XRP Price Prediction after the SEC Appeal Tomorrow

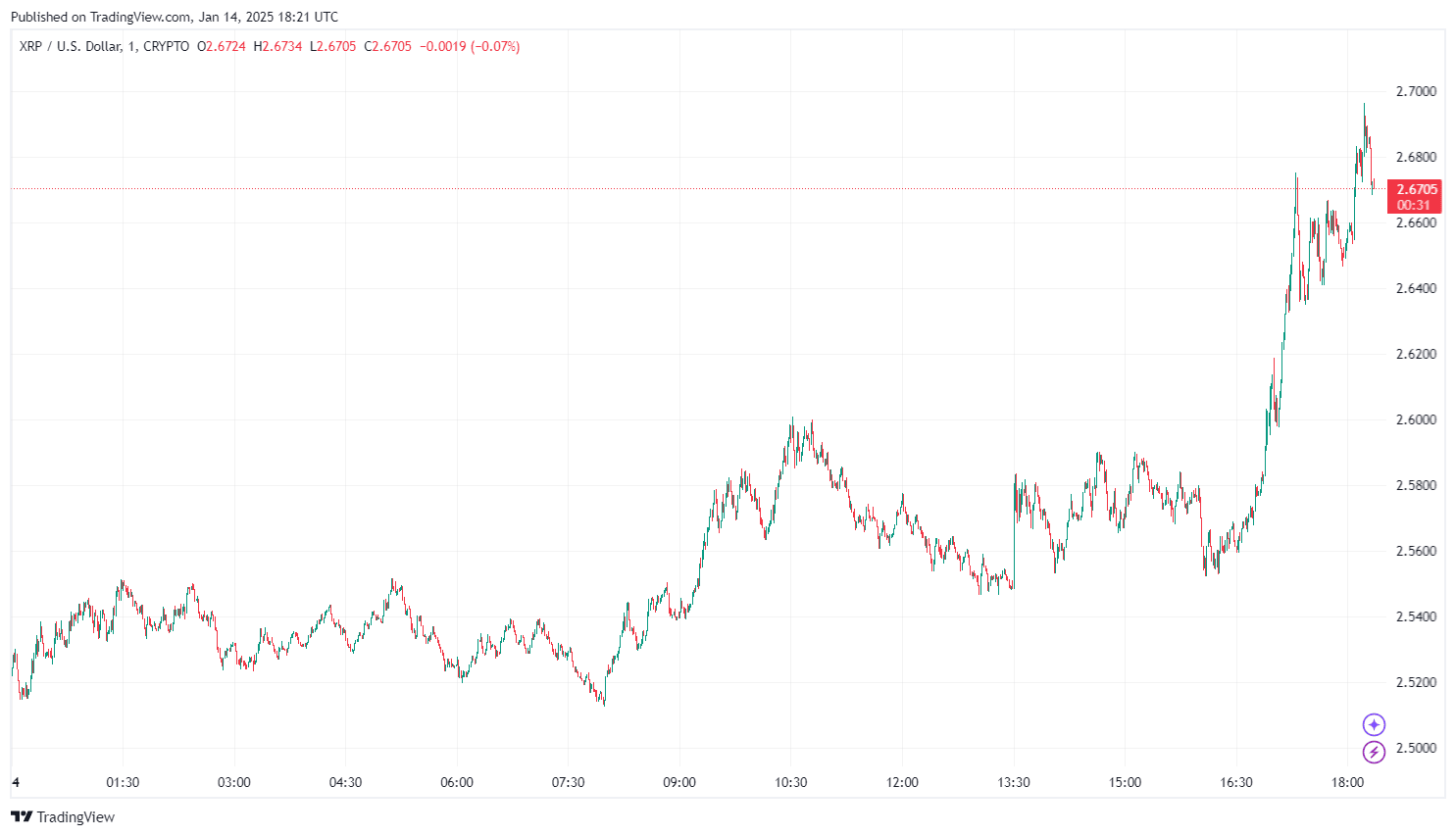

XRP price surged today , gaining over 10% in the last 24 hours and reaching an intraday high of $2.68. As Ripple Labs and the U.S. Securities and Exchange Commission (SEC) approach a critical legal milestone with the SEC’s appeal deadline on January 15, 2025, market participants are closely watching XRP's price movements . The next 48 hours are crucial for the XRP price which is currently fueled by momentum and investor confidence , will it keep or lose them?

