Bitcoin ( BTC ) returned to $70,000 after the March 29 daily close as traders counted down the final hours of a roaring Q1.

BTC/USD 1-hour chart. Source: TradingView

Fed's Powell reinforces "careful" position on rate cuts

Data from Cointelegraph markets Pro and TradingView showed old all-time highs at $69,000 forming tentative BTC price support into the weekend.

Bitcoin gained around $1,000 in the latter part of the day, seemingly aided by comments from Jerome Powell, Chair of the United States Federal Reserve.

Speaking in an interview at the Macroeconomics and Monetary Policy Conference in San Francisco, California, Powell appeared cool on both inflation and the economic outlook.

The Fed, he stressed, was not in a hurry to enact Interest rate cuts — a key event for risk assets.

“Growth is strong right now, the labor market is strong right now and inflation has been coming down,” he said.

“We can and we will be careful about this decision — because we can be.”

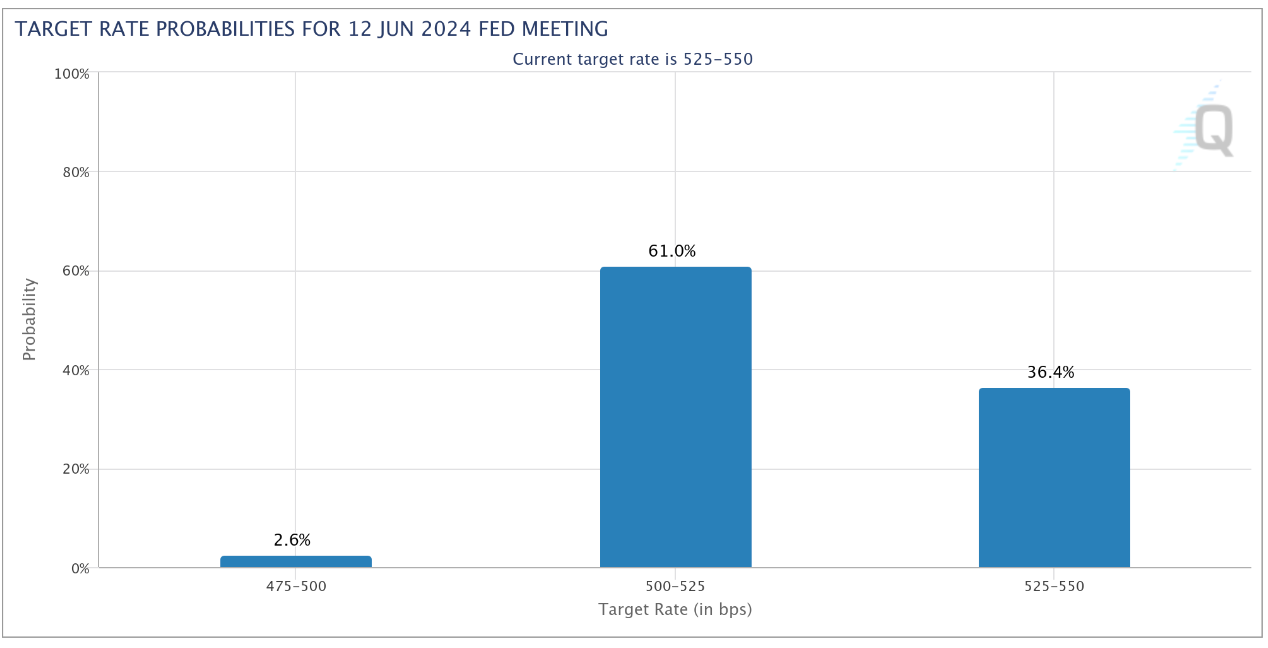

Fed target rate probabilities. Source: CME Group

June is currently markets’ favored bet for the first such cut to take place, with 61% odds of a 0.25% reduction at that month’s meeting of the Federal Open Market Committee, or FOMC, per data from CME Group’s FedWatch Tool .

March 29, while a Wall Street holiday, also saw the latest print of the Personal Consumption Expenditures ( PCE ) Index — known to be the Fed’s preferred inflation gauge — match expectations at 2.5%.

BTC price analysis reveals key levels

Considering the hurdles for BTC price action next, attention continues to focus on the weekly, monthly and quarterly candle close.

For popular trader and analyst Rekt Capital, $69,000 was as significant as ever — a close above would mark Bitcoin’s highest-ever such close.

“BTC is going to continue whip-sawing and zig-zagging within this Weekly Range until the Weekly Candle Close,” he predicted on X (formerly Twitter).

“Weekly Candle Close above old All Time Highs of ~$69,000 gets Bitcoin closer to a breakout. Anything else in the meantime is consolidation.”

BTC/USD chart. Source: Rekt Capital/X

Others eyed positive on-chain signals, with fellow trader and Kevin Svenson highlighting the moving average convergence/divergence (MACD) oscillator on daily timeframes.

A chart uploaded to X described MACD as “positioned for a cross-up,” with such an event coinciding with a potential BTC price breakout beyond all-time highs near $74,000.

BTC/USD chart with MACD data. Source: Kevin Svenson/X

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.