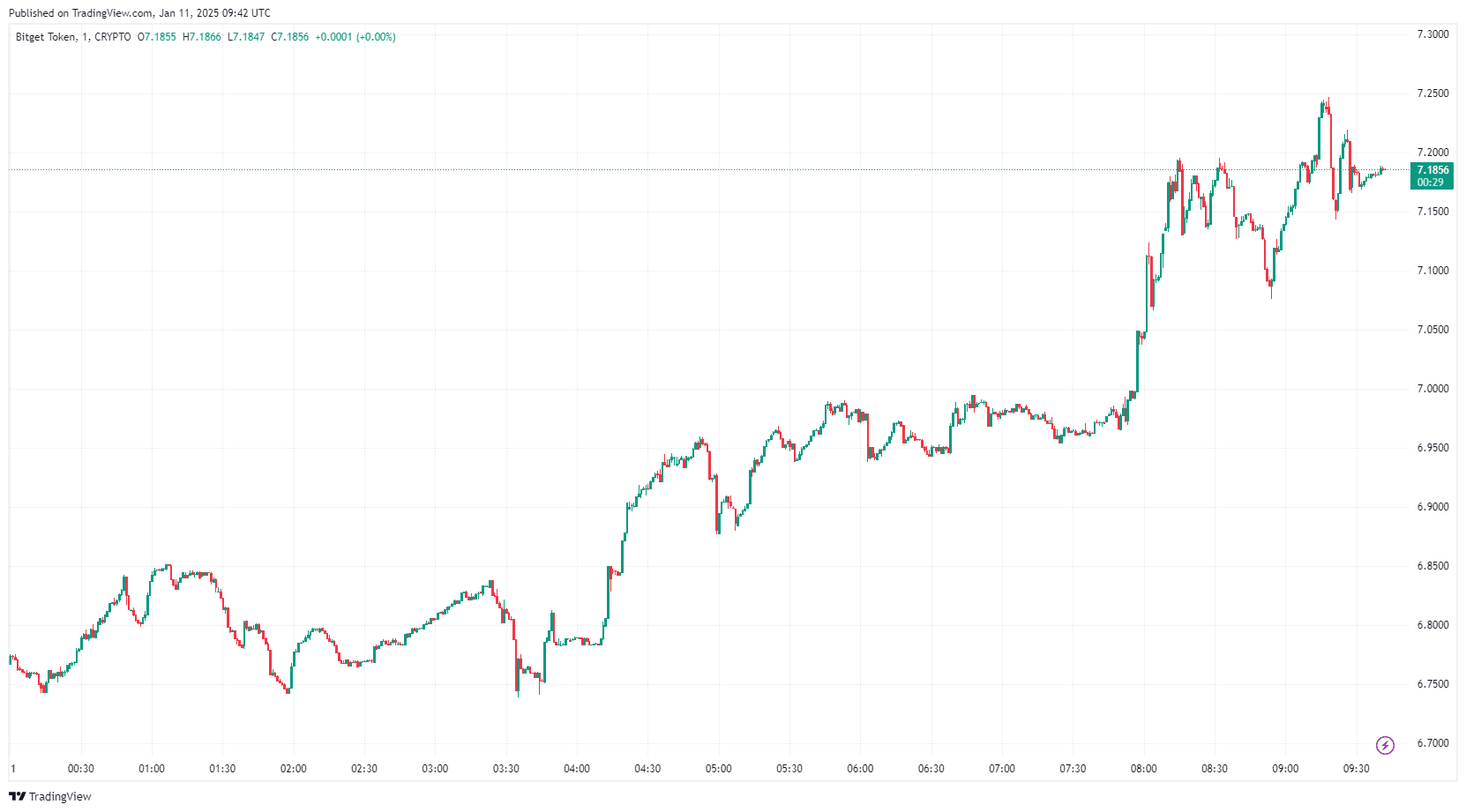

Bitget Token Price Surge amid Market Downturn: New 2025 BGB ATH?

