Bitcoin’s Diamond Hands Double Down, Targets All-Time High

Bitcoin’s Permanent Holders are doubling down, continuing their accumulation even amidst market volatility. With demand surging, BTC is poised to test resistance and could break its all-time high if the momentum continues.

Since the beginning of February, Bitcoin has had difficulty stabilizing above the $100,000 mark. Donald Trump’s tariff wars have triggered significant market volatility, keeping traders on edge.

However, despite these headwinds, a key group of coin holders—those with no recorded history of selling—have intensified their accumulation. This signals a strong conviction in the asset’s long-term prospects.

Bitcoin Long-Term Holders Remain Resilient

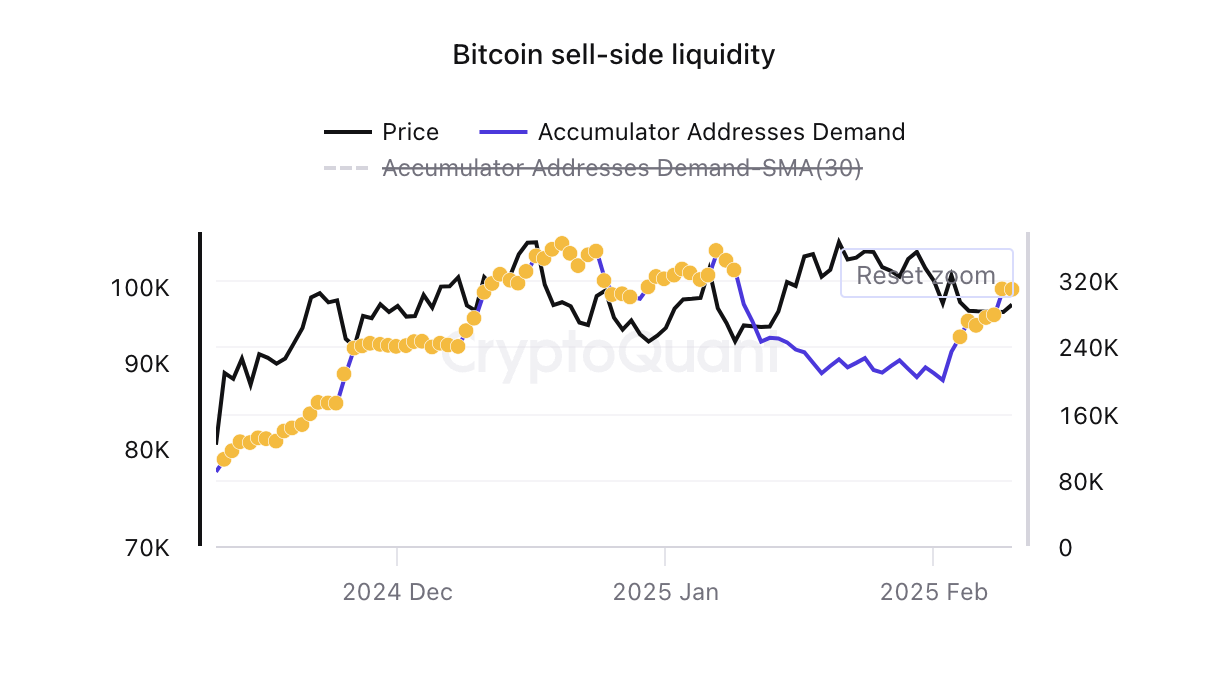

Data from the on-chain analytics platform CryptoQuant shows a spike in Bitcoin’s Permanent Holder Demand. According to the data provider, Bitcoin’s permanent holders consist of owners who primarily accumulate the coin over time and never engage in spending transactions, indicating a long-term holding strategy.

Bitcoin Accumulator Addresses Demand. Source:

CryptoQuant

Bitcoin Accumulator Addresses Demand. Source:

CryptoQuant

BeInCrypto’s assessment of the coin’s accumulator address demand reveals that since it hit a year-to-date low on February 2, it has soared. This reflects the surge in accumulation among these long-term investors.

