Bitcoin ( BTC ) headed higher into the April 7 weekly close as uncharacteristic weekend BTC price action boosted bulls.

Bitcoin bulls nudge at $70K as BTC price sees 'not typical' weekend

Bitcoin is "well positioned" for a strong weekly close, but not everyone is trusting of traditionally unreliable weekend BTC price action.

BTC price echoes initial run to $70,000

Data from Cointelegraph markets Pro and TradingView showed a sudden move above $69,000 during the weekend, with Bitcoin hitting local highs of $69,781 on Bitstamp.

With the close now just hours away, traders evoked similar weekend scenarios, hoping that upside would continue into the new week.

“Not your typical weekend, as price has mostly grinded up the entire weekend instead of just hovering at the same level,” popular trader Daan Crypto Trades told followers on X (formerly Twitter).

“We've seen this kind of price action a few times during our initial move to 70K+. Often saw a quick wick after futures re-open, back into up only.”

For Michaël van de Poppe, founder and CEO of trading firm MNTrading, the area immediately above $69,000, in which BTC/USD was acting at the time of writing, was “crucial.”

“If this breaks, we'll likely see a strong continuation towards the all-time highs pre-halving,” part of X analysis read on the day.

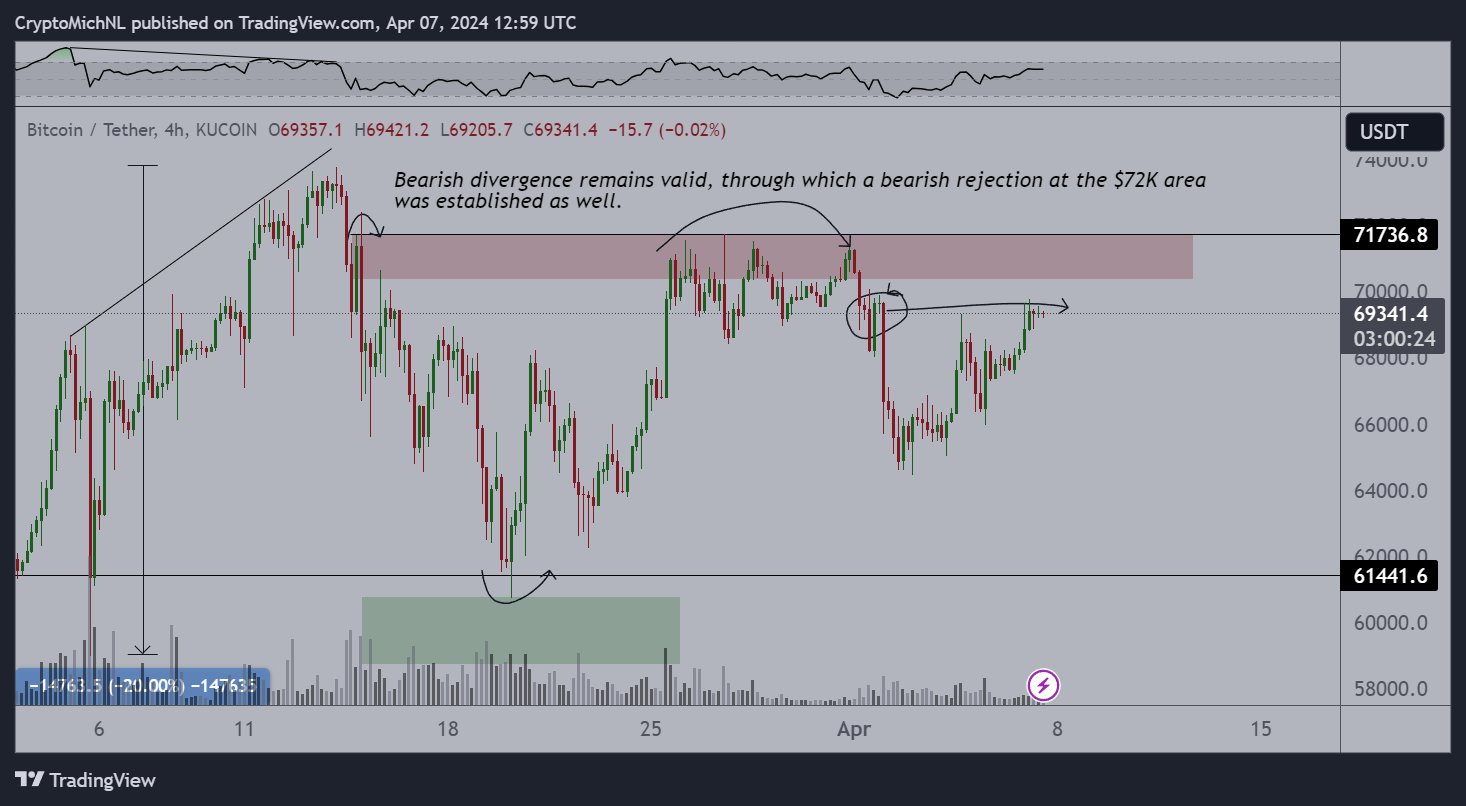

An accompanying chart nonetheless noted the ongoing existence of a bearish divergence, heightening the odds of a BTC price rejection at $72,000.

