Bitcoin whales are accumulating at their fastest rate since April 2023: CryptoQuant

Bitcoin long-term holders are accumulating at their fastest rate in over one year, CryptoQuant analysts said.However, the lack of stablecoin liquidity could dampen the effect of any subsequent price rally, the analysts added.

Bitcoin BTC +1.10% long-term holders are adding to their holdings at the fastest monthly rate since April 2023, according to CryptoQuant analysts.

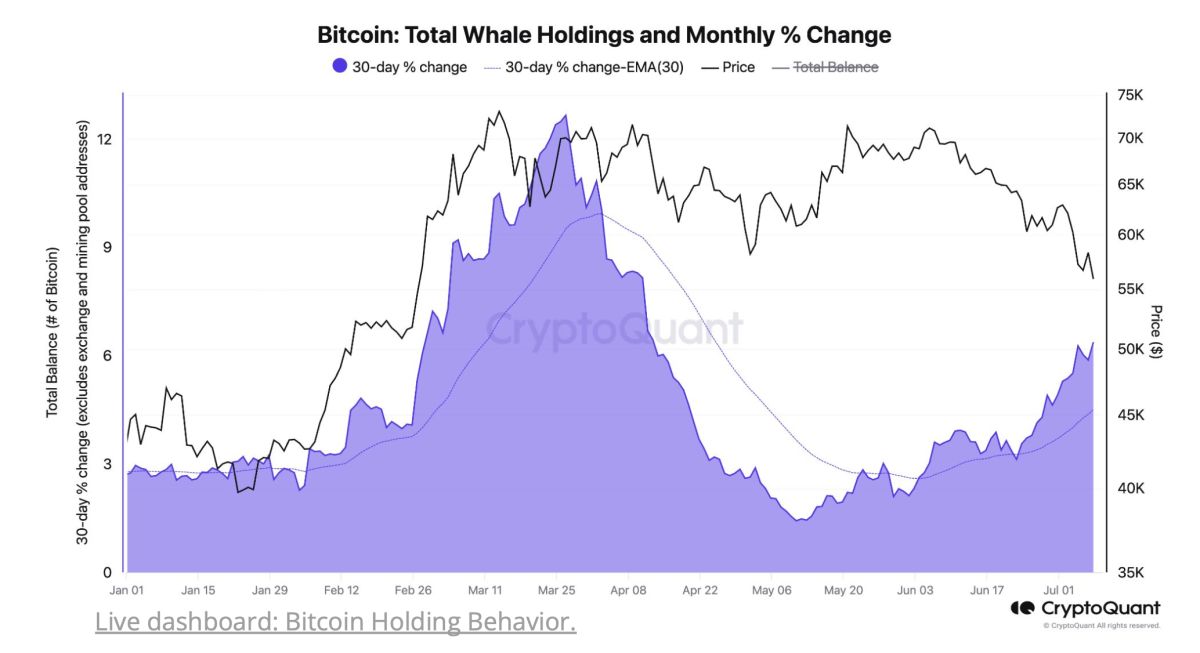

"Bitcoin whales have been increasing their holdings at a monthly growth rate of 6.3%, the fastest pace since April 2023, indicating rising demand for bitcoin," CryptyQuant said.

Wednesday's market report from the analytics firm noted that the increase in bitcoin demand from long-term holders is supporting the digital asset's price. This comes despite the cryptocurrency facing an increase in supply hitting the market that originated from seized bitcoins held by the German and U.S. governments, along with the distribution of funds from the defunct bitcoin exchange Mt. Gox . The report highlighted charts indicating that as the bitcoin price dropped from a high of $71,000 to its current range between $58,000 and $59,000, the rate of whale accumulation has risen.

Bitcoin long-term holders are now increasing their coin stashes at their fastest rate in over one year. Image: CryptoQuant.

Analysts said that long-term holders realized strong profits when prices peaked above $70,000 at the beginning of June. However, they have since experienced some losses and are less willing to sell. "This could be an early sign of a bitcoin price bottom," they added. Nonetheless, the CryptoQuant report said that bitcoin prices may take a little longer to bottom and start a new leg up as stablecoin liquidity growth is still not in full swing.

Lack of stablecoin liquidity

The report said that USDT market capitalization is still slowing down. "Bitcoin price typically rallies as more liquidity enters the crypto market via USDT minting, a condition that has still not been met," the analysts added.

The CryptoQuant report said that stablecoin liquidity is a necessary condition for a price rally. While there is some positive movement in the stablecoin market through USDC, the lack of corresponding growth in USDT market cap may delay or dampen the potential for a significant bitcoin price rally.

The largest digital asset by market cap was changing hands at around $57,927 at the time of writing, having fallen from a daily high of around $59,500, according to The Block’s price page .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Talus (US)

Five charts to help you understand: Where does the market go after each policy storm?

After this regulatory crackdown, is it a harbinger of an impending downturn, or the beginning of a new cycle where all negative news has been fully priced in? Let’s examine the trajectory after the storm through five key policy milestones.

Mars Morning News | The crypto market rebounds across the board, Bitcoin rises above $94,500; The "CLARITY Act" draft is expected to be released this week

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

Federal Reserve’s Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.