BlackRock plans to include Bitcoin exposure in its Strategic Income Opportunities Fund with an asset management scale of 36.5 billion US dollars

The world's largest asset management company, BlackRock, has submitted an amendment to include Bitcoin exposure in its Strategic Income Opportunities Fund (BSIIX). The BSIIX fund has a total scale of $36.5 billion and as of March 1st, the net assets of its share class totaled $24.2 billion. The fund typically invests in fixed income securities and other market sectors under specific conditions. This inclusion of Bitcoin exposure, including spot Bitcoin exchange-traded funds (ETF), is expected to enhance the attractiveness and performance of the fund, providing a modern investment path for traditional asset investments. According to documents from March 4th, BlackRock intends to purchase shares in Exchange Traded Products (ETP) that closely track the price performance of Bitcoin; this includes shares directly holding digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

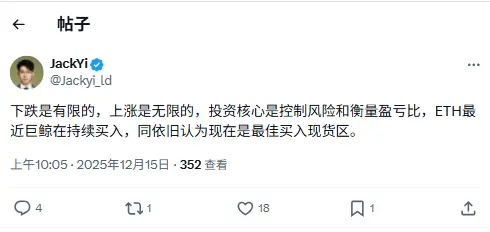

Yilihua: ETH whales are continuing to buy, and I still believe now is the best time to buy spot.

Eric Trump: Bitcoin Has No "Management," No Issues of Corruption, Fraud, or Abuse

Data: Hyperliquid platform whales currently hold $5.517 billions in positions, with a long-short ratio of 0.93.

AI blockchain security platform TestMachine completes $6.5 million financing, led by BlockChange Ventures and others