Updating his BTC/USD view, popular trader and analyst Rekt Capital meanwhile agreed that the pair was capable of a strong finish to the week.

"BTC is now well-positioned for a bullish Weekly Candle Close," he summarized .

"Can it hold above ~$69,000 until the Weekly Close is in?"

Bitcoin ETFs consolidate return to net inflows

With Bitcoin approaching new April highs, optimism also focused on how institutional inflows might shape up going forward.

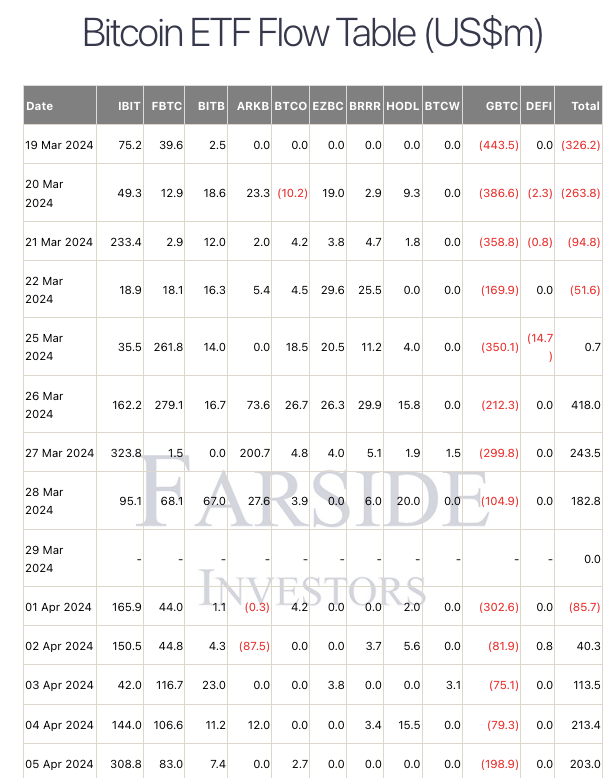

A rebound in net flows among the United States spot Bitcoin exchange-traded funds (ETFs) last week had set tone, along with news that bankrupt crypto lending firm Genesis had finished selling billions of dollars’ worth of shares in the Grayscale Bitcoin Trust (GBTC).

At the same time, largest global asset manager BlackRock, one of the ETF operators, revealed that it had added various big name U.S. banks as “authorized participants.”

Per the latest data, including from United Kingdom-based investment firm Farside , April 5 ended in net ETF inflows of just over $200 million, with the week’s total at around $570 million.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin surges to $93K after Sunday flush, as analysts eye $100K

BTC returns to $93,000 after a brief dip to $83,000—what exactly happened?

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.