Meme coin takeover: PEPE surpasses market value of all major NFT collections combined

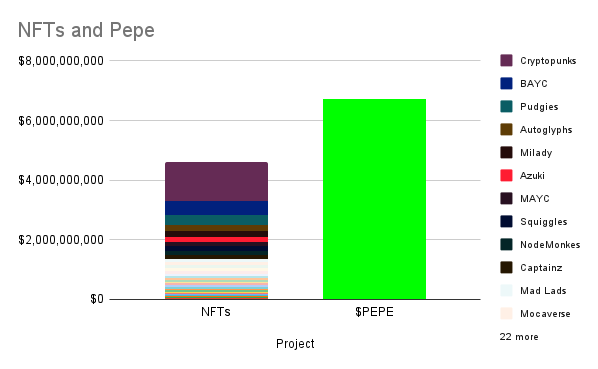

Pepecoin (PEPE) is currently larger than all the major non-fungible token (NFT) collections combined, user Stats highlighted on X. PEPE’s market cap is now over $6.2 billion and stands 10% above the total market cap of all profile picture (PFP) NFT collections.

Moreover, PEPE is also outclassing major NFT collections by daily trading volume, exhibiting a $1.3 billion volume in the last 24 hours against $12.8 million moved by the blue chips in the NFT sector.

Comparison between largest NFT collections and PEPE. Image: Stats/X

Comparison between largest NFT collections and PEPE. Image: Stats/X

Despite recent signs of strength, such as Bitcoin and Solana NFT trading volumes reaching weekly records , and the NFT lending market surpassing $2 billion in the first quarter, the non-fungible token market is still in a slump. The investor Hildobby, who is a member of the data team for DragonFly, shared yesterday that the NFT trader count is down 85% in the past two years.

Meanwhile, the meme coin market has experienced a gradual crescent in the past months, nearing a $69 billion market cap after a 10% weekly growth. PEPE is one of the meme coins showing the best performances recently, hiking 111% in one month and registering a new all-time high on May 27th, according to data aggregator CoinGecko.

Nevertheless, NFT Price Floor analyst Nicolás Lallement highlighted that once investors are done profiting with the current narratives, such as meme coins, a capital flow back to Bitcoin, Ethereum, and blue chip NFT collections might happen.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After a 1460% surge, re-examining the value foundation of ZEC

History has repeatedly shown that extremely short payback periods (super high ROI) are often precursors to mining disasters and sharp declines in coin prices.

Tom Lee reveals: The crash was caused by the 1011 liquidity crunch, with market makers selling off to fill a "financial black hole"

Lee stated directly: Market makers are essentially like the central banks of crypto. When their balance sheets are damaged, liquidity tightens and the market becomes fragile.

Boxing champion Andrew Tate's "Going to Zero": How did he lose $720,000 on Hyperliquid?

Andrew Tate hardly engages in risk management and tends to re-enter losing trades with higher leverage.

New Beginnings in the Darkest Hour: Is the Dawn of Bitcoin in 2026 Already Visible?

Risk assets are expected to perform strongly in 2026, and bitcoin is likely to strengthen as well.