The January non-farm employment data affects the trend of the US dollar

Last December, the Euro-American rose by more than 1%, reaching its highest level since July at 1.1140, and then underwent a technical adjustment starting in 2024. The Fxstreet analyst team stated that if non-farm employment data exceeds 200,000 and wage inflation unexpectedly rises, it may increase the credibility of hawkish comments from the Federal Reserve, providing support for a re-uptrend in the US dollar while suppressing the Euro-American. Conversely, if the data disappoints and strengthens expectations of a rate cut by the Federal Reserve in March, the US dollar may face new selling pressure. However, after the Federal Reserve postpones interest rate cuts, even if non-farm employment data disappoints, selling pressure on the US dollar may be temporary.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple has completed its $200 million acquisition of stablecoin platform Rail

Data: Multiple tokens experience a surge followed by a pullback, USTC drops over 26%

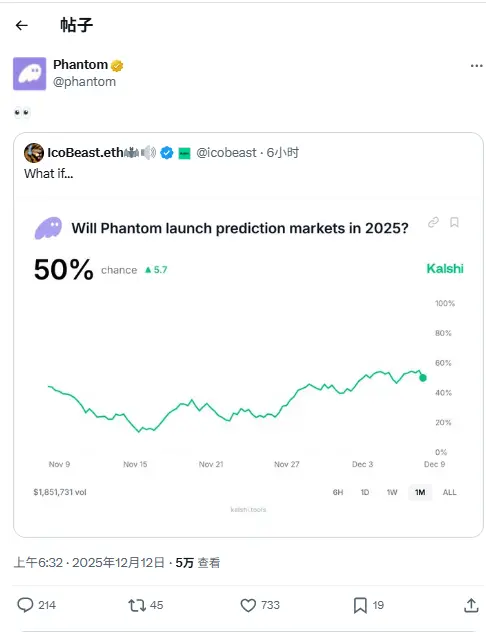

Phantom reposts a Polymarket prediction screenshot, hinting at a possible launch of a prediction market.

YouTube introduces a new option to pay US creators with stablecoins