The tokenization of the U.S. Treasury market has exceeded 2 billion dollars, with BlackRock's BUIDL fund ranking first

According to data from the RWA monitoring platform RWA.xyz, as of August 25th, the tokenized US Treasury market size was $2 billion and is currently at $2.02 billion. Among them, BlackRock's BUIDL fund has a scale of $502 million, ranking first; followed by Franklin Templeton's FOBXX fund with a scale of $425 million. It is worth mentioning that Ondo Finance's total TVL (tokenized US Treasury market value) exceeds $540 million (including OUSG and USDY), ranking first among all protocols. In addition, the Ethereum chain's US Treasury token market value is about $1.45 billion, ranking first among all networks, followed by Stellar (about $430 million).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

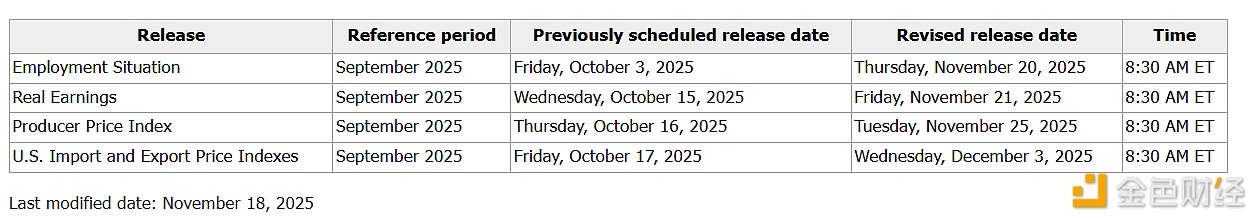

Release dates set for new batch of US data, including CFTC weekly report and PPI

The Dow Jones Index closed down 498.5 points, with the S&P 500 and Nasdaq also declining.

All three major U.S. stock indexes closed lower.