Vanguard: Raising interest rates establishes the foundation for risk-adjusted returns for long-term investors

Global asset management giant Vanguard stated in its 2024 economic and market outlook that higher interest rates force consumers and businesses to be more cautious in their borrowing decisions, increase the cost of capital, and encourage savings. For governments, high interest rates will compel them to reexamine their fiscal perspectives in the short term. Although volatility is expected to increase during the process of market adaptation to the new normal, an interest rate hike is a welcomed development. Higher rates establish a solid foundation for risk-adjusted returns for highly diversified long-term investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

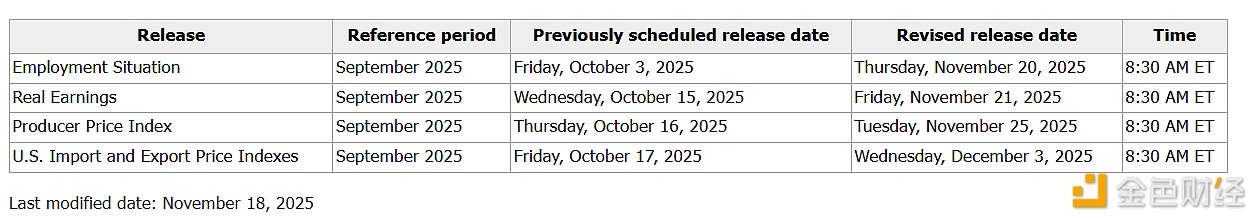

Release dates set for new batch of US data, including CFTC weekly report and PPI

The Dow Jones Index closed down 498.5 points, with the S&P 500 and Nasdaq also declining.

All three major U.S. stock indexes closed lower.