JPMorgan Chase: Bitcoin volatility has reached four times that of the S&P 500, portfolio construction depends on risk tolerance

Global market strategist Jack Manley and research analyst Sahil Gaba at JPMorgan Chase released a report titled "Does Cryptocurrency Deserve a Place in Portfolio Construction?" The report points out that the appeal of cryptocurrency largely lies in its potential for excess returns, but challenges still exist. Although Bitcoin's returns are impressive, its volatility is also very high, four times that of the SP 500 index.

The role of cryptocurrency in portfolio construction mainly depends on risk tolerance. Cryptocurrencies are inherently unpredictable: there is little visibility into future price trends, and while blockchain technology is exciting, there are few barriers to entry. This means that as new tokens with improved features enter the market, existing tokens may become obsolete (and therefore worthless). Therefore, for most investors, any allocation to cryptocurrencies in their portfolios should be kept small enough to ensure that even significant sell-offs will not disrupt overall investment goals and achieve good diversification.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

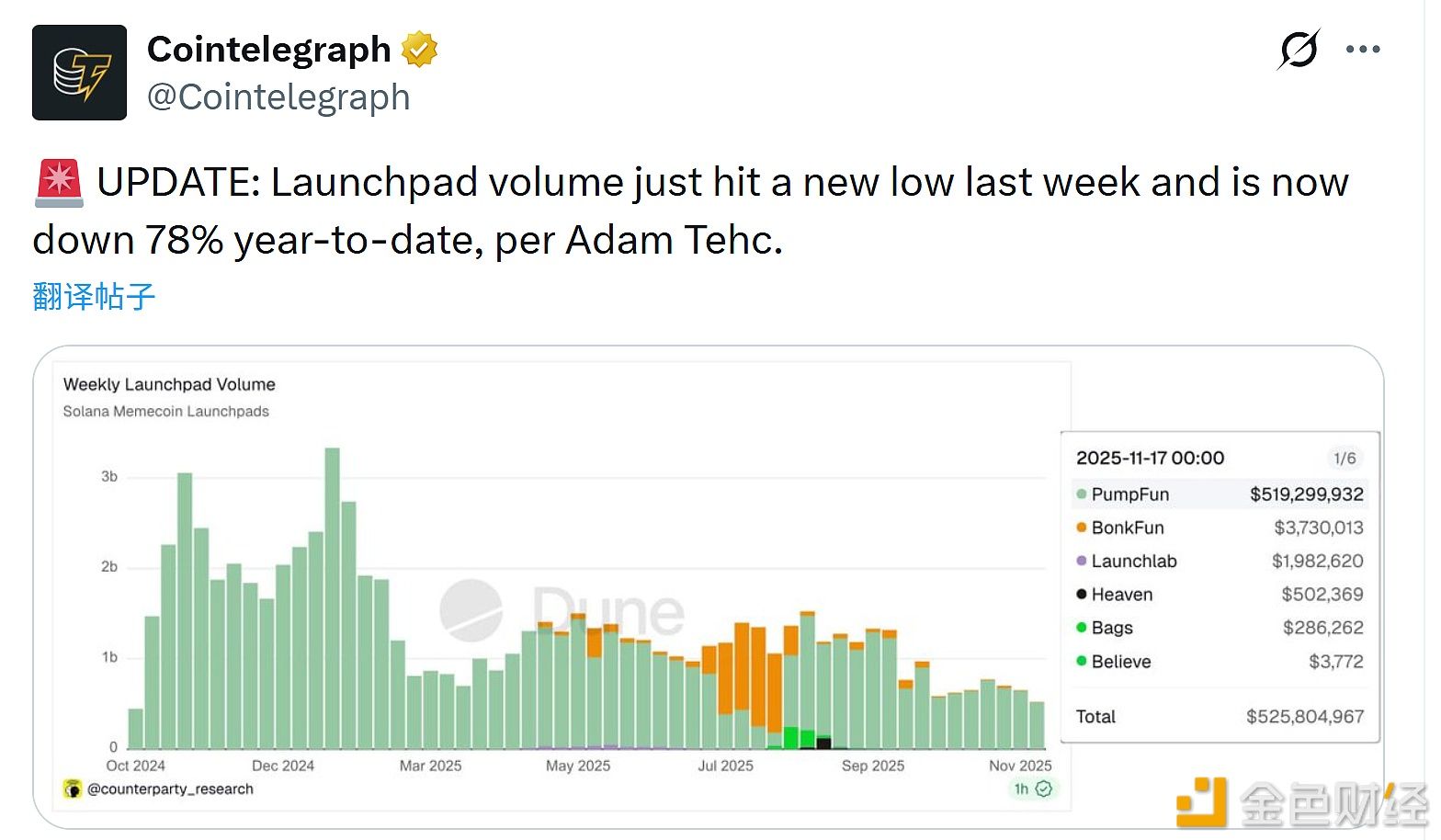

Adam Tech: Launchpad trading volume hit a new low last week

Data: Hyperliquid platform whales currently hold $4.576 billions in positions, with a long-short ratio of 0.93

Tether suspends Bitcoin mining operations in Uruguay due to rising energy costs