US Bitcoin ETF’s Continued With Positive Results on 10 July

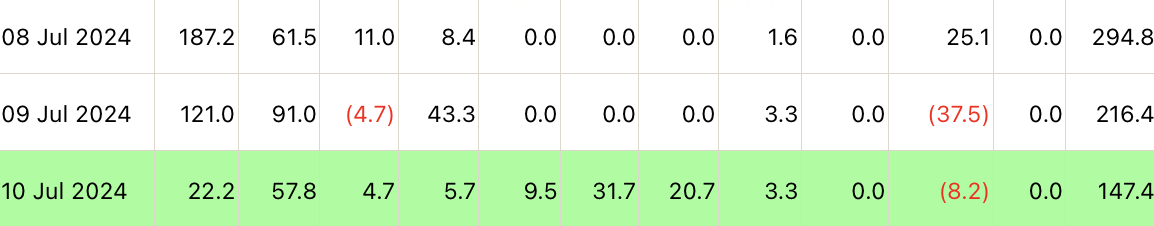

The U.S. spot Bitcoin exchange traded fund (ETF) sector doesn't seem to be losing confidence in the asset, as it posted positive results again on June 10, registering total inflows of $147.4 million.

Leading financial institutions this time were Franklin Templeton (EZBC) and Fidelity (FBTC) with $31.7 million and $57.8 million, respectively.

They are followed by BlackRock’s IBTC with $22.2 million, which still reflects a decline given that this ETF attracted $121 million on July 9.

Also on July 8, IBTC registered an impressive daily inflow of $187.2 million, helping to bring the total for all U.S. spot ETFs to $294 million for the day, registering its strongest day of net inflows in more than a month.

READ MORE:

Cathie Wood Discusses Bitcoin’s Current Bull Cycle and ETF ProspectsGrayscale’s ETF was the only participant to see negative results over the same time period, registering outflows of $8.2 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Boxing champion Andrew Tate's "Going to Zero": How did he lose $720,000 on Hyperliquid?

Andrew Tate hardly engages in risk management and tends to re-enter losing trades with higher leverage.

New Beginnings in the Darkest Hour: Is the Dawn of Bitcoin in 2026 Already Visible?

Risk assets are expected to perform strongly in 2026, and bitcoin is likely to strengthen as well.

Ethereum at a Crossroads: Quantum Threat Approaches, Wall Street Capital Exerts Dual Pressure

This battle between technology and human nature will determine whether Ethereum ultimately becomes the fintech backend for Wall Street or serves as the public infrastructure for digital civilization.

$1.3 million in 15 minutes, the ones who always profit are always them