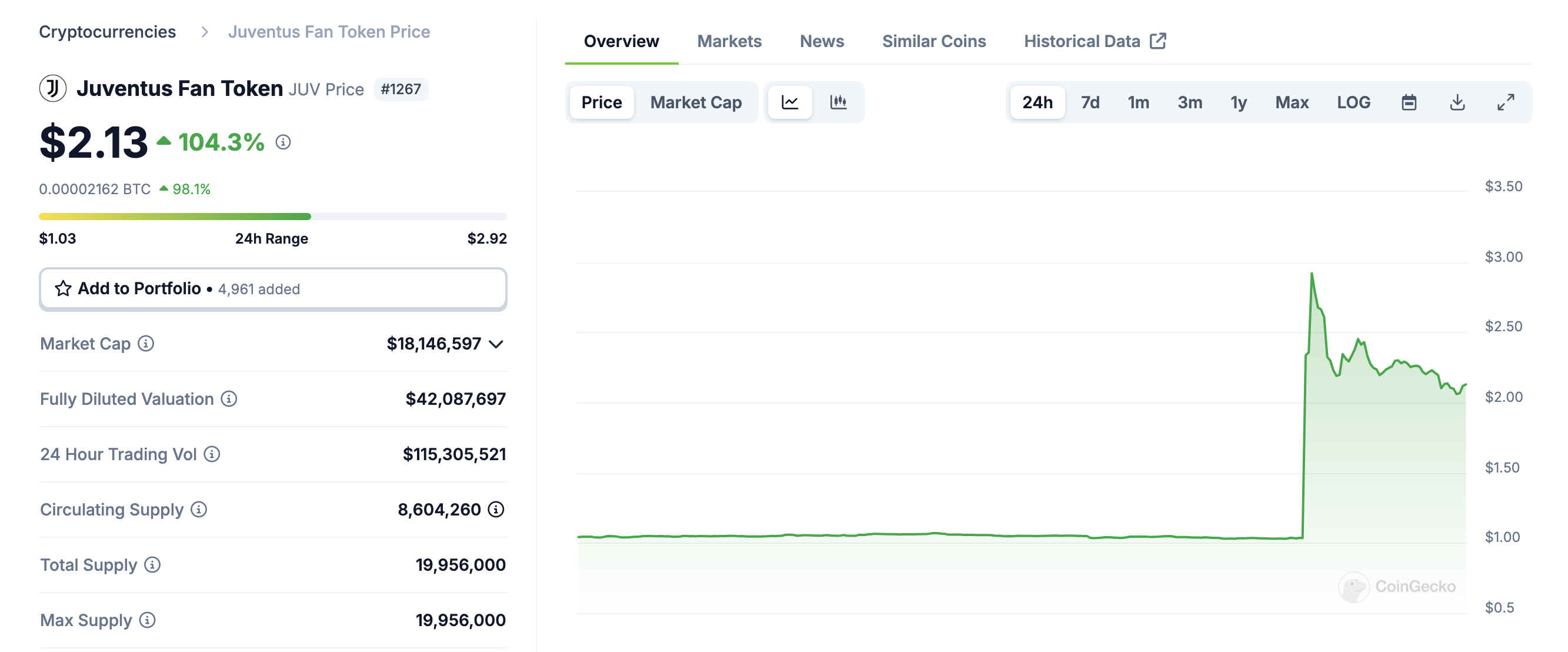

For world-famous football teams, a collaboration like this is fairly standard. In the last World Cup, Binance made a futures index for fan tokens and football-themed fan tokens like JUV have spiked all around the world. Juventus’ token has been inactive for several years, but it shot up today after the Tether announcement:

Juventus (JUV) Price Performance. Source:

CoinGecko.

Juventus (JUV) Price Performance. Source:

CoinGecko.

A more pressing question is why Tether, the world’s leading stablecoin issuer, would substantially invest in Juventus in the first place. The firm has conducted international partnerships to bring value to completely different sectors, but it’s not shown much interest in a sports club like this. However, according to the announcement, this is going to change.

Technically, the firm indirectly invested in a Swiss football team last year. If that one is a small stepping stone, Juventus is the next step, as Tether plans to bring more sports organizations onto the blockchain in the future. This doesn’t just include tokenization or payment availability; Tether will leverage its research sectors like AI and biotech where it can.

Another clue could help explain why Tether is investing in Juventus. Last December, its stablecoin got kicked out of the EU due to MiCA regulations, but the firm’s bottom line stayed intact. Tether spent months preparing for this doomsday scenario, limiting EU operations and setting up new revenue streams. Juventus is a European team, so it also falls in this category.

Tether could afford to draw back operations in Europe, but it can’t afford to lose both it and the US in quick succession. Impending stablecoin regulations could have an apocalyptic impact on Tether, and US exchanges are already preparing to eject the firm if asked. In short, Juventus and other sporting opportunities may be another part of Tether’s doomsday preparation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell faces the ultimate test: At least three dissenters at the December meeting, Federal Reserve consensus collapses!

The "Fed mouthpiece" reported that internal divisions within the Federal Reserve have intensified amid a data vacuum, with three board members appointed by Trump strongly supporting a dovish stance, while the hawkish camp has recently expanded.

Weekly Hot Picks: Data Disappearance Doesn’t Stop the Fed’s Hawkish Stance! Global Multi-Asset Markets Face “Backstabbing”

The U.S. government shutdown has ended, but the release of key data remains chaotic. The Federal Reserve has sent frequent hawkish signals, causing significant declines in gold, silver, stocks, and currencies on Friday. The U.S. has launched Operation "Southern Spear". Buffett delivered his farewell letter, and the "Big Short" exited abruptly. What exciting market events did you miss this week?

SignalPlus Macro Analysis Special Edition: Is It Going to Zero?

Over the past week, cryptocurrency prices declined once again. BTC briefly reached $94,000 on Monday due to lighter selling pressure before pulling back, and major cryptocurrencies saw further week-on-week declines...