LINK Faces Volatility Amid Whale Activity: Can It Hold Support?

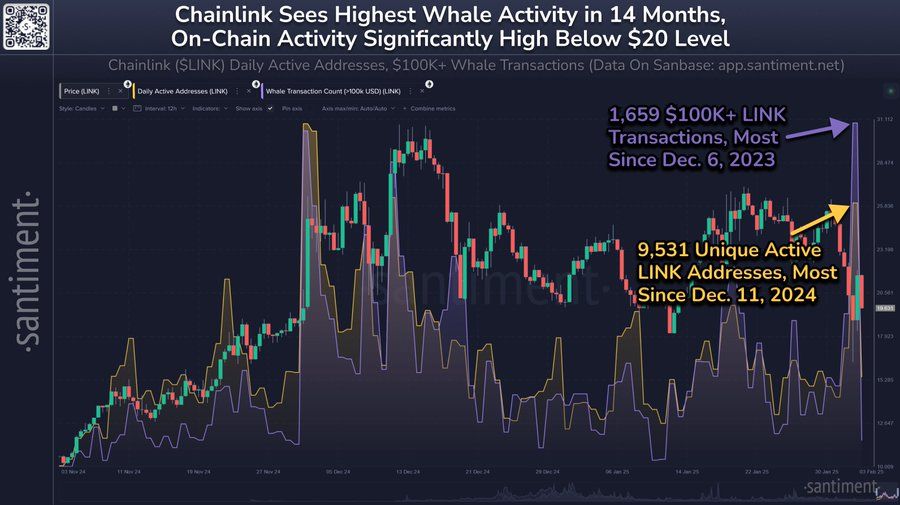

- Chainlink records 1,659 transactions over $100K, the highest since December 2023.

- 9,531 active wallets recorded, marking the most since December 2024 for Chainlink.

- Whales offload 4.13 million LINK in 48 hours, triggering volatility in price action.

Chainlink (LINK) attracts significant investor interest levels during a recent market correction period. At press time, LINK price stands at $19.93, which has decreased by 4.39% throughout the day. Chainlink experiences heightened scrutiny because of significant whale transaction patterns, including market buying and selling behaviors during market volatility. What impact will whale movements have on LINK’s ongoing price recovery from its recent market drop?

Whale Activity Influences LINK’s Price

Chainlink’s recent price action shows fluctuations between $19 and $21. Based on its price consolidation, LINK appears to have reached an essential support zone. According to Santiment, LINK saw 1,659 transactions exceeding $100K, the highest level since December 2023. The asset also recorded 9,531 active wallets, the highest number since December 2024. The rising whale transactions and active wallet numbers show growing LINK investor interest, suggesting the digital asset could experience a market price movement when market stability returns.

Source:

X

Source:

X

LINK shows signs of downward pressure despite increased whale activity as whales completed recent sell-offs. According to Ali Martinez’s analysis, the offloading of 4.13 million LINK by whales in the last 48 hours is significant since it might cause additional pricing pressure. The substantial price decline of LINK occurred after whales unloaded their vast holdings, which reached highs of $21. The chart Ali provides shows how whale movement affects LINK price trends during this substantial market dump.