Amid a challenging cryptocurrency market, Bitget Token (BGB) has defied the odds, delivering a remarkable performance. With Bitcoin (BTC) witnessing a decline , BGB's bullish breakout has captured investors' attention. Trading at $7.18 with a one-day gain of +10.30%, BGB’s performance metrics highlight its growing strength. This article explores the factors driving BGB's rise and whether it can sustain its momentum.

By TradingView - BGBUSD_2025-01-11 (1D)

By TradingView - BGBUSD_2025-01-11 (1D)

Key Factors Behind BGB’s Unprecedented Growth

1- Regulatory Approval in El Salvador

Bitget recently gained regulatory approval from El Salvador’s Central Reserve Bank , becoming a Bitcoin Service Provider . This milestone enables fiat-to-Bitcoin exchange services and custody solutions, solidifying Bitget's credibility and attracting global investors .

2- Major Token Burn

In a strategic move, Bitget burned 800 million BGB tokens, slashing total supply by 40% . This scarcity model has proven instrumental in increasing BGB’s value, with quarterly burns planned to maintain its deflationary stance.

By TradingView - BGBUSD_2025-01-11 (3M)

By TradingView - BGBUSD_2025-01-11 (3M)

3- Strong Marketing and Ecosystem-Building effort

Bitget's aggressive expansion strategy includes:

- New listings across diverse crypto niches,

- Marketing campaigns like rewards, giveaways, and staking incentives,

- User engagement through promotional activities, is likely contributing to increased adoption of its ecosystem, reinforcing BGB’s value and price.

