GME meme coin skyrockets 97% following RoaringKitty livestream announcement

The Solana-based meme coin GameStop (GME) skyrocketed 94% and is the largest gainer in the last 24 hours, according to data aggregator CoinGecko. The sharp rise was fueled by the notification of a livestream scheduled by notorious investor RoaringKitty, set to happen tomorrow at 16h (UTC). For the past seven days, GME growth has surpassed 395%, eclipsing the performances of all the Solana meme coins listed on CoinGecko.

GME meme coin price in the past 24 hours. Image: CoinGecko

GME meme coin price in the past 24 hours. Image: CoinGecko

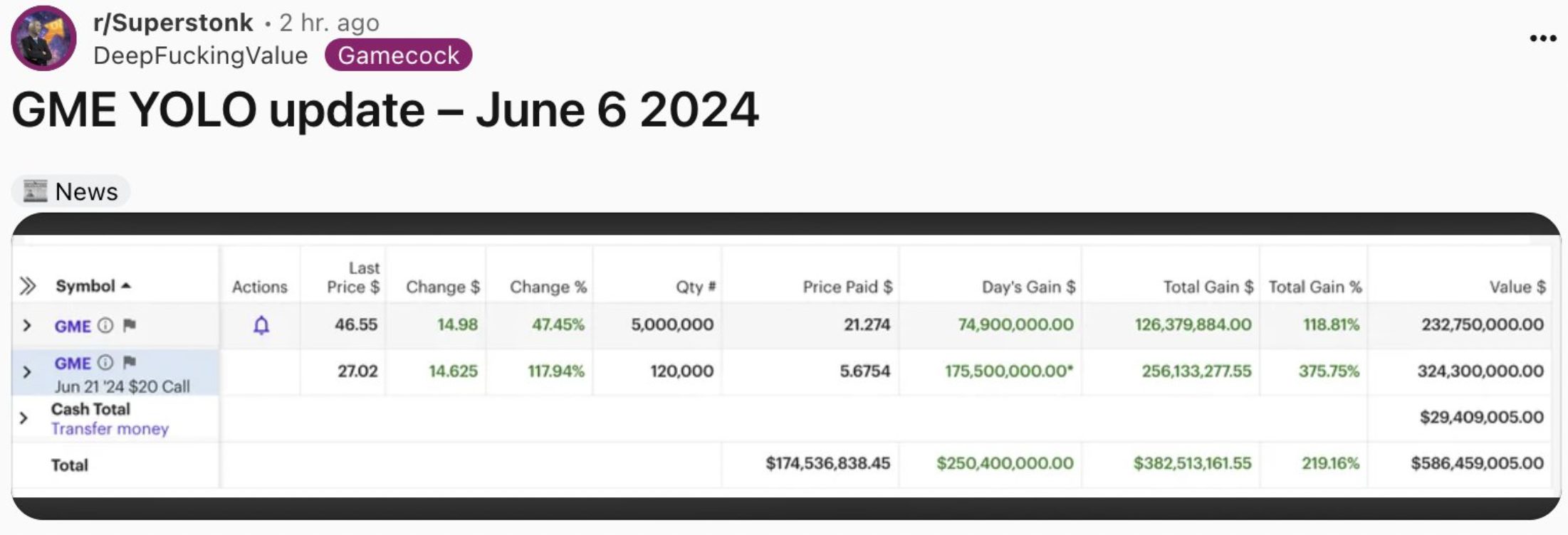

Keith Gill, RoaringKitty’s real identity, is one of the main figures behind the GameStop stock price leap in 2020. The livestream notification also prompted a daily growth of 47.5% on GME stock, now priced at $46.55 each. As a result, Gill’s position in GME stocks is now worth over $586 million.

Keith Gill posting his GME stock position on Reddit

Keith Gill posting his GME stock position on Reddit

The token Roaring Kitty (KITTY) showed an even more impressive performance, with a 196% daily gain. Deep F*cking Value (DFV), a token inspired by Gill’s other known alias, also displayed a three-digit rise by soaring 163% in the same period.

Even the token AMC, which references another stock related to Gill’s pump efforts back in 2020, benefited from the livestream scheduling and has risen 109% at the time of writing.

Notably, the recent price leaps on GME-related tokens based on Solana raised the total market cap of meme coins deployed on this blockchain to nearly $10 billion , surpassing the investment portfolios of firms such as OKX Ventures and Sequoia Capital.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

The central bank sets a major tone on stablecoins for the first time—where will the market go next?

The People's Bank of China held a meeting to crack down on virtual currency trading and speculation, clearly defining stablecoins as a form of virtual currency with risks of illegal financial activities, and emphasized the continued prohibition of all virtual currency-related businesses.