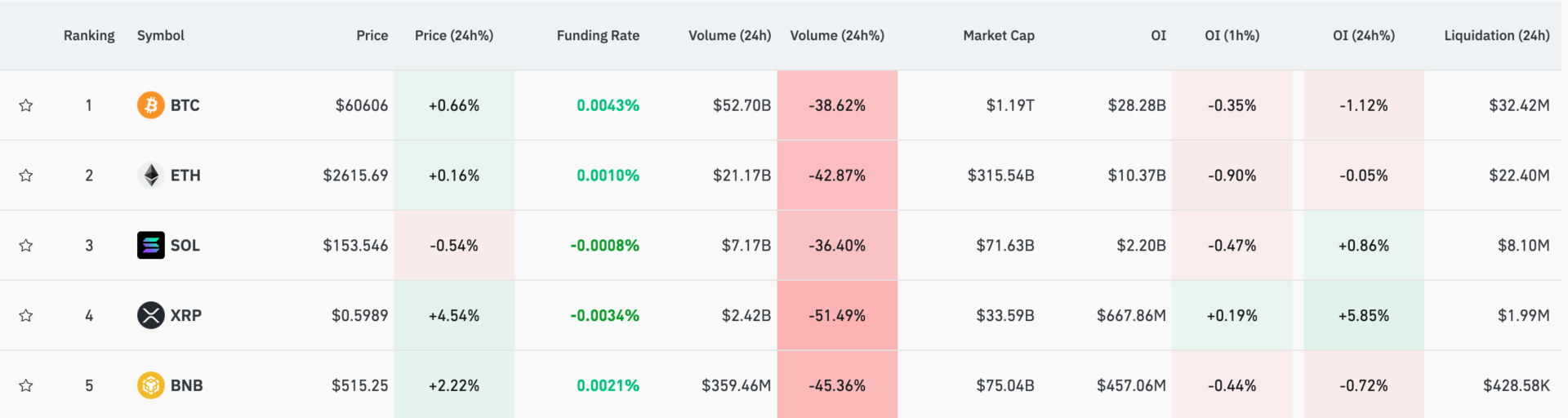

This week has been a wild ride in the crypto markets. Bitcoin and Ethereum took a nosedive, wiping out $367 billion in value. If you blinked, you might have missed the chaos.

As the week started, the sell-off in Bitcoin and Ether was brutal. Bitcoin’s value plummeted, dragging down the entire crypto market just as Japanese markets were taking a hit too.

But instead of freaking out, institutional investors did what they do best—they bought the dip.

Massive inflows into spot ETFs

Spot Ethereum exchange-traded funds (ETFs) saw a massive influx of cash, with traders pumping in about $120 million early in the week. Monday and Tuesday were the days to buy, especially with Ether down 42% from its peak in March.

The institutional players jumped on Ether like a lion on a gazelle. Now, for Bitcoin, the story is a bit different. The net flows for spot Bitcoin ETFs were negative at first, which might’ve worried some.

But by midweek, things took a turn. According to data from Coinglass , demand picked up speed, and these funds added over $245 million between Wednesday and Thursday.

So while Bitcoin had a rough start to the week, the institutional cash flow gave it the push it needed to start climbing back up. This surge in activity came right after Morgan Stanley made a big move.

They gave the green light to their 15,000 financial advisors to start pushing clients with big pockets—like those with a net worth over $1.5 million—towards Bitcoin funds issued by BlackRock and Fidelity.

Before this, wealth management firms would only dip their toes into crypto if a client specifically requested it.

Now, Morgan Stanley is the first to actively promote these funds. According to their May 13F filing, the Wall Street bank holds about $270 million in spot Bitcoin ETFs out of their $1.5 trillion in assets under management.

The expectation is that other big players, who have been sitting on the sidelines doing their due diligence, will feel the heat to follow Morgan Stanley’s lead.

Despite the rough start to the week, the crypto market has managed to claw its way back up.

The market cap of all tokens combined has regained hundreds of billions of dollars since Monday and is now sitting comfortably above $2.1 trillion. That’s a serious comeback, considering where things were just a few days ago.

Bitcoin even hit an intraday high of nearly $63,000 on Friday, while Ether was trading above $2,700 earlier in the day.

More than $100 million in short bets on Bitcoin got liquidated in the past 24 hours, which has only helped to boost Bitcoin’s gains.

But they are both still down compared to their highs earlier this year. Ether, in particular, is on track for its worst week in nearly two years.