Bullish For Bitcoin? Important Indicators Shift as Prices Head South

Check out which factors indicate that BTC may soon return to a bullish path.

TL;DR

- Recent market corrections have led to a decrease in enthusiasm among traders, with discussions shifting from a “bull market” to a “bear market” mindset.

- However, this sentiment could ironically suggest an impending bullish trend.

Enthusiasm Goes Down

The latest cryptocurrency market correction, which saw Bitcoin (BTC) dipping to a two-month low of $60,000 and Ethereum (ETH) tumbling below $3,000, has affected the general feeling of traders and investors.

According to the market intelligence platform Santiment, the phrase “bull market” is not so popular anymore among the crypto community, replaced by increasing “bear market” mentions.

The Bitcoin Fear and Greed Index, representing the current sentiment of the crowd, has also headed south. Today (April 18), it points at 57, the lowest level since the end of January.

On the other hand, Santiment reminded that the community’s bearish shift may indicate a bullish move for the crypto market since “historically, prices move in the opposite direction of mass traders’ expectations.”

“The quick dropoff of FOMO combined with a notable rise in FUD is a promising combination that cryptocurrency may see a recovery either right before the halving or shortly after,” the platform concluded.

Additional Indicators Signaling a Potential Recovery

Perhaps the most obvious element expected to positively impact the BTC value in the near future is the approaching halving (slated for April 19).

The event, ocurring roughly every four years, cuts the reward for mining blocks in half. The entrance of fewer coins into circulation makes them scarcer and potentially more valuable (should demand rise or remain the same). Each halving in previous years was followed by a substantial BTC rally and resurgence of the entire cryptocurrency market.

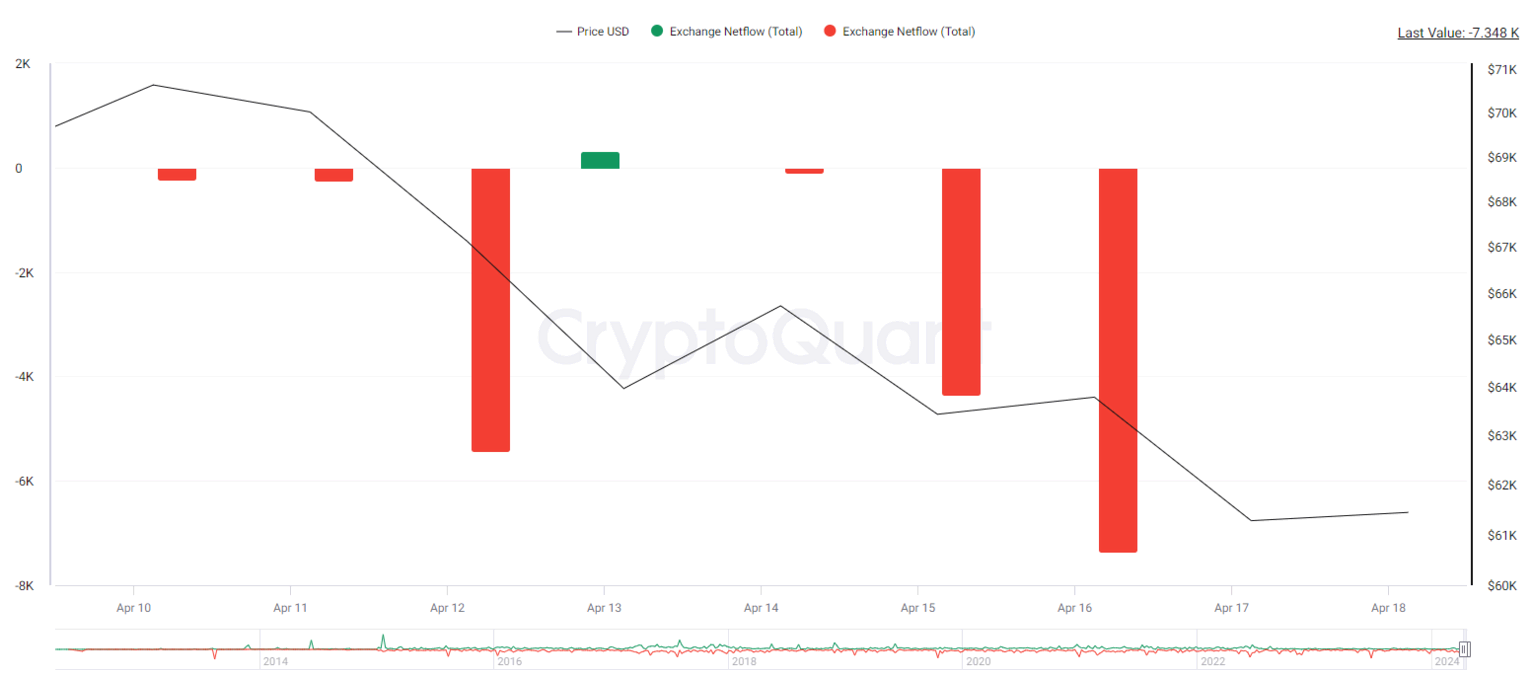

Another factor hinting that the primary digital asset may head north soon is the Bitcoin exchange netflow, which has been predominantly negative in the last week (according to CryptoQuant’s data ). A shift from centralized platforms toward self-custody methods is considered bullish since it reduces the immediate selling pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.