The U.S. Treasury market is pricing in a 25 basis point Fed rate cut in November and December in line with the median dot plot

On October 8, Felipe Villarroel, a portfolio management partner at TwentyFour Asset Management, said that investor expectations have become more aligned with those of the Federal Reserve over the past few weeks. “The U.S. Treasury market is now pricing in two 25 basis point rate cuts in November and December in line with the median dot plot,” he said in a note. He said the Fed's base case of a soft economic landing (a decline in inflation without harming the economy and the labor market) and growth close to 2% potential would require the neutral rate to be set at around 3%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysis: ETH rises possibly due to market optimism about the Fusaka upgrade

SlowMist: Beware of Solana Wallet Owner Permission Tampering Attacks

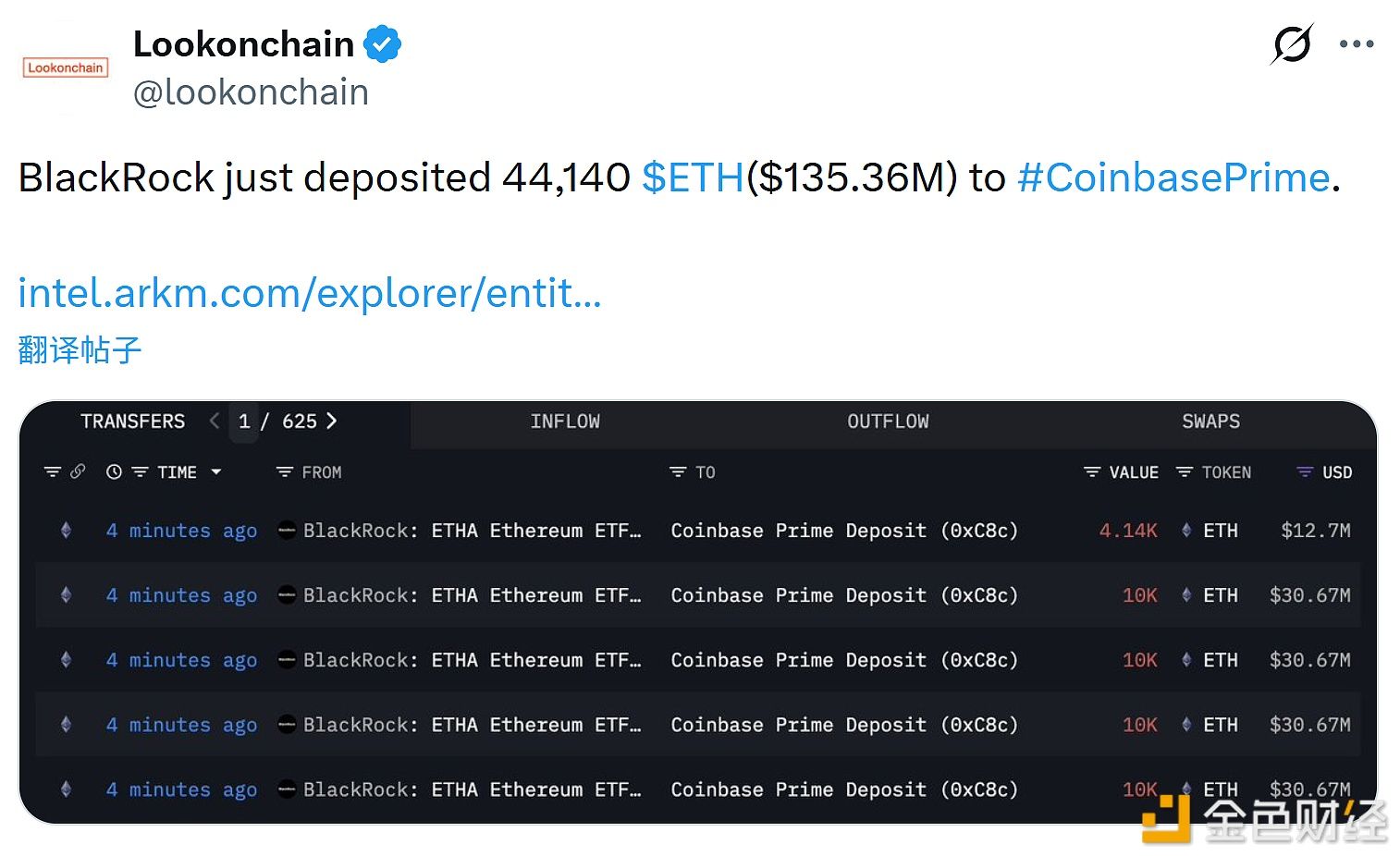

BlackRock deposits 44,140 ETH into a certain exchange's Prime platform

Reuters: Strategy in Talks with MSCI to Address Potential Removal from MSCI Index