Will $2.4B Bitcoin Options Expiry Drive Markets Lower?

Friday has come around again and that means Bitcoin options expiry day with a large batch of contracts ready to go.

Bitcoin is already in retreat following its all-time high of $73,580 this week, but will today’s big expiry event send prices tumbling lower?

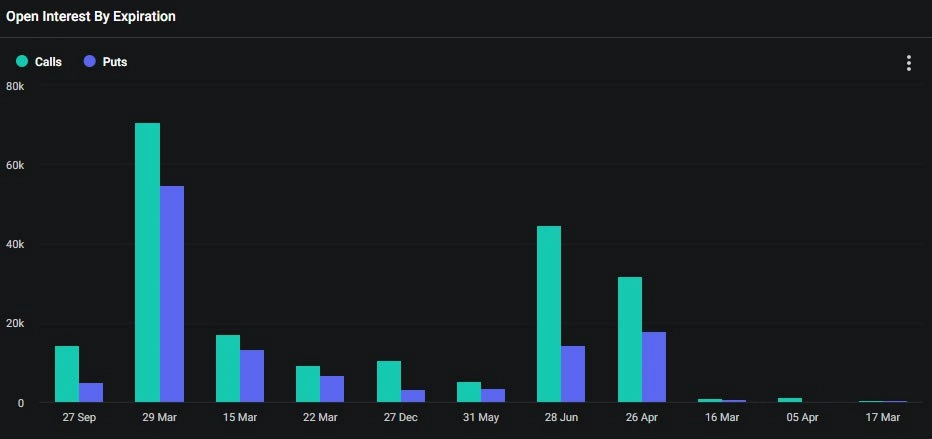

Around 30,600 Bitcoin options contracts will expire on March 15 with a notional value of around $2.45 billion.

This week’s expiry event is slightly larger than last week’s, but a huge one worth almost $10 billion will occur at the end of March.

Bitcoin Options Expiry

The put/call ratio for today’s batch of Bitcoin options is 0.78 which means there are slightly more calls (long contracts) being sold than puts (shorts).

There is a lot of open interest (OI) at the $65,000 strike price, according to Deribit , with $1.1 billion in total notional value there. Furthermore, there is almost $1 billion in OI at both $60,000 and $70,000 strike prices.

Crypto derivatives tooling provider Greeks Live commented that BTC has started to decline “with a recent change in market tempo” before adding that the US trading session is seeing the majority of declines, and the Asian trading session is seeing gains.

“The current narrative of ETF inflows may be starting to turn, with IV’s [implied volatility] of all major terms also showing significant declines in recent days, and with the recent lack of direction in block options orders, market sentiment seems to be starting to weaken.”

In addition to the Bitcoin options, around 331,000 Ethereum options contracts are also set to expire today. These have a notional value of $1.2 billion and a put/call ratio of 0.69.

There is a lot of open interest at the $4,000 strike price, but also at the $3,000 strike price for ETH contracts.

Crypto Markets Tank

Crypto markets have begun to slide, with total capitalization falling by 6.8% to $2.7 trillion at the time of writing during Friday morning’s Asian trading session.

Bitcoin plunged more than 7% on the day in a fall to $66,858 before recovering to reclaim the $68,000 level at the time of writing.

👀 https://t.co/hmsTH48t3o pic.twitter.com/8e8hkoCBal

— CrediBULL Crypto (@CredibleCrypto) March 14, 2024

Ethereum followed suit with a 7.5% daily dump to $3,700. Most of the altcoins were suffering heavier losses aside from Solana (SOL) and Near Protocol (NEAR), which were bucking the trend with a daily gain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.

Bitcoin Under Pressure Despite Fed Optimism