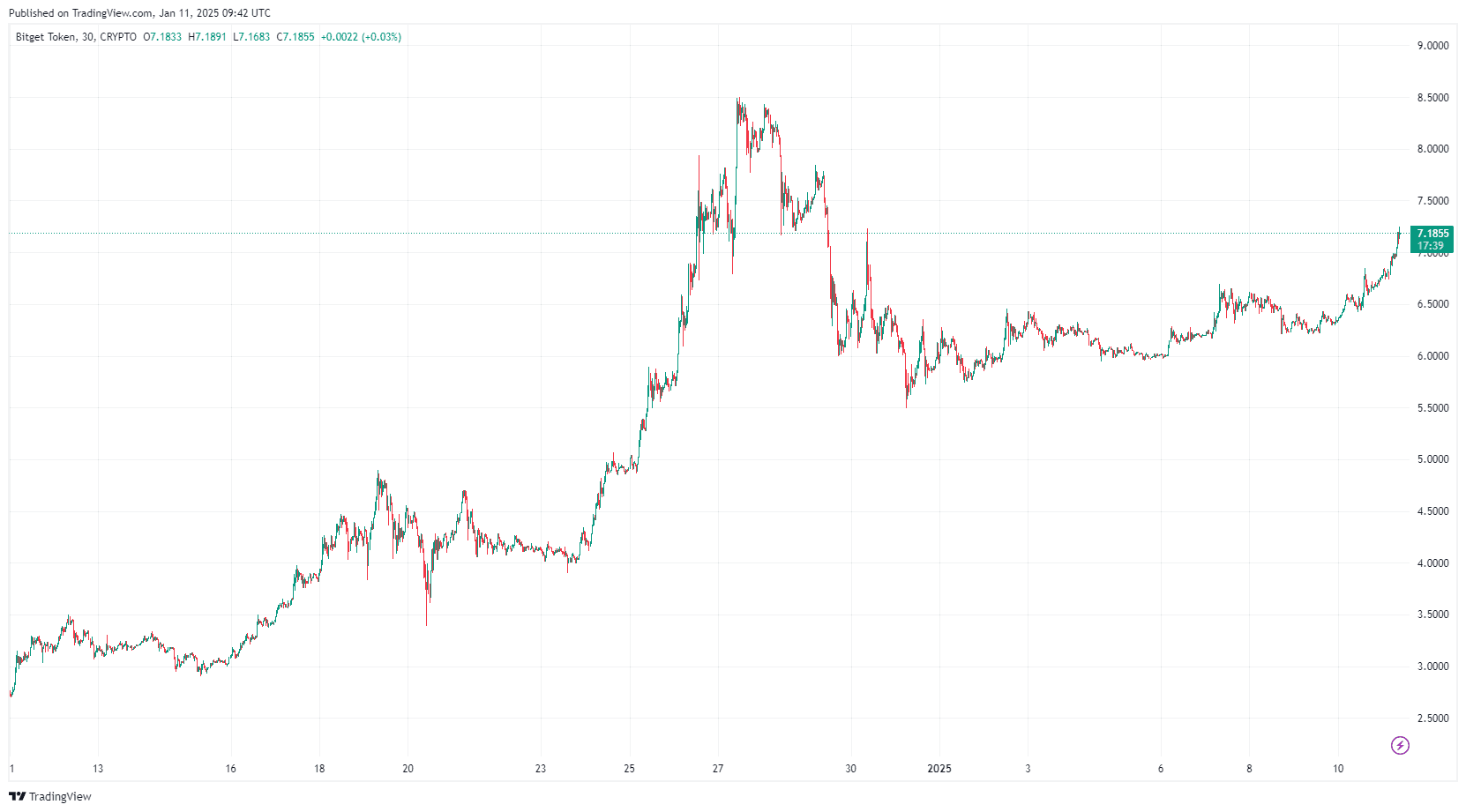

Can BGB’s Breakout Push It to New Highs?

