Ethena Labs Determines Reserve Fund RWA Allocation, Risk Committee Monitors

On October 10th, Ethena Labs announced in a post on Platform X that it has finalized its Reserve Fund RWA allocation and that the Risk Committee has identified four assets, BUIDL (Blackrock/Securitize), USDS (Sky), USTB (Superstate), and USDM (Mountain).

The Risk Committee is comprised of five voting members from industry-leading risk and advisory firms: Gauntlet, Block Analitica, Steakhouse, Llama Risk, and Blockworks Advisory.

Allocations from the Reserve Fund are expected to take place over the next few days, with interim changes to the Reserve Fund balance, and the Risk Committee is tasked with monitoring these allocations on an ongoing basis and will provide regular risk updates to the institutional community.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A certain whale has rebuilt a position of 90.85 WBTC at an average price of $87,242.

Economist: December rate cut becomes highly probable again, Williams' remarks set the tone for the market

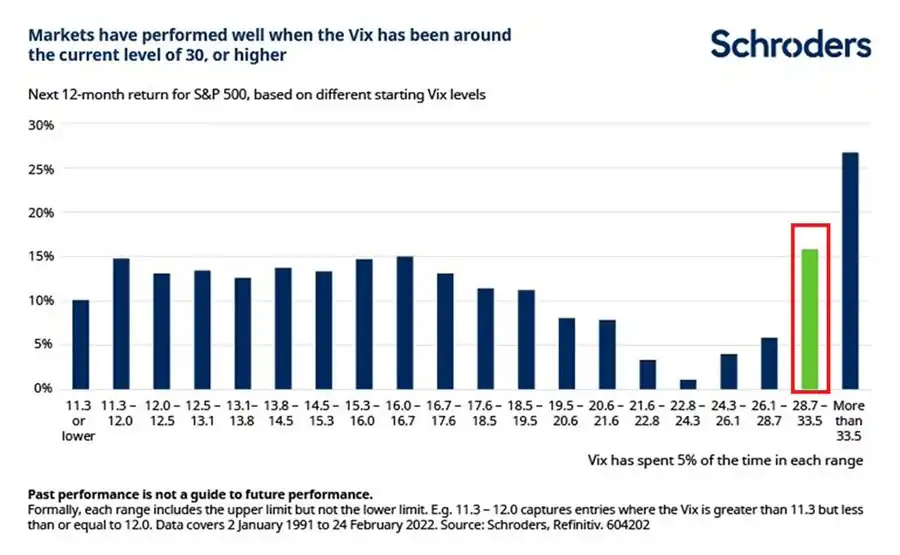

Analysis: When the volatility index VIX exceeds 28.7, the S&P 500 often delivers strong returns

Trading volume on BSC remains sluggish, with most popular meme tokens seeing transactions below $1 million.