The SEC has again delayed the approval of the Ethereum ETF

The US Securities and Exchange Commission has returned S-1 forms to potential Ethereum ETF issuers after reviewing them.

According to source , familiar with the matter, the forms were returned with minor remarks and issuers have until July 8 to remove them and resubmit them.

The move indicates that at least one more round of filings will be needed before the ETFs can start trading.

The S-1 forms represent the second phase in the ETF approval process, following earlier in May approved the issuers' Forms 19b-4.

READ MORE:

What are the most valuable cryptocurrencies according to GrayscaleUnlike Forms 19b-4, there is no specific deadline for filing the S-1, so the schedule depends on the speed of processing by the SEC.

Initial expectations for a July 4 market launch of the ETF fell through, and issuers are awaiting further guidance from the SEC on when final filings will be made.

Securities and Exchange Commission (SEC) Chairman Gary Gensler has already hinted at possible approvals this summer, but specifics remain unclear.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

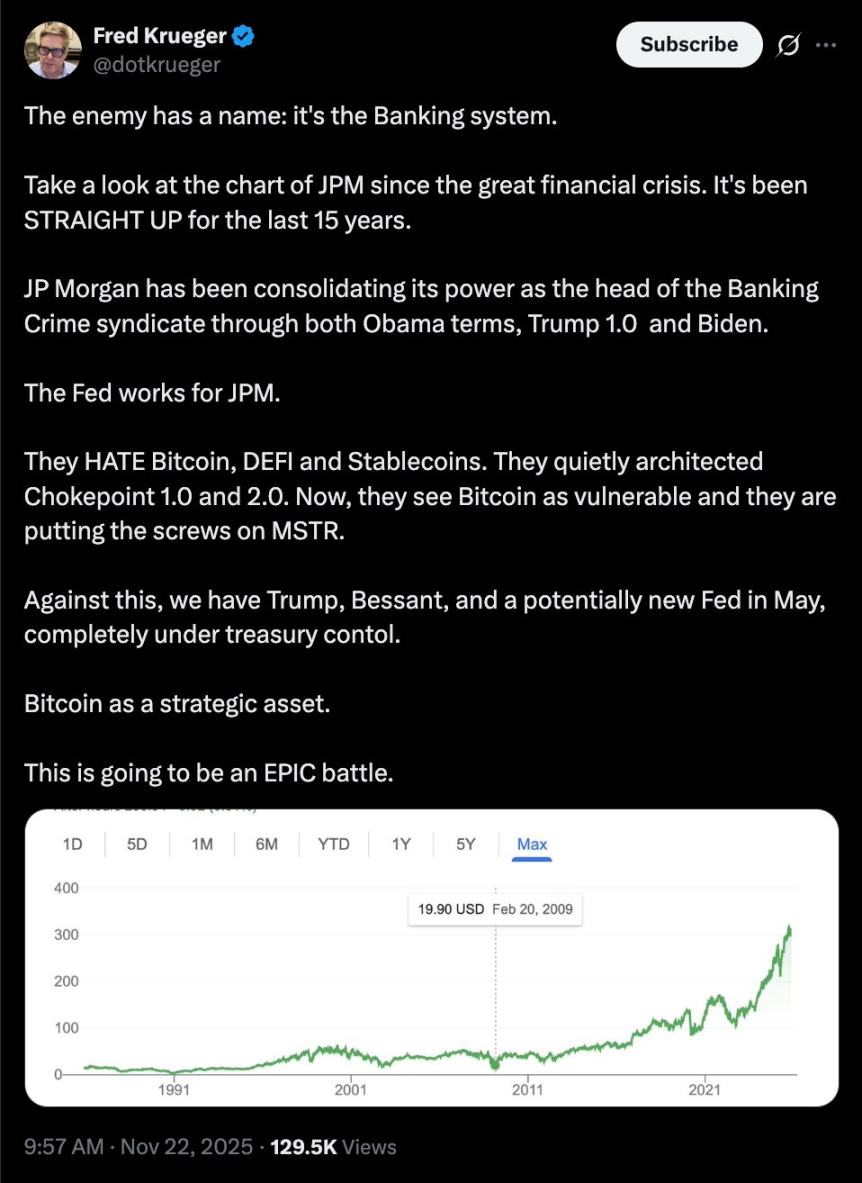

MSTR to be "excluded" from the index, JPMorgan research report "unexpectedly implicated", crypto community calls for "boycott"

JPMorgan warned in a research report that if Strategy is eventually removed, it could trigger a mandatory sell-off worth $2.8 billion.

It's already 2025, and this billionaire collector is still buying NFTs?

Adam Weitsman recently acquired 229 Meebits, further increasing his investment in the NFT sector.

Why do traditional media professionals criticize stablecoin innovation?

Are stablecoins truly "the most dangerous cryptocurrencies," or are they "a global public good"?

Crypto Market Faces Intense Pressure from Massive Coin Unlocks

In Brief Cryptocurrency market faces over $566 million in coin unlocks next week. Single-event and linear unlocks may impact market supply and investor sentiment. Investors are wary of potential short-term price fluctuations.