CICC: Lowering the forecast for Fed rate cuts this year to once

CICC Research indicates that since this year, the pace of inflation slowdown in the United States has decelerated, the labor market remains strong, consumer spending is robust, and real estate and manufacturing are recovering. At the same time, financial conditions remain loose, corporate financing costs have decreased, and impressive stock market performance supports expansion of household wealth. From an economic fundamentals perspective, we believe that the urgency and necessity for the Federal Reserve to cut interest rates have declined. It may be difficult for the Fed to follow its guidance of three rate cuts this year; therefore we lower our forecast for rate cuts to once with a possible delay until Q4. However, as it's an election year unpredictable non-economic factors could disrupt predictions; there's risk that these factors might prompt earlier rate cuts by Fed. But history shows such actions can easily trigger "second-round inflation", adding complexity to subsequent economic trends and policy directions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

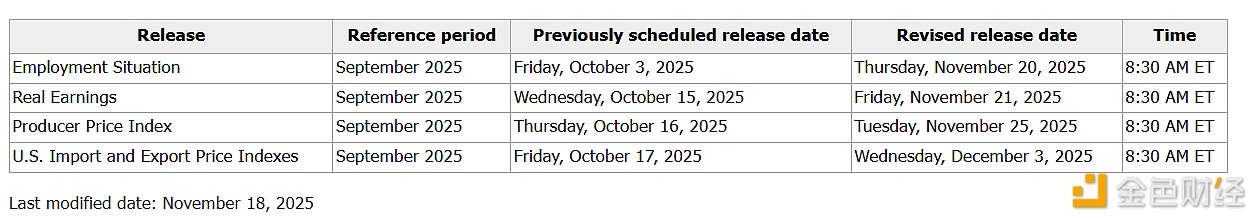

Release dates set for new batch of US data, including CFTC weekly report and PPI

The Dow Jones Index closed down 498.5 points, with the S&P 500 and Nasdaq also declining.

All three major U.S. stock indexes closed lower.