Bitcoin ( BTC ) saw snap losses into the Feb. 13 Wall Street open as United States inflation data dealt a blow to risk assets.

Bitcoin ( BTC ) saw snap losses into the Feb. 13 Wall Street open as United States inflation data dealt a blow to risk assets.

Data from Cointelegraph markets Pro and TradingView followed a 3.8% BTC price decline on the day, bottoming at $48,435 on Bitstamp.

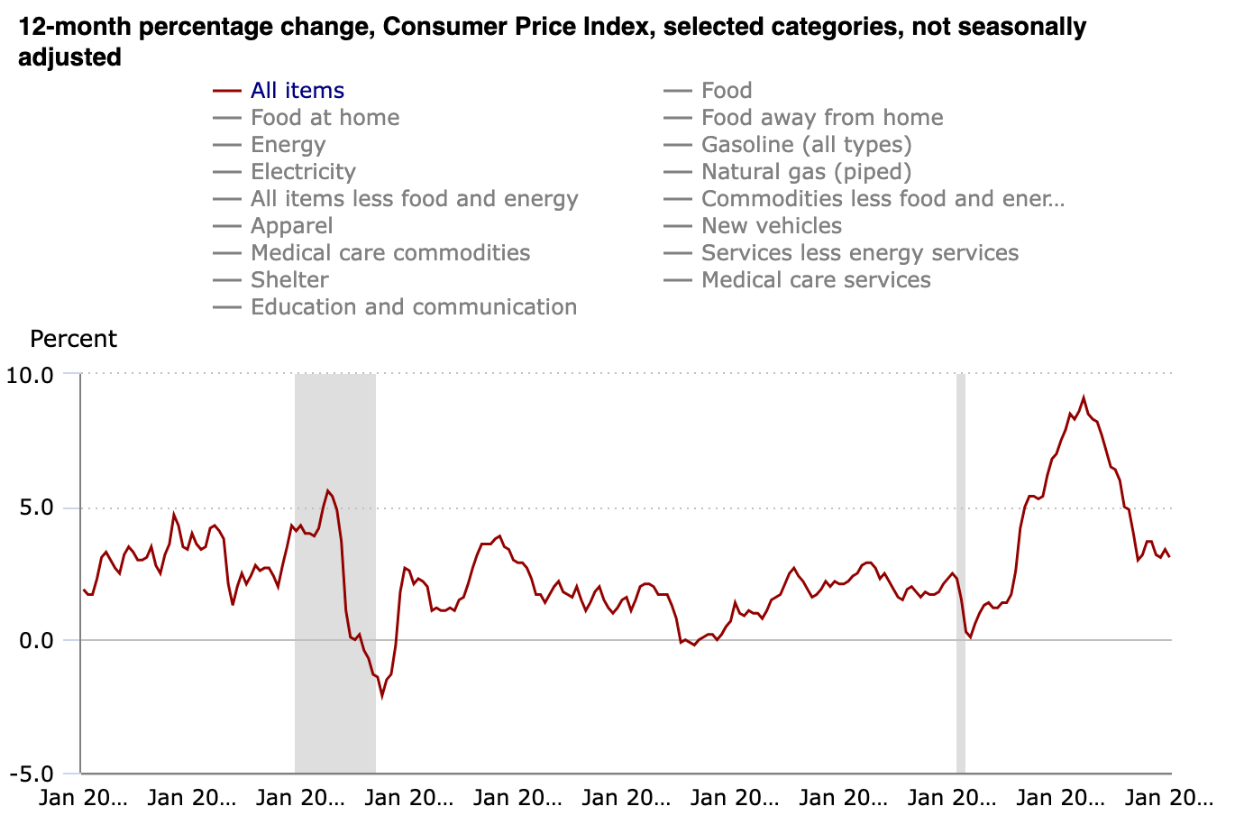

Bitcoin reacted badly to the January Consumer Price Index (CPI) print, which exceeded expectations.

Month-on-month CPI came in at 0.3%, with the year-on-year figure at 3.1% — 0.1% and 0.3% higher than predicted, respectively.

"The index for shelter continued to rise in January, increasing 0.6 percent and contributing over two thirds of the monthly all items increase. The food index increased 0.4 percent in January, as the food at home index increased 0.4 percent and the food away from home index rose 0.5 percent over the month," an official press release from the U.S. Bureau of Labor Statistics read.

"In contrast, the energy index fell 0.9 percent over the month due in large part to the decline in the gasoline index."