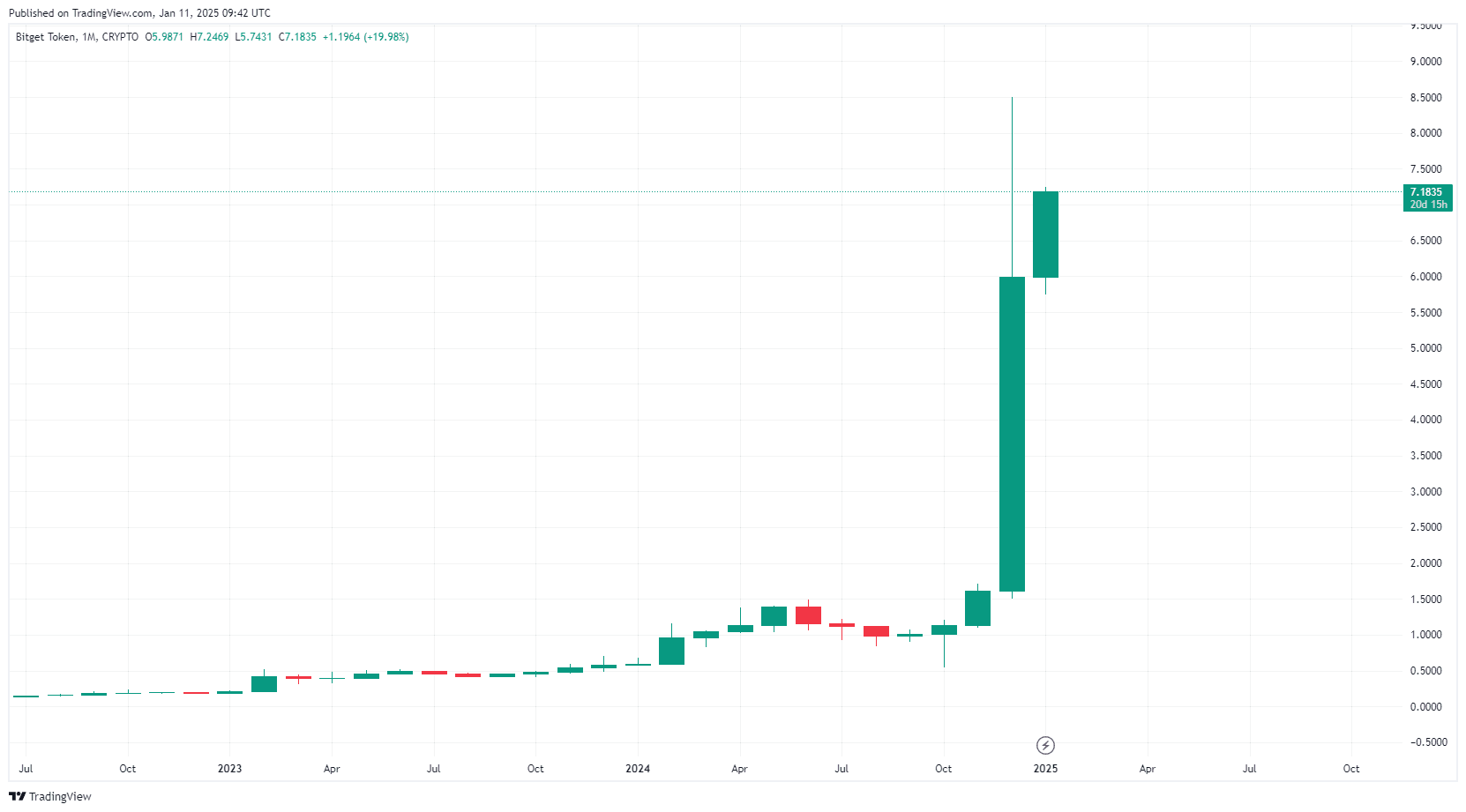

BGB has demonstrated resilience, breaking a critical resistance at $6.72 and surging to $7.18, with an intraday high of $7.24. This performance marks a +126.73% gain in one month and an all-time high of $8.49 just 15 days ago .

By TradingView - BGBUSD_2025-01-11 (1M)

By TradingView - BGBUSD_2025-01-11 (1M)

Historically, BGB’s trendline breakouts have led to significant price rallies. If the pattern holds, BGB could soon retest its all-time high, representing a potential upside from its current price. Strong support at $6.43 reinforces investor confidence.

