Solana jumps almost 10% as VanEck files for first US Solana ETF

Key Takeaways

- Solana's price jump reflects market optimism following VanEck's ETF filing.

- VanEck's initiative could set a precedent for future cryptocurrency ETFs in the US.

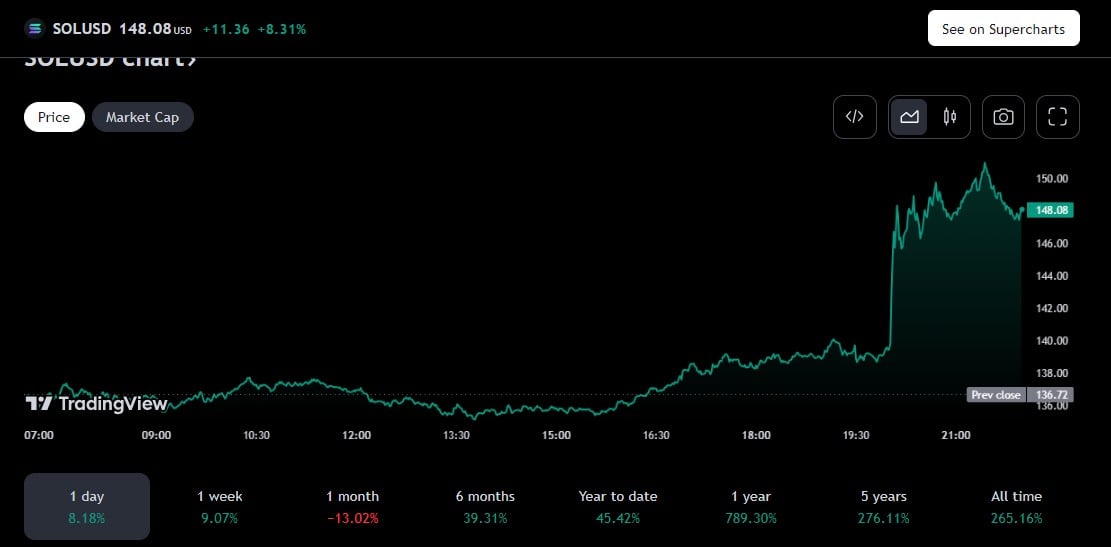

Solana’s (SOL) price surged almost 10%, from around $139 to $151, shortly after VanEck’s application for a spot Solana exchange-traded fund (ETF). According to TradingView, SOL is currently trading at around $148, up 8% in the past 24 hours.

Source:

TradingView

Source:

TradingView

On Thursday, VanEck, the prominent player in the ETF market, submitted an S-1 form to the US Securities and Exchange Commission (SEC) to launch the VanEck Solana Trust . VanEck’s move marks the first attempt to establish a Solana-based ETF in the US.

With the latest filing, VanEck has classified Solana as a commodity rather than a security.

In addition, Matthew Sigel, Head of Digital Assets at VanEck, said Solana stands out as a high-performance blockchain with remarkable attributes like high scalability, speed, and low transaction fees.

VanEck’s new filing comes ahead of the anticipated launch of spot Ethereum funds in the US. In May, the SEC greenlit a batch of Ethereum ETF filings, including one from VanEck. These ETFs are currently pending trading approval from the SEC.

Bloomberg ETF analyst Eric Balchunas predicts the SEC will allow Ethereum ETFs to start trading as soon as next week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wall Street interprets the Federal Reserve decision as more dovish than expected

The market originally expected a "hawkish rate cut" from the Federal Reserve, but in reality, there were no additional dissenters, no higher dot plot, and the anticipated tough stance from Powell did not materialize.

The Federal Reserve cuts rates again but divisions deepen, next year's path may become more conservative

Although this rate cut was as expected, there was an unusual split within the Federal Reserve, and it hinted at a possible prolonged pause in the future. At the same time, the Fed is stabilizing year-end liquidity by purchasing short-term bonds.

Betting on LUNA: $1.8 billion is being wagered on Do Kwon's prison sentence

The surge in LUNA’s price and huge trading volume are not a result of fundamental recovery, but rather the market betting with real money on how long Do Kwon will be sentenced on the eve of his sentencing.

What is the overseas crypto community talking about today?

What have foreigners been most concerned about in the past 24 hours?