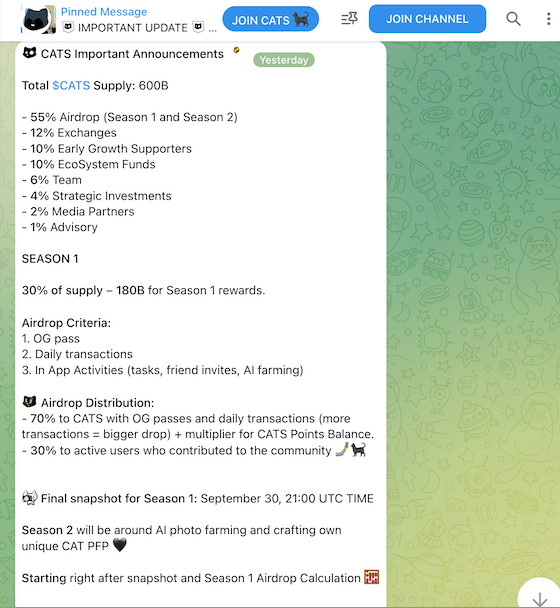

Important Announcements From CATS community

Total $CATS Supply: 600B

- 55% Airdrop (Season 1 and Season 2)

- 12% Exchanges

- 10% Early Growth Supporters

- 10% EcoSystem Funds

- 6% Team

- 4% Strategic Investments

- 2% Media Partners

- 1% Advisory

SEASON 1

30% of supply – 180B for Season 1 rewards.

Airdrop Criteria:

1. OG pass

2. Daily transactions

3. In App Activities (tasks, friend invites, AI farming)

Airdrop Distribution:

- 70% to CATS with OG passes and daily transactions (more transactions = bigger drop) + multiplier for CATS Points Balance.

- 30% to active users who contributed to the community

Final snapshot for Season 1: September 30, 21:00 UTC TIME

Season 2 will be around AI photo farming and crafting own unique CAT PFP

Starting right after snapshot and Season 1 Airdrop Calculation

At CATS, we value the clever cats who know that free cheese only comes in a mousetrap , far more than the mice and hamsters who just want to tap and expect millions. While some may believe they can earn big rewards with little effort, we reward those who truly understand the game and invest their time and resources wisely.

The bigger, juicier rewards are reserved for the real CATS — those who value the project and are ready to be part of it, growing together with the community in this new era of digital renaissance

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIPBitget VIP Weekly Research Insights

Bitcoin Updates: Negative Cycle Drives Bitcoin Down Even as Long-Term Outlook Remains Positive

- NYDIG reports capital flight from crypto via ETF outflows, stablecoin contractions, and corporate treasury sales, reversing Bitcoin's demand engine. - BlackRock's $520M IBIT ETF redemption highlights institutional shifts, with ETFs now amplifying Bitcoin's downward pressure instead of stabilizing prices. - Stablecoin supply declines and DATs selling assets (e.g., Sequans) create a feedback loop, accelerating Bitcoin's bearish momentum post-October liquidation crisis. - Despite weak near-term indicators,

XRP News Update: Alternative Coin ETFs Launch as Grayscale Broadens Its Reach Past Bitcoin

- NYSE approves Grayscale's GDOG and GXRP ETFs for Dogecoin and XRP , launching Nov 24 after SEC-compliant regulatory clearance. - SEC's 2025 framework enabled rapid altcoin ETF approvals, with Franklin Templeton and others entering competitive XRP market. - GDOG charges 0.35% fees targeting retail investors, while Franklin's fee-free XRP ETF aims to attract institutional capital through Coinbase . - Despite $4B+ outflows in Bitcoin ETFs, JPMorgan forecasts $4-8B in XRP ETF inflows, signaling growing insti

Risk Down First: 4 Altcoins Showing Stronger Drawdown Control and 2x+ Growth Potential