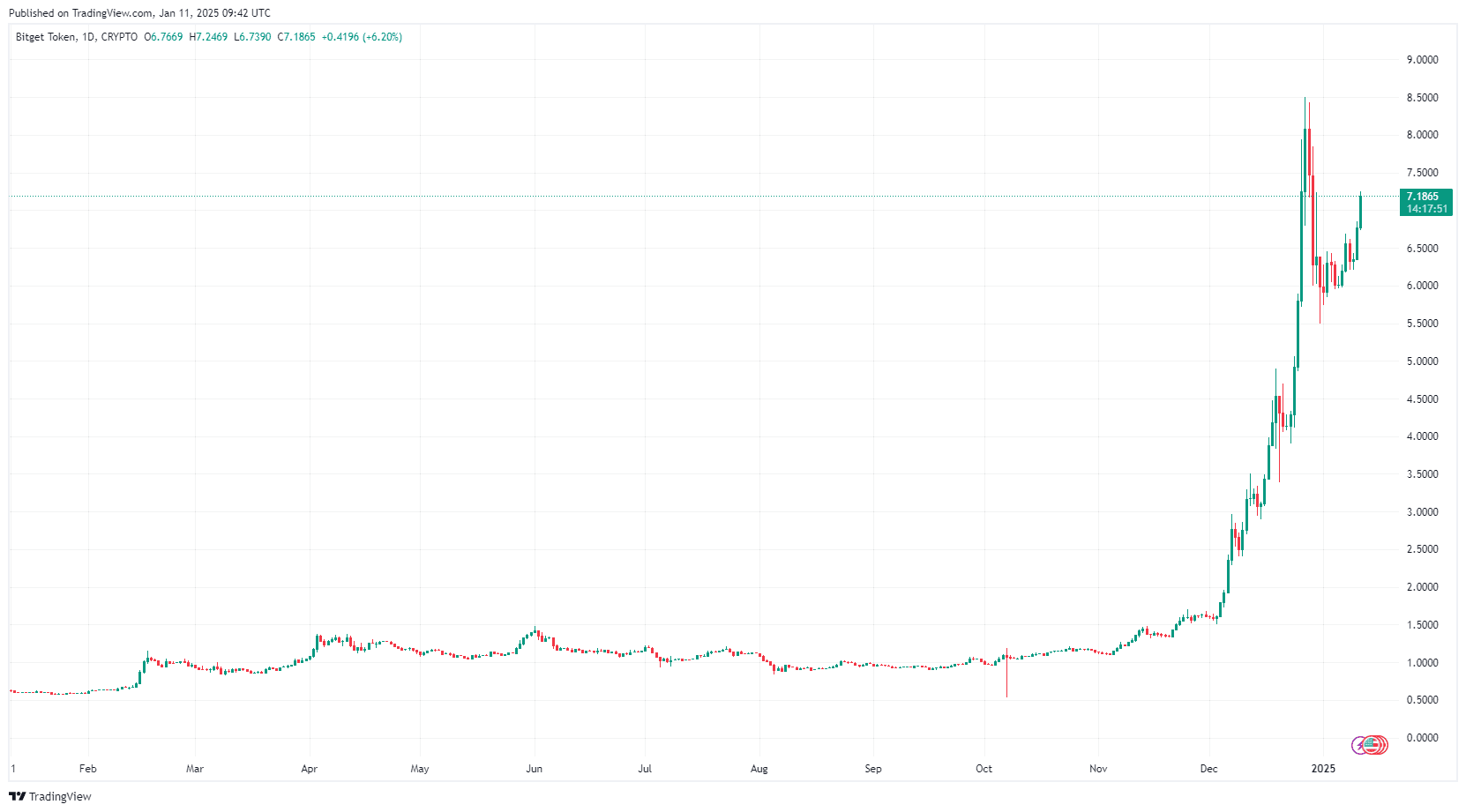

By TradingView - BGBUSD_2025-01-11 (1Y)

By TradingView - BGBUSD_2025-01-11 (1Y)

Technical Indicators Signal Bullish Momentum

MACD (Moving Average Convergence Divergence)

- The MACD line recently crossed above the signal line, indicating continued bullish momentum and the potential for further gains.

RSI (Relative Strength Index)

- With an RSI of 75.22, BGB remains in strong buying territory, suggesting sustained demand despite nearing overbought levels.