By TradingView - XRPUSD_2025-01-14 (1D)

By TradingView - XRPUSD_2025-01-14 (1D)

The SEC Appeal and the XRP Price Momentum

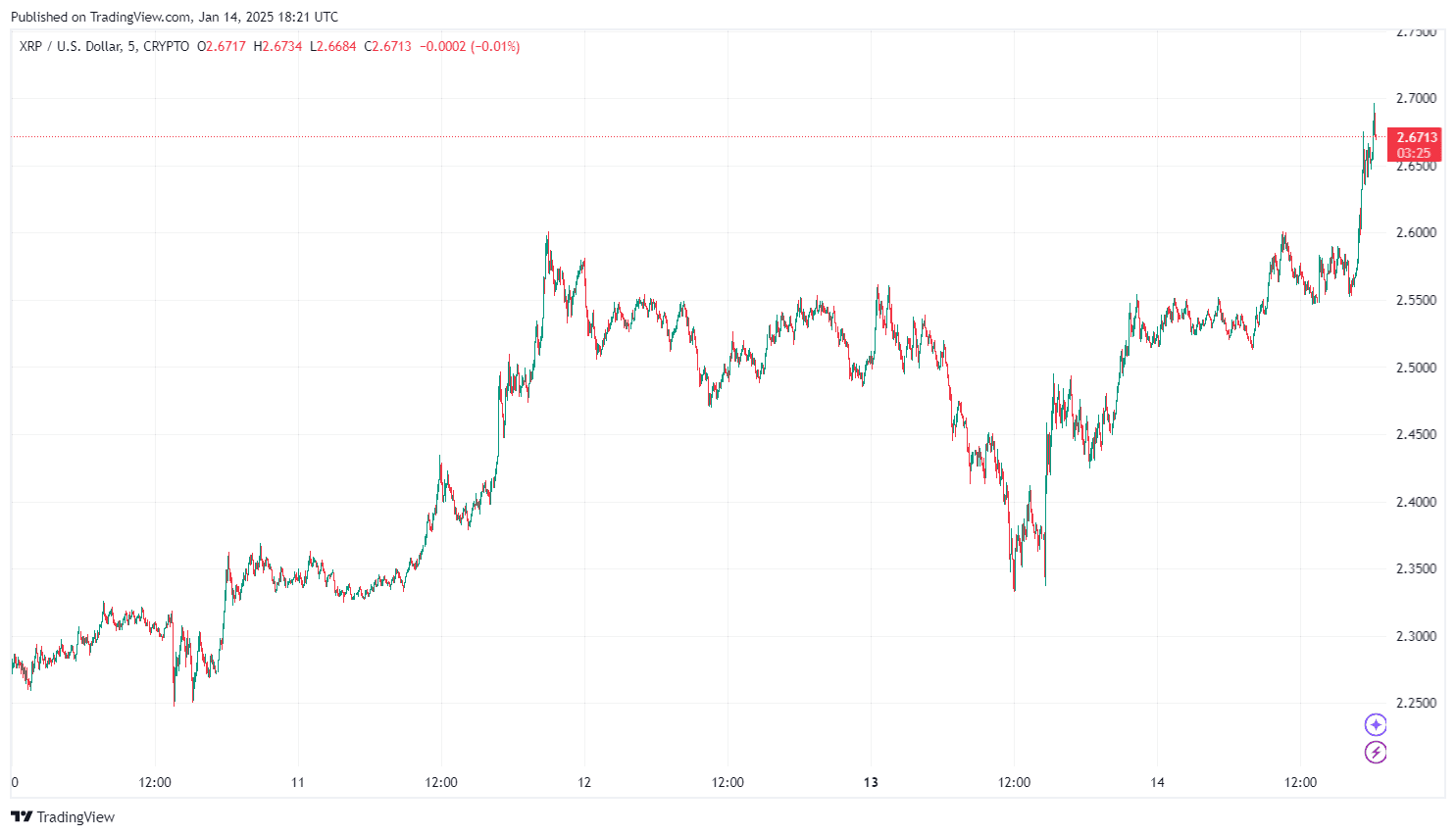

Ripple’s legal battle with the SEC has been a defining narrative for XRP’s performance over the past few years. The SEC must file its opening brief tomorrow, challenging previous court rulings that declared XRP not a security when sold to retail investors. Failure to meet this deadline could lead to the dismissal of the appeal, solidifying Ripple’s victory and potentially providing much-needed regulatory clarity for XRP and the broader crypto market.

