Glassnode Co-Founders Issue Bitcoin Alert After $100,000 Milestone Is Hit, Say BTC Early Warning Signal Flashing

The co-founders of the crypto analytics platform Glassnode are issuing a warning that Bitcoin ( BTC ) may be heading for a severe correction after its historic $100,000 breakthrough.

Jan Happel and Yann Allemann, who go by the handle Negentropic, tell their 63,200 followers on the social media platform X that the Bitcoin Fundamental Index (BFI) metric is singling a weakening market.

The BFI evaluates several aspects of the Bitcoin market, including wallet activity and transaction volume. When it declines, the risk of a market correction increases.

“Not to rain on the parade, but Bitcoin has crossed $100,000, yet the Bitcoin Fundamental Index (BFI) is starting to weaken. Should we be concerned? This indicator often sends early warning signals, and once confirmed, they’re hard to ignore. Take the market peak in Q1 this year as an example: the BFI showed the exit point ahead of a significant correction. For now, we’ll keep monitoring, but the bull run still has fuel left.”

Source: Negentropic/X

Source: Negentropic/X

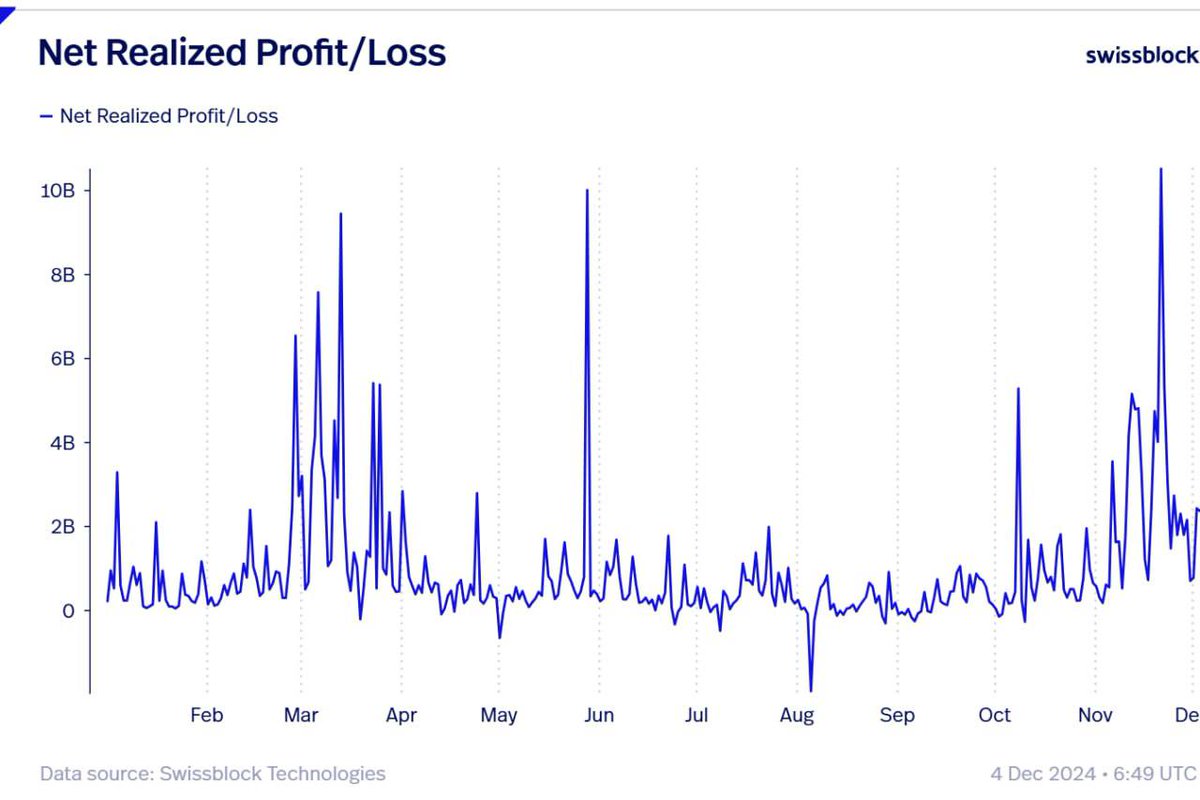

Prior to Bitcoin breaking the $100,000 resistance level, the analysts said the net realized profit/loss metric, which tracks whether Bitcoin holders are selling at a loss or a profit, indicated holders were waiting for higher price targets before they’d likely start taking profits.

“Bitcoin traders hold out for higher levels. Another sign of Bitcoin’s price consolidation is traders’ reluctance to take profits in this range. They’re aiming for higher levels, expecting gains once Bitcoin starts challenging key resistances. Once Bitcoin overcomes its resistance and establishes itself above $100,000, we’ll likely witness spikes to the upside on this chart, signaling trader confidence turning into action.”

Source: Negentropic/X

Source: Negentropic/X

Bitcoin is trading for $96,579 at time of writing, down 6.8% from its new all-time high of $103,679.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hotcoin Research | Fusaka Upgrade Approaching: Analysis and Outlook on Ethereum Long and Short Positions

This article will review Ethereum's recent performance, provide an in-depth analysis of the current bullish and bearish factors facing Ethereum, and look ahead to its prospects and trends for the end of this year, next year, and the medium to long term. The aim is to help ordinary investors clarify uncertainties, grasp trends, and provide some reference to support more rational decision-making during key turning points.

Crypto Market Surges as Bitcoin Rebounds and Privacy Coins Shine

In Brief Bitcoin rebounded over the weekend, testing the $86,000 mark. Privacy-focused altcoins Monero and Zcash showed notable gains. Total market value surged, crossing the $3 trillion threshold again.

Crypto Markets Rebound as Traders Signal Seller Fatigue

In Brief Crypto markets rebounded amid significant liquidations and oversold RSI signals. Weekend trading conditions with thin liquidity influenced rapid price shifts. The rebound's sustainability remains uncertain, prompting scrutinous investor attention.

Cardano : Network security questioned after a major incident