Demand has rebounded even amid Bitcoin’s early February correction, signaling that long-term holders remain confident in the leading asset. Compared to previous cycles, fewer long-term holders are selling, reinforcing the bullish conviction.

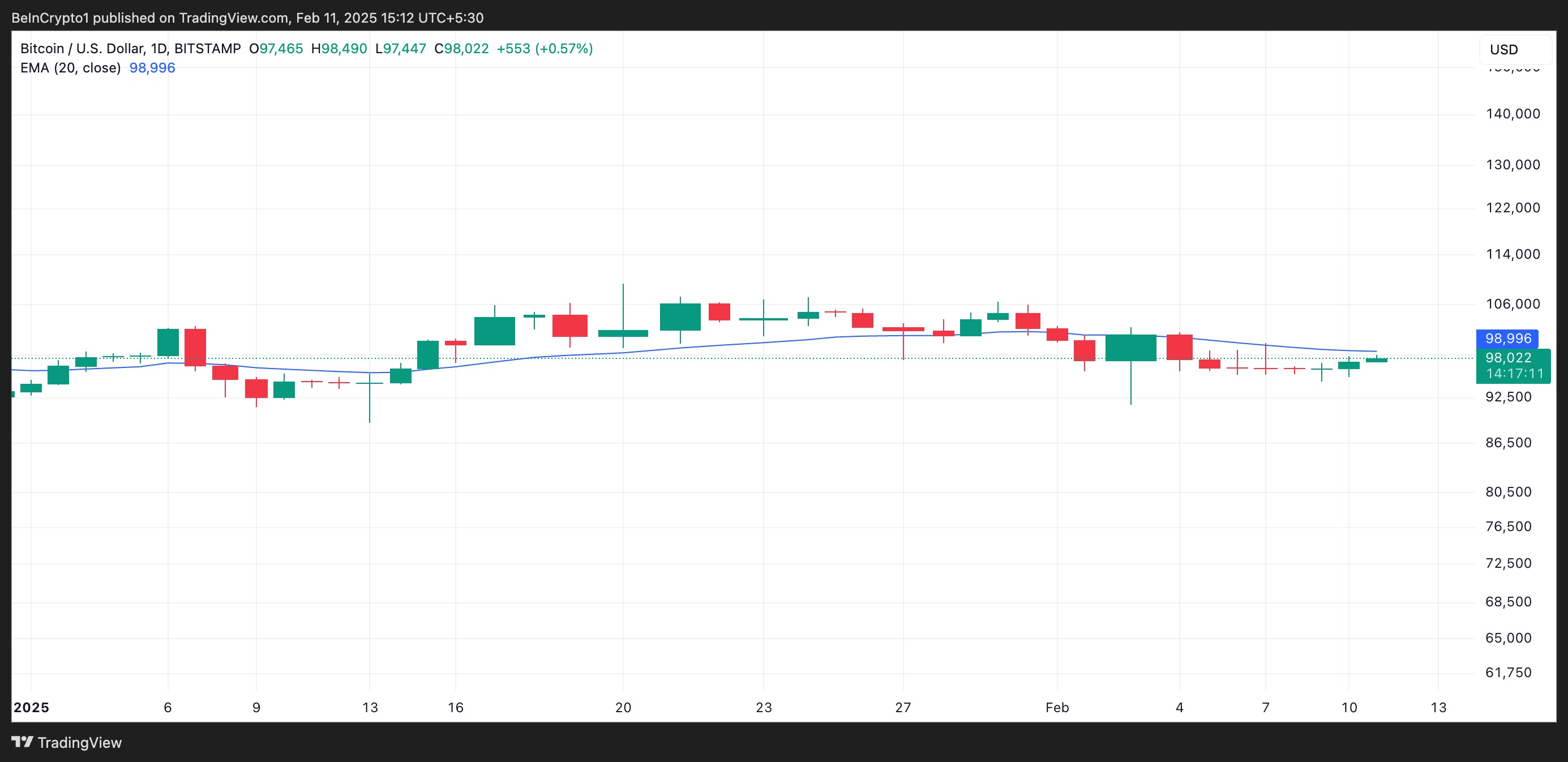

Furthermore, BTC’s attempt to cross above its 20-day exponential moving average (EMA) confirms the resurgence in demand for the king coin. At press time, BTC trades at $98,022, slightly below this key moving average, which forms resistance above it at $98,995.

BTC 20-Day EMA. Source:

TradingView

BTC 20-Day EMA. Source:

TradingView

The 20-day EMA tracks an asset’s average price over the past 20 trading days by giving more weight to recent price data. When an asset is poised to break above this moving average, it signals growing bullish momentum, suggesting a potential shift toward an uptrend if sustained.

BTC Price Prediction: Strong Holder Demand to Push BTC Above Key Resistance?

Sustained demand for BTC among its permanent holders could trigger a rally above the resistance formed by its 20-day EMA. A successful break above this level would provide the momentum needed for the coin to reclaim its all-time high of $109,356.

BTC Price Analysis. Source:

TradingView

BTC Price Analysis. Source:

TradingView

However, if accumulation stalls among BTC investors, it could reverse current gains and drop to $92,325.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Kiyosaki Trades BTC for Steady Earnings During Crypto Slump, Promises Future Repurchase

- Robert Kiyosaki sold $2.25M in Bitcoin at ~$90,000/coin to fund surgery centers and billboards, aiming for $27,500/month tax-free income by 2026. - The sale occurred amid Bitcoin's 33% drop from $126K peak, with the Crypto Fear & Greed Index hitting a multi-year low of 11. - Kiyosaki insists this is tactical cash flow generation to reaccumulate BTC, maintaining $250K/2026 and $27K/ounce gold price targets. - Market analysts remain divided on Bitcoin's trajectory, with some citing ETF outflows as short-te

