CryptoQuant: Bitcoin trades at discount on Coinbase, could indicate weakening demand from U.S. investors

According to Mars Finance news, the market dynamics of Bitcoin’s recent rebound to new all-time highs have changed, indicating that domestic demand for it in the United States has weakened.

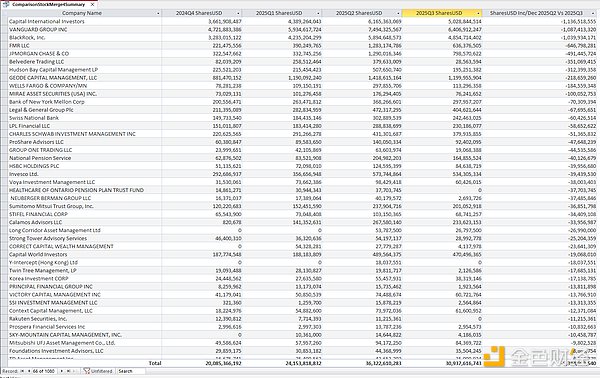

The seven-day moving average of the Coinbase Premium indicator has turned negative, according to data tracked by CryptoQuant. This metric tracks the difference between Bitcoin prices on Coinbase and Binance. In other words, Bitcoin is now trading at a discount on Coinbase, the custodian of eight of the 11 Bitcoin spot ETFs launched in the United States two months ago. This development may reflect relatively weak net buying by U.S. investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC mining faces short-term pressure, why does JPMorgan have a high target of $170,000?

The US CFTC officially approves cryptocurrency spot products, reshaping the regulatory landscape from the "crypto sprint" to 2025

US crypto regulation is gradually becoming clearer.

Controversial Strategy: The Dilemma of BTC Faith Stocks After a Sharp Decline

SOL price capped at $140 as altcoin ETF rivals reshape crypto demand