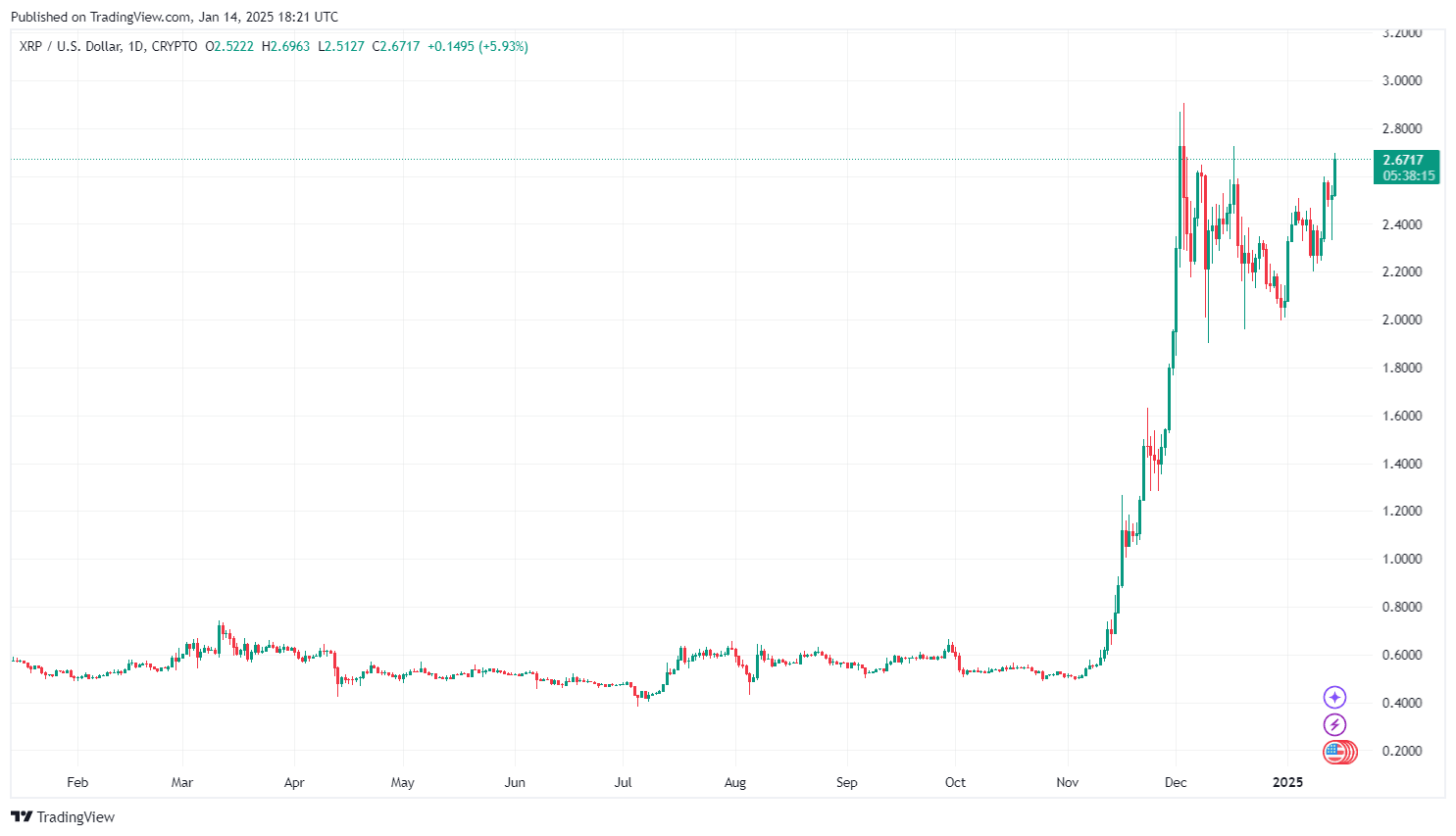

This clarity is a major driver behind XRP’s current momentum, with investors betting on a favorable outcome . Market analysts suggest that if the SEC’s appeal is dismissed or Ripple gains further ground, XRP could break through the $2.86 intra-year high, paving the way for new targets around $3 and beyond to a new ATH. Some analysts forecast potential rallies toward $4 and even $8 in the long term.

By TradingView - XRPUSD_2025-01-14 (5D)

By TradingView - XRPUSD_2025-01-14 (5D)

XRP Price Predictions and Analysis

1- Why XRP Is Outperforming Bitcoin

XRP’s recent surge, marked by a 10% gain in 24 hours, has significantly outpaced Bitcoin’s performance. Several factors are contributing to XRP’s bullish momentum:

- SEC Deadline Catalysts: The looming appeal deadline has heightened market activity around XRP, with traders positioning for potential positive outcomes.

- Pro-Crypto Political Environment: The imminent inauguration of pro-crypto President Donald Trump on January 20, coupled with expected leadership changes at the SEC , has fueled optimism about a more favorable regulatory environment.

- Investor Confidence: The XRP market reflects growing confidence, supported by robust trading volume and technical indicators signaling further upside potential.

2- Technical Analysis: Can XRP Break Its Intra-Year High?

At $2.68, XRP is approaching critical resistance levels. Analysts believe that sustained momentum, driven by the SEC’s appeal outcome, could push XRP toward or beyond its intra-year high of $2.86. Key support levels around $2.55 have been holding strong, while resistance above $2.70 remains the next hurdle.