Ethereum Updates: Automated Bear Market: $2 Billion in Crypto Liquidations Reveal the Dangers of Leverage

- Cryptocurrency markets faced $2B in 24-hour liquidations, with Ethereum and Bitcoin suffering largest losses as leveraged longs dominated exits. - Macroeconomic pressures including surging Japanese yields and algorithmic trading triggered cascading sell-offs, pushing ETH below $2,900 for first time in months. - High-profile traders like "Anti-CZ Whale" and Machi lost millions as leveraged positions collapsed, exposing systemic risks in crypto's interconnected markets. - Market turmoil highlighted crypto-

Bitcoin Updates: Major Institutions Increase Bitcoin Holdings While Retail Investors Withdraw $3 Billion

- Bitcoin faces divergent flows: $2B institutional inflows vs. $3B ETF outflows in November, highlighting market fragmentation. - Mubadala, El Salvador, and Czech Republic boost Bitcoin holdings, signaling institutional confidence despite 21% price drop. - Leverage Shares launches 3x crypto ETFs in Europe while BlackRock's IBIT records $2.1B redemptions, reflecting risk appetite shifts. - BTC.ℏ expands cross-chain capabilities as ETF outflows and weak derivatives markets underscore waning retail demand for

Hyperliquid (HYPE) Price Rally: DeFi Liquidity Breakthroughs and Investor Outlook in Late 2025

- Hyperliquid (HYPE) introduces HIP-3 Growth Mode and BLP to attract institutional liquidity via fee cuts and shared pools. - Despite 30% usage growth and $2.15B TVL, HYPE's $37.54 price lags key resistance amid volatile sentiment and a $4.9M bid manipulation loss. - Breaking $42.75 resistance could trigger self-reinforcing liquidity growth, but failure risks $35 support breaches and eroded trust in DeFi's institutional readiness.