Copper will provide custodial services for tokenized currency market funds such as Belayed BUIDL

According to CoinDesk, cryptocurrency company Copper stated in a press release on Wednesday that it will now provide secure custody and trading for clients of BlackRock's BUIDL and other tokenized cryptocurrency market funds.

The company has signed new partnerships with major players in the tokenization field, including Securitize, Franklin Templeton, Ondo and Hashnote. Securitize is the transfer agent and tokenization platform for BlackRock's dollar institutional digital liquidity fund, which is issued on the Ethereum blockchain and represented by the blockchain-based BUIDL token.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysts: The Federal Reserve May Be Shifting Toward a Dovish Stance

Bloomberg Analyst: BTC May Fall Below $84,000 by Year-End, 'Santa Claus Rally' Unlikely to Occur

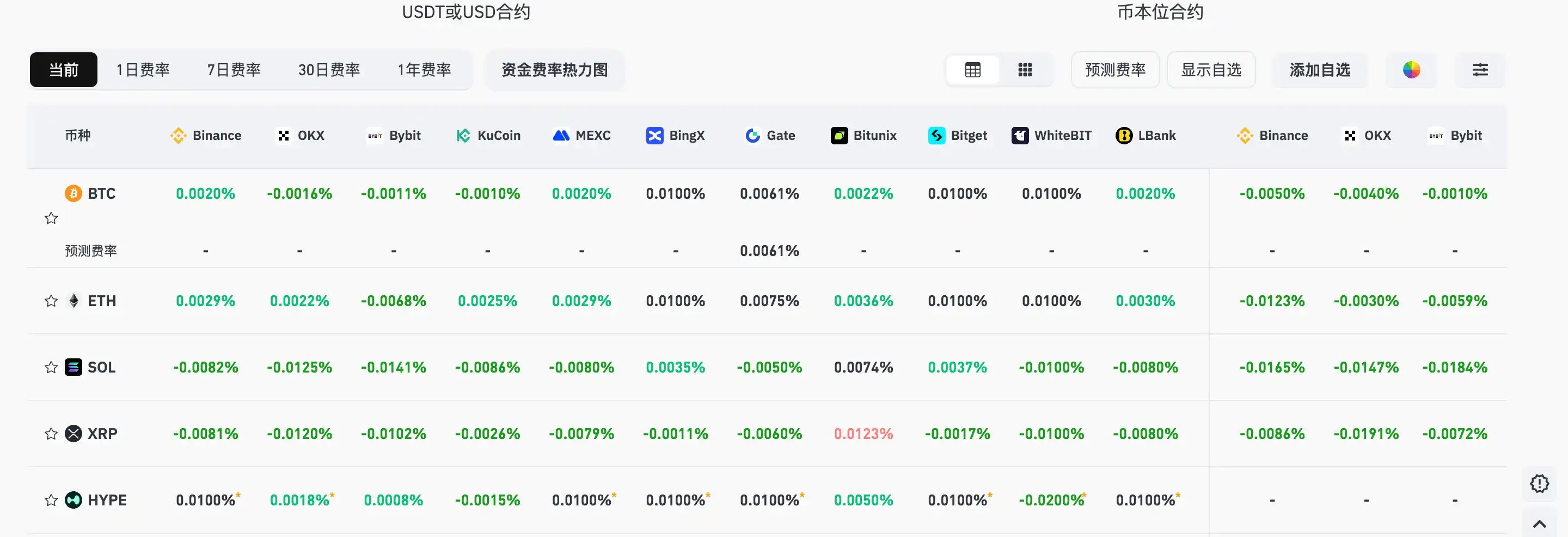

Current mainstream CEX and DEX funding rates indicate that the market remains broadly bearish.