SUI Overtakes Bitcoin, Aptos To Become 13th-Largest DeFi Network

The SUI blockchain has been ramping up since the year 2024 began, and a natural consequence of this rapid growth is that it has now surpassed some major players in the decentralized finance (DeFi) space. This has put it ahead of heavy hitters such as Bitcoin and Aptos as SUI begins to leave its mark on the market.

SUI Network TVL Crosses $360 Million

The total value locked (TVL) on the SUI network has completely exploded in the last year. The total value locked on the blockchain was sitting at less than $12 million in the middle of 2024. But now, less than a month into the year 2024, the TVL has already crossed the $360 million mark.

While this figure is still far off from the likes of Ethereum and BSC which continue to dominate the DeFi TVL, it puts it ahead of some heavy hitters in the game. For example, the Bitcoin TVL is currently sitting at $298.8 million, which means SUI TVL is much higher than that of Bitcoin.

Then again, another network which is currently lagging behind SUI is the Aptos TVL. The Aptos blockchain, which was launched to much fanfare back in 2022, is sitting at a TVL of $133 million. This means that SUI’s TVL is more than 2x higher than that of Aptos .

Other DeFi networks which SUI has surged ahead of include the likes of Kava at a TVL of $251 million, Near at a TVL of $94 million, and Metis at a TVL of $124 million. With its TVL figures, SUI is now the 13th-largest DeFi network.

DeFi Making A Comeback

After a long stretch of poor performance, the DeFi market looks to be making its comeback in 2024. As DeFiLlama data shows, after the market peaked at a TVL of almost $245 billion in 2022, it dropped more than 50%, spending the majority of 2023 trailing below $70 billion.

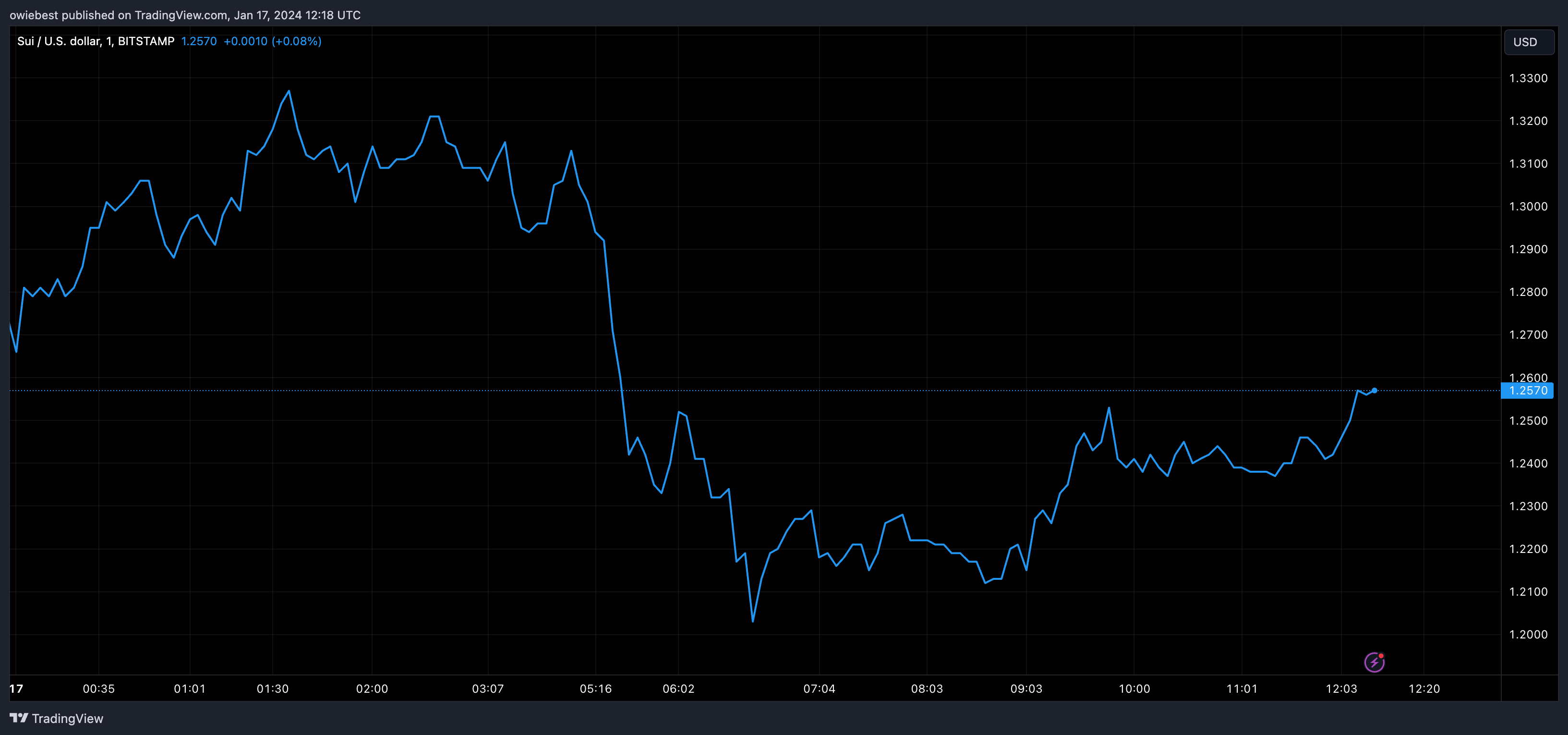

However, as crypto market sentiment has improved, so has the DeFi TVL. The TVL has grown from its October 2023 lows of $47 billion to more than $72 billion so far in 2024. This is as a result of the likes of SUI gaining more adoption and their token prices also increasing.

As expected, Ethereum dominates the majority of this TVL, currently sitting at $43.743 billion. The Tron and BSC networks are the second and third-largest, with TVLs of $8.14 billion and $5.41 billion, respectively.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinglass report interprets Bitcoin's "life-or-death line": 96K becomes the battleground between bulls and bears—Is the ETF capital withdrawal an opportunity or a trap?

Bitcoin's price remains stable above the real market mean, but the market structure is similar to Q1 2022, with 25% of supply currently at a loss. The key support range is between $96.1K and $106K; breaking below this range will increase downside risk. ETF capital flows are negative, demand in both spot and derivatives markets is weakening, and volatility in the options market is underestimated. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

Ethereum undergoes "Fusaka upgrade" to further "scale and improve efficiency," strengthening on-chain settlement capabilities

Ethereum has activated the key "Fusaka" upgrade, increasing Layer-2 data capacity eightfold through PeerDAS technology. Combined with the BPO fork mechanism and the blob base price mechanism, this upgrade is expected to significantly reduce Layer-2 operating costs and ensure the network’s long-term economic sustainability.

Down 1/3 in the first minute after opening, halved in 26 minutes, "Trump concept" dumped by the market

Cryptocurrency projects related to the Trump family were once market favorites, but are now experiencing a dramatic collapse in trust.