By TradingView - XRPUSD_2025-01-14 (1Y)

By TradingView - XRPUSD_2025-01-14 (1Y)

If XRP successfully breaks through $2.86, its next targets could include $3 and even $3.20, driven by a combination of technical and fundamental factors, approaching its $3.84 ATH of 7 years for the first time in a long time, to maybe even surpassing it and hitting a new one.

By TradingView - XRPUSD_2025-01-14 (All)

By TradingView - XRPUSD_2025-01-14 (All)

3- What to Expect Before and After the SEC Appeal?

XRP Price Predictions

- Before the Deadline: XRP’s price is likely to remain volatile as traders react to news and speculation. A favorable signal, such as the SEC missing its deadline or filing a weak brief, could trigger a rally.

- After the Decision: The SEC appeal process is expected to extend into 2026 , but early decisions could set the tone for the case. A Ripple victory could strengthen XRP’s market position, potentially attracting institutional investors and driving long-term growth.

Broader Market Impact of the Ripple SEC Lawsuit Outcome

The outcome of this Ripple SEC lawsuit case will not only affect XRP tokens, but will influence the regulatory landscape for cryptocurrencies in the U.S., affecting tokens beyond XRP, as all eyes are on Ripple’s legal battle and its potential to reshape the future of cryptocurrency regulation. And now a pro-crypto administration under Trump could amplify this impact , encouraging innovation and investment in blockchain technologies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.