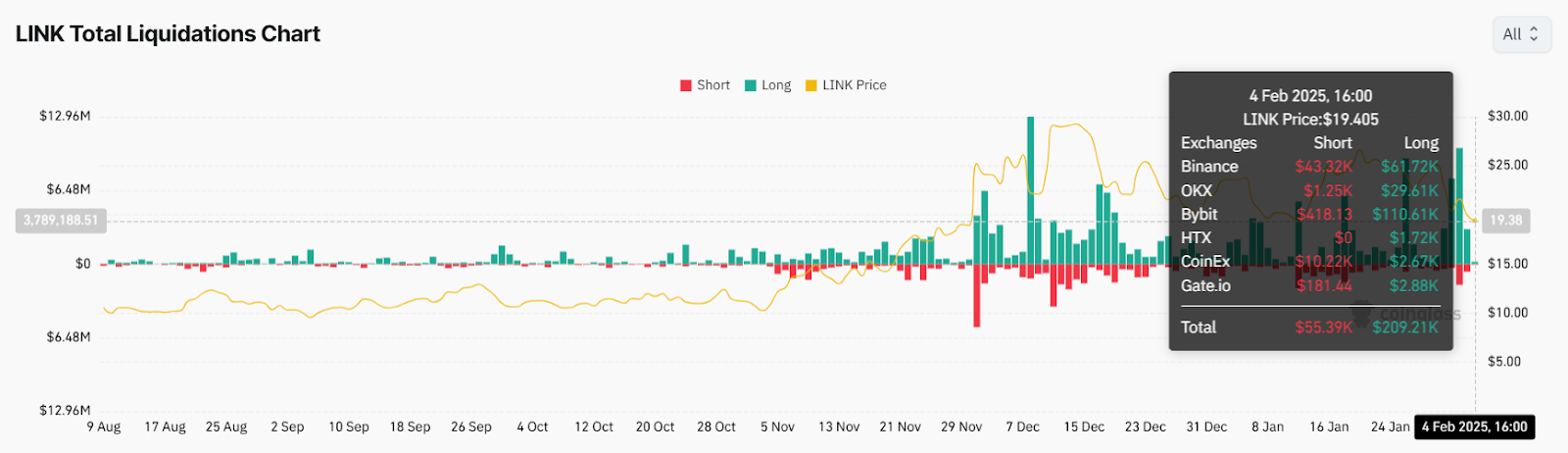

Chainlink’s Total Liquidations: How Are Traders Reacting?

Total liquidations indicate that Chainlink has faced major market oscillations. On February 4, 2025, traders faced extensive position closures that strongly affected holders investing long. The market data suggests traders are both collecting profits and closing their positions due to market confusion. Increasing market liquidations threatens to decrease LINK prices when market sentiment turns more negative.

Source:

Coinglass

Source:

Coinglass

Related: Chainlink Eyes $35 Amid Developments and Technical Strength

Conclusion: Can Chainlink Maintain Its Momentum?

Despite recent market dips, investor attention toward Chainlink remains intact based on the data showing major transactions coupled with multiple wallet address activities. The offloading of 4.13 million LINK by whales, while the technical indicators point to bearish behavior, presents potential negative risks for LINK. Link’s recovery to a bullish trend will become more likely once market conditions strengthen and temporary selling pressure declines. LINK has a neutral market direction that reveals multiple challenges and prospective benefits to traders at the present time.

The post LINK Faces Volatility Amid Whale Activity: Can It Hold Support? appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Growing Influence of Health and Wellness on Academic and Professional Growth

- Global workforce transformation integrates wellness, cybersecurity, and tech innovation to address burnout, skills gaps, and rising cyber threats. - AI-powered wellness tools like JuggernautAI and Whoop Coach boost productivity by 20% through real-time health monitoring and personalized interventions. - Educational institutions face 35% higher cyberattacks, shifting to zero-trust security and upskilling staff to manage AI risks in K-12 and higher education. - EdTech's $163B market growth prioritizes AI-d

New Trends in Public Interest Law Careers and Their Influence on Law School Financial Structures

- Growing demand for public interest legal careers is reshaping law school funding models through scholarships, endowment reallocations, and policy-driven financial strategies. - Institutions like Berkeley and Stanford prioritize public service by offering full-tuition scholarships and redirecting resources to legal aid, addressing unmet low-income legal needs and graduate debt challenges. - Federal policies, including tiered endowment taxes and loan reforms, force schools to balance fiscal responsibility

Evaluating the Factors Driving the Recent Rise in Trust Wallet Token’s Value

- Trust Wallet Token (TWT) price surge stems from institutional adoption and ecosystem expansion, redefining its utility and market perception. - Partnerships with Ondo Finance (RWAs) and Onramper (fiat-to-crypto onramps) enhanced institutional credibility and global accessibility for 210 million users. - Utility-driven features like FlexGas (TWT-based transaction fees) and Trust Premium (loyalty incentives) boosted demand while reducing circulating supply. - 200M+ downloads and 17M monthly active users by

OpenAI secures business victory just days following internal 'code red' over Google competition