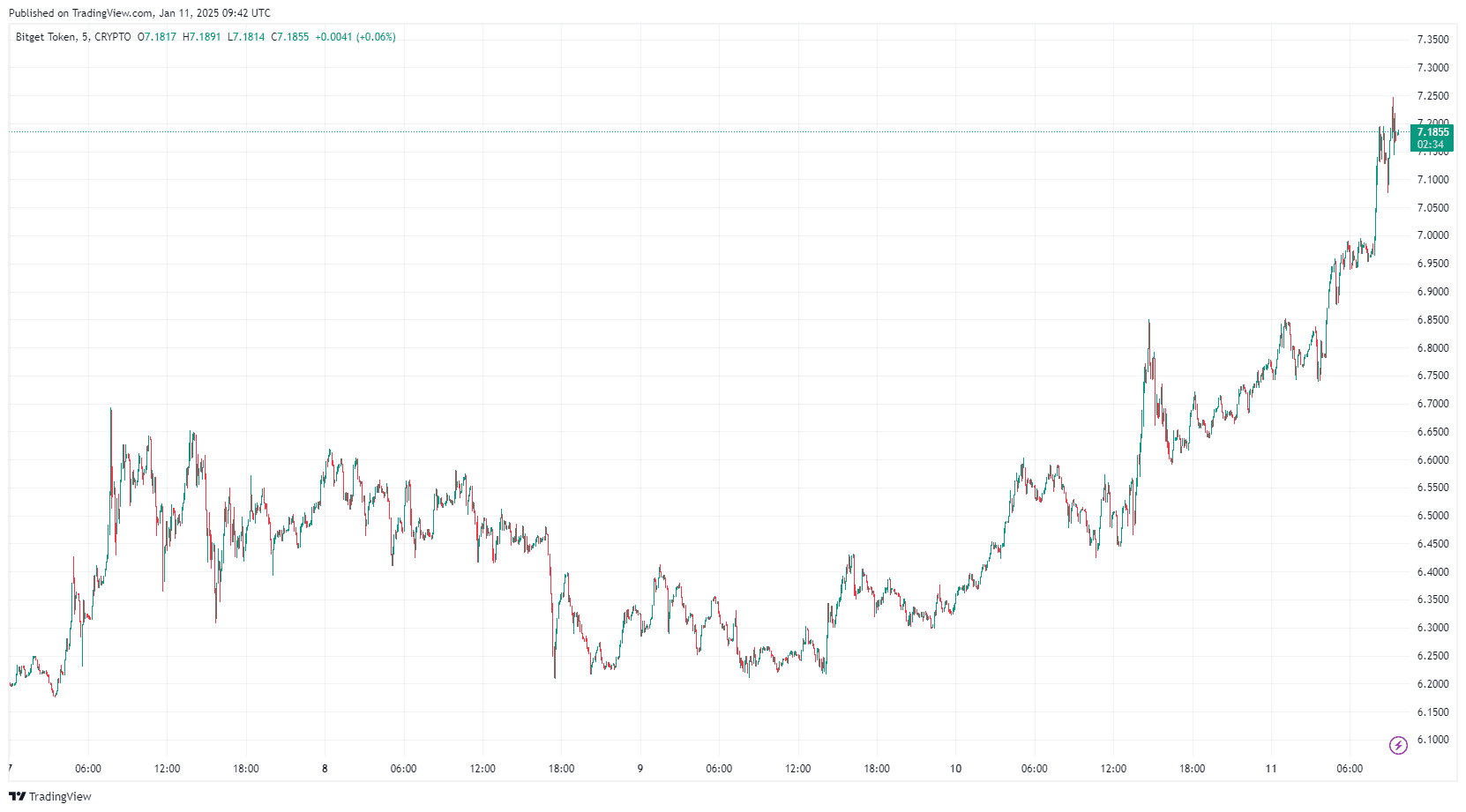

By TradingView - BGBUSD_2025-01-11 (5D)

By TradingView - BGBUSD_2025-01-11 (5D)

Conclusion

As BGB continues its stellar rally , its regulatory advancements and strategic token burn have positioned it as one of the best-performing assets in the crypto market. Over the past year, BGB has surged by 1,051.85%, with an astounding all-time performance of +5,153.40%. If Bitcoin stabilizes between $91K and $94K, BGB’s momentum could accelerate, setting the stage for a new all-time high, with its continuous market efforts and strong community engagement.

By TradingView - BGBUSD_2025-01-11 (All)

By TradingView - BGBUSD_2025-01-11 (All)

For now, BGB’s bullish breakout keeps it firmly on the radar of investors looking for standout performers in a volatile market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hotcoin Research | Fusaka Upgrade Approaching: Analysis and Outlook on Ethereum Long and Short Positions

This article will review Ethereum's recent performance, provide an in-depth analysis of the current bullish and bearish factors facing Ethereum, and look ahead to its prospects and trends for the end of this year, next year, and the medium to long term. The aim is to help ordinary investors clarify uncertainties, grasp trends, and provide some reference to support more rational decision-making during key turning points.

Crypto Market Surges as Bitcoin Rebounds and Privacy Coins Shine

In Brief Bitcoin rebounded over the weekend, testing the $86,000 mark. Privacy-focused altcoins Monero and Zcash showed notable gains. Total market value surged, crossing the $3 trillion threshold again.

Trending news

MoreBitget Daily Digest (Nov 24) | Total Crypto Market Cap Rebounds Above $3 Trillion; Michael Saylor Posts “Won’t Surrender,” Hinting at Further Bitcoin Accumulation; Bloomberg: Bitcoin’s Decline Signals Weak Year-End Performance for Risk Assets, but 2026 May Have Growth Momentum

Following the attack, Port3 Network announced it would migrate its tokens at a 1:1 ratio and burn 162.7 million PORT3 tokens.