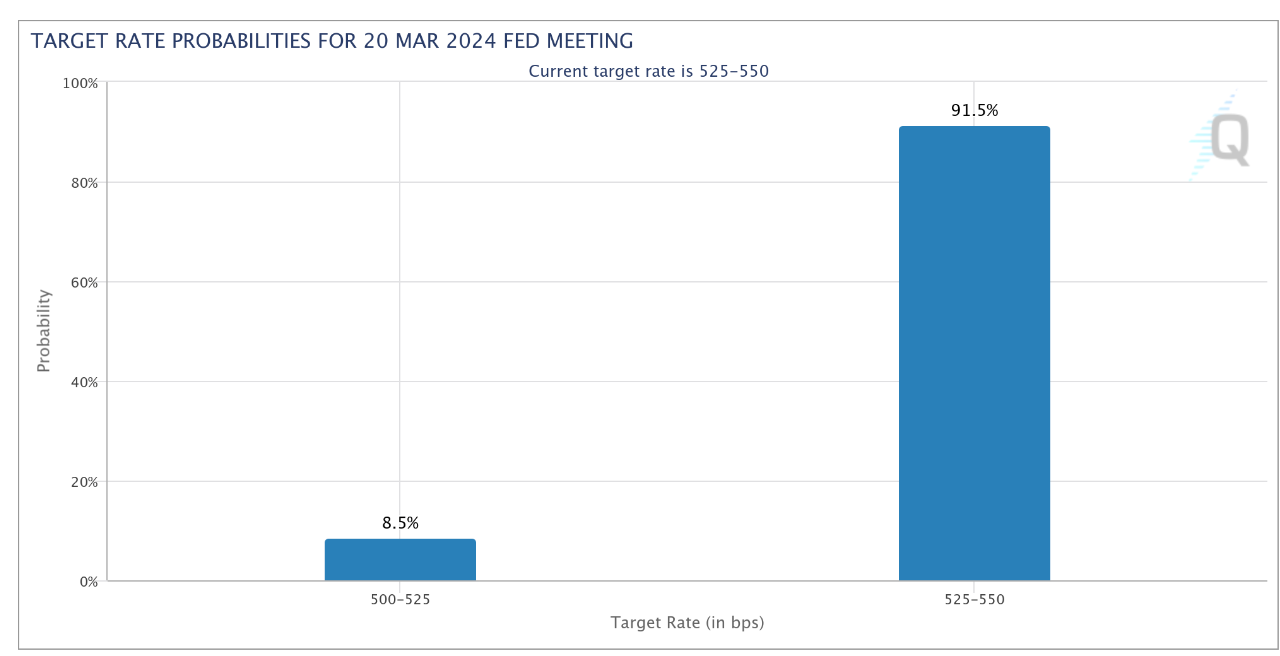

Markets immediately began reassessing the likelihood of the Federal Reserve cutting interest rates, shifting their timing from March to later in the year.

The latest data from CME Group’s FedWatch Tool put the odds of a March rate cut at just 8.5% at the time of writing versus 17.5% on Feb. 12.

“This inflation reading was much hotter than expected all around the board,” trading resource The Kobeissi Letter wrote in part of a reaction on X (formerly Twitter).

“Core CPI was expected to fall and it didn't while CPI inflation came in 20 bps above expectations. A March rate cut is likely gone.”

Kobeissi added that avoiding the premature rate cut, which would boost risk assets including crypto, was the Fed’s “top priority.”

The recommencing of inflows into the spot Bitcoin exchange-traded funds (ETFs) meanwhile did little to steady the ship for Bitcoin.

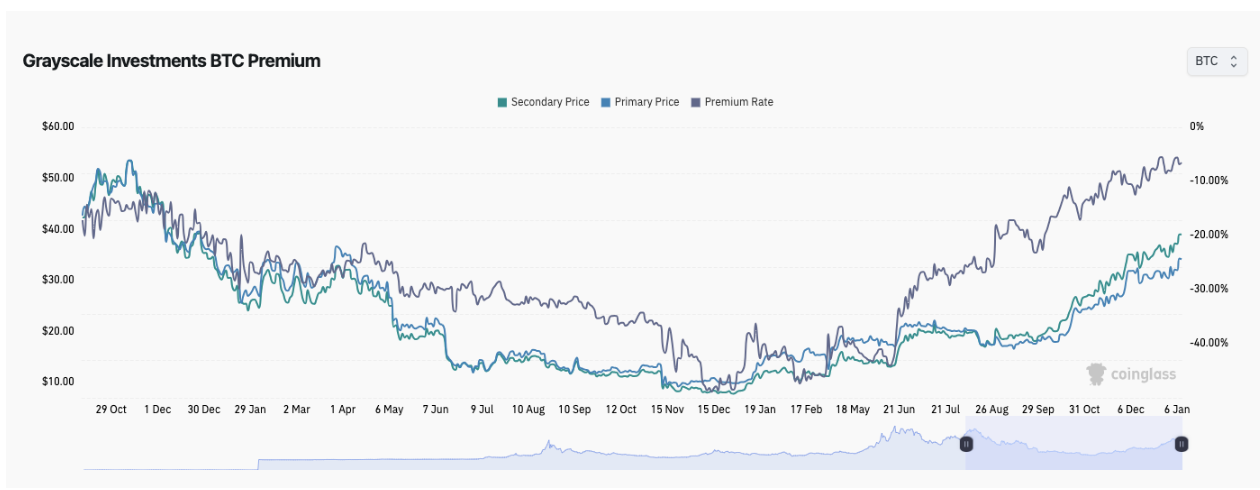

$49,000 remained out of reach at the time of writing, as the day’s outflows from the Grayscale Bitcoin Trust (GBTC) totaled around 2,400 BTC ($117 million), per data from crypto intelligence firm Arkham.

Uploading the numbers to X, popular trader Daan Crypto Trades nonetheless acknowledged positive trends persisting for ETF flows, these now absorbing the BTC supply around twelve times faster than new coins enter the market.

“$GBTC Outflows remain relatively low while the other ETFs are ramping up their buys more recently. Yesterday's ETF net flows saw another massive +$493M increase,” he wrote.

“This makes for $1.4B in net inflows during the past 3 trading days. We now have 12 consecutive positive days of net inflows.”

The difference between GBTC’s share price relative to Bitcoin — the so-called net asset value, or NAV — flipped positive for the first time in nearly three years last week.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

$1.3 million in 15 minutes, the ones who always profit are always them

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.