Bitcoin price rises as spot ETF's start first day of trading

Spot bitcoin ETFs are live in a first day of trading in the U.S.

Yahoo Finance showed both BlackRock's IBIT and Grayscale's GBTC as trending tickers.

"While focus as been on bitcoin, a big takeaway is that ETFs continue to show they can handle just about anything," Bloomberg Intelligence analyst Eric Balchunas said on X, posting a chart that showed the trading profile of the spot bitcoin ETFs in Europe, "where spreads and prem/disc have tightened. Expecting same in U.S. over time."

"What happened to selling the news?" he said in a follow up post.

Volumes to come

All eyes will be on volumes, with Valkyrie co-founder and CIO Steven McClurg saying he expects $200 million to $400 million of investors’ funds coming to Valkyrie’s ETF, and all participants might see $4 billion to $5 billion of inflows over the first couple of weeks.

VanEck estimated that $1 billion of funds would flow into these products over the first few days, and $2.4 billion within a quarter. Galaxy anticipates inflows of $14 billion within the first year. Bitwise said it reckons the market for spot bitcoin ETFs will reach roughly $72 billion within five years.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

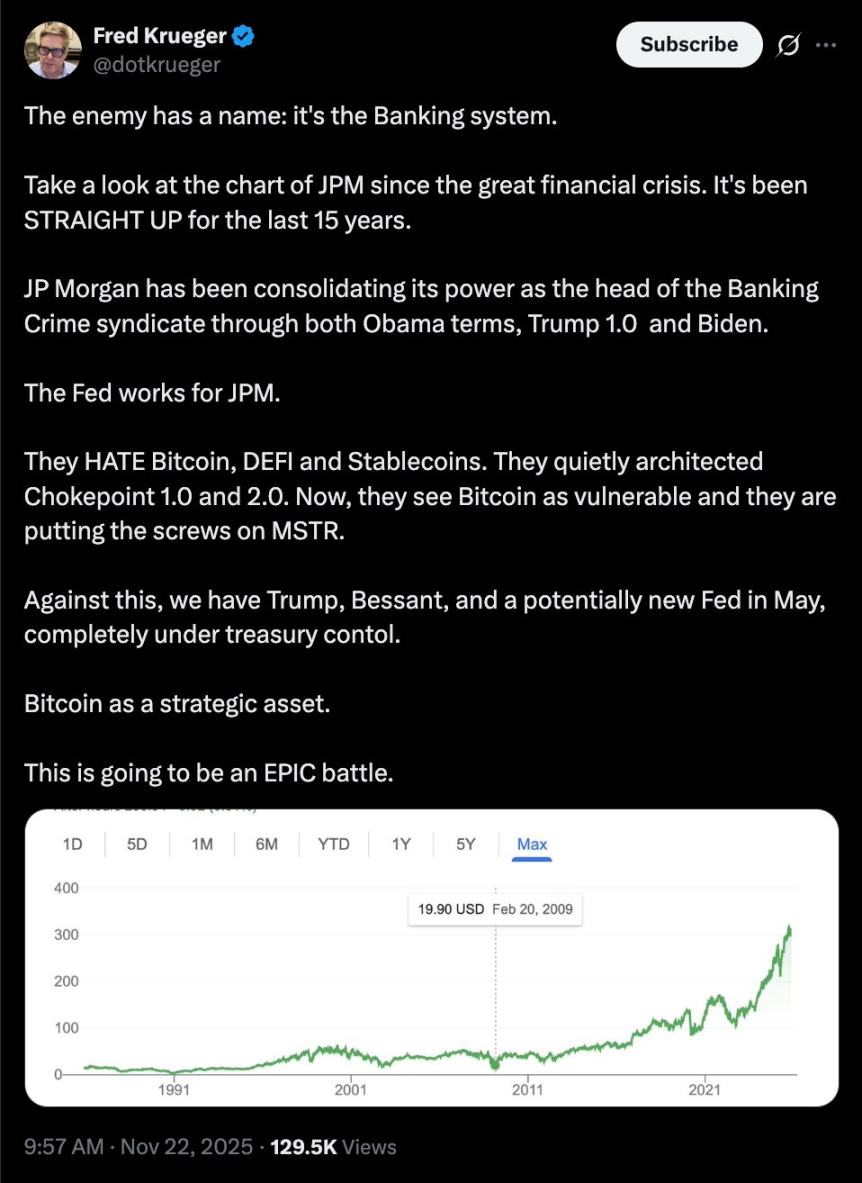

MSTR to be "excluded" from the index, JPMorgan research report "unexpectedly implicated", crypto community calls for "boycott"

JPMorgan warned in a research report that if Strategy is eventually removed, it could trigger a mandatory sell-off worth $2.8 billion.

It's already 2025, and this billionaire collector is still buying NFTs?

Adam Weitsman recently acquired 229 Meebits, further increasing his investment in the NFT sector.

Why do traditional media professionals criticize stablecoin innovation?

Are stablecoins truly "the most dangerous cryptocurrencies," or are they "a global public good"?

Crypto Market Faces Intense Pressure from Massive Coin Unlocks

In Brief Cryptocurrency market faces over $566 million in coin unlocks next week. Single-event and linear unlocks may impact market supply and investor sentiment. Investors are wary of potential short-term price fluctuations.