-

Arbitrum’s (ARB) recent performance indicates a growing bullish sentiment, positioning the coin for potential substantial gains ahead.

-

As highlighted by recent trading activities, ARB has surpassed its short-term resistance levels, creating optimism among investors.

-

According to COINOTAG, “this upward trend could persist as market participants’ actions continue to support the bullish momentum.”

Explore how Arbitrum (ARB) is gaining momentum in the crypto market, with rising netflow and market accumulation fueling bullish sentiment.

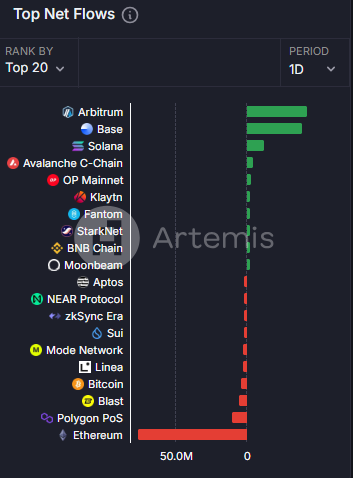

Chain Netflow Signals Accumulation Trend for ARB

Current data reveals that Arbitrum’s netflow has surged, marking a pivotal moment for the altcoin. At the latest update, ARB showcased the highest chain netflow over the past 24 hours compared to industry giants like Ethereum and Solana, with an impressive total of $42.6 million in net inflows.

This metric—chain netflow—represents the difference between the inflow and outflow of assets, providing insights into trading behavior and user engagement. Positive netflow suggests a strong interest in accumulation, which can foreshadow future price increases for ARB.

Source: Artemis

Further insights indicate a robust accumulation strategy among investors, suggesting ARB’s bullish trajectory may continue, driven by favorable market conditions.

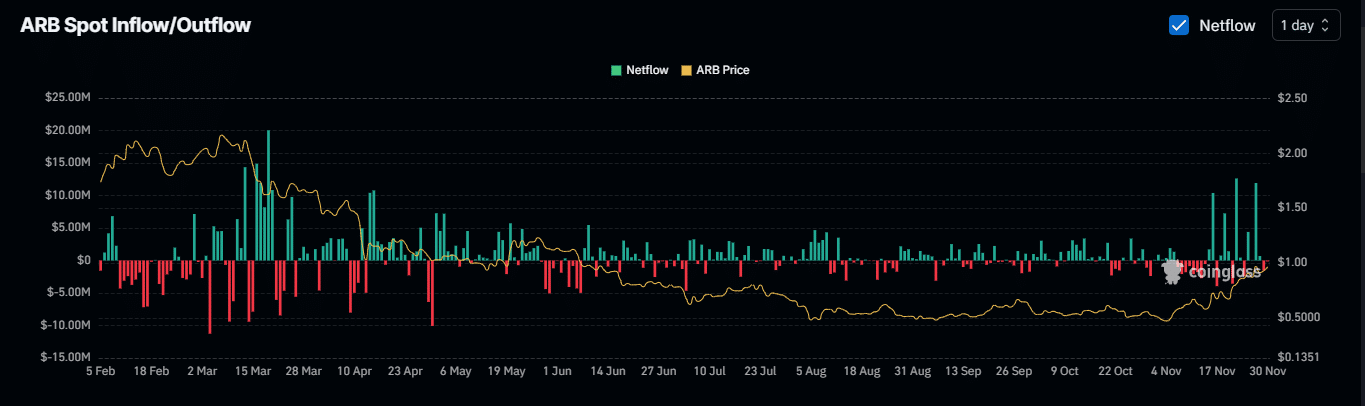

Shifting Dynamics in Selling Pressure for ARB

After witnessing four consecutive days of positive exchange netflow totaling $17.04 million, a notable shift has emerged in selling dynamics. Recent data shows that during the last 48 hours, negative netflow transactions have surfaced, totaling $1.66 million, indicating that many are choosing to hold rather than sell.

The decline in large-holder transaction volume is also significant, with a report showing a drop from 706 to just 206 large-holder transactions. This retrenchment from whales suggests a strategic pivot towards retention of ARB holdings, a behavior that can stabilize and support an upward movement in prices.

Source: Coinglass

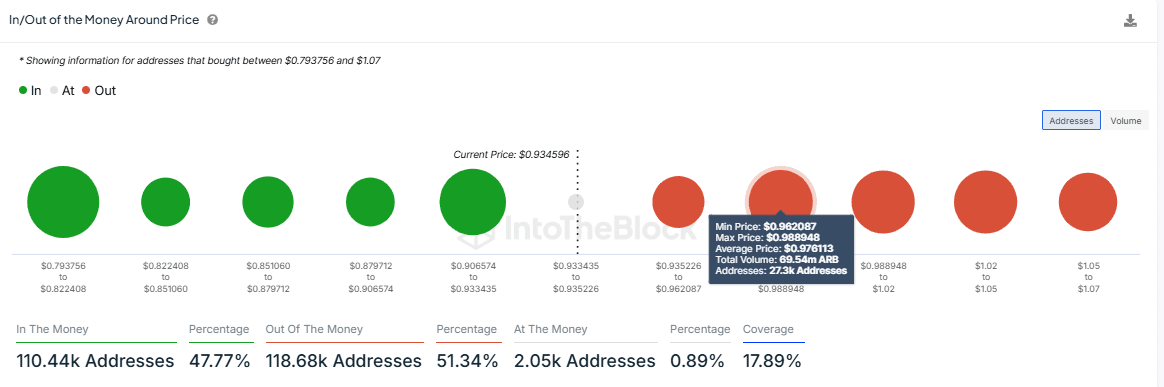

Resistance Levels: ARB Faces $0.983 Challenge

As ARB continues its upward trend, it is likely to face significant resistance at the critical supply zone identified through the In/Out of the Money Around Price (IOMAP) metric. This zone, situated between $0.96 and $0.98, indicates a selling pressure of approximately 69.5 million ARB across over 27,000 addresses, highlighting the challenges ahead.

If ARB succeeds in breaking through the resistance at $0.983, it may pave the way for a climb towards the upper price target of $2.4, where robust liquidity exists—potentially signaling a significant rally for the asset.

Source: IntoTheBlock

Conclusion

In summary, Arbitrum’s recent bullish movements, marked by strong accumulative netflow and easing selling pressures, indicate a positive outlook for ARB. As resistance levels loom ahead, navigating through these challenges will be crucial for sustaining momentum and reaching future price targets. A careful watch on market dynamics will provide critical insights for investors looking to capitalize on ARB’s performance.