Wood Says ARK Is ‘Taking Profits’ as It Sells $26 Million in COIN

The sale comes a day after ARK sold $50.5 million of the crypto exchange’s stock.

Cathie Wood’s ARK Invest is offloading more Coinbase shares after the stock closed Monday at $105.55, just shy of its one-year high of $107.

A trade disclosure sent out by the growth-focused fund shows that it offloaded 248,838 of COIN, worth just over $26 million, based on Monday’s closing price.

ARK has been selling off its holdings of COIN as the stock continues to perform well. On July 14, it disclosed it had sold 480,000 COIN shares across three funds, based on the day’s closing prices. The previous week as the stock rallied.

“We’re very positive about Coinbase, especially in light of the court ruling for Ripple against the SEC,” . “We’re simply taking profits and reallocating the capital to some laggards.”

Wood recently said that since Elon Musk took it private last year.

Edited by James Rubin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Turmoil and AI Breakthroughs: Grok 4.1, Gemini 3, Cloudflare Outage

AI Confidence and Economic Concerns Set Crypto Strength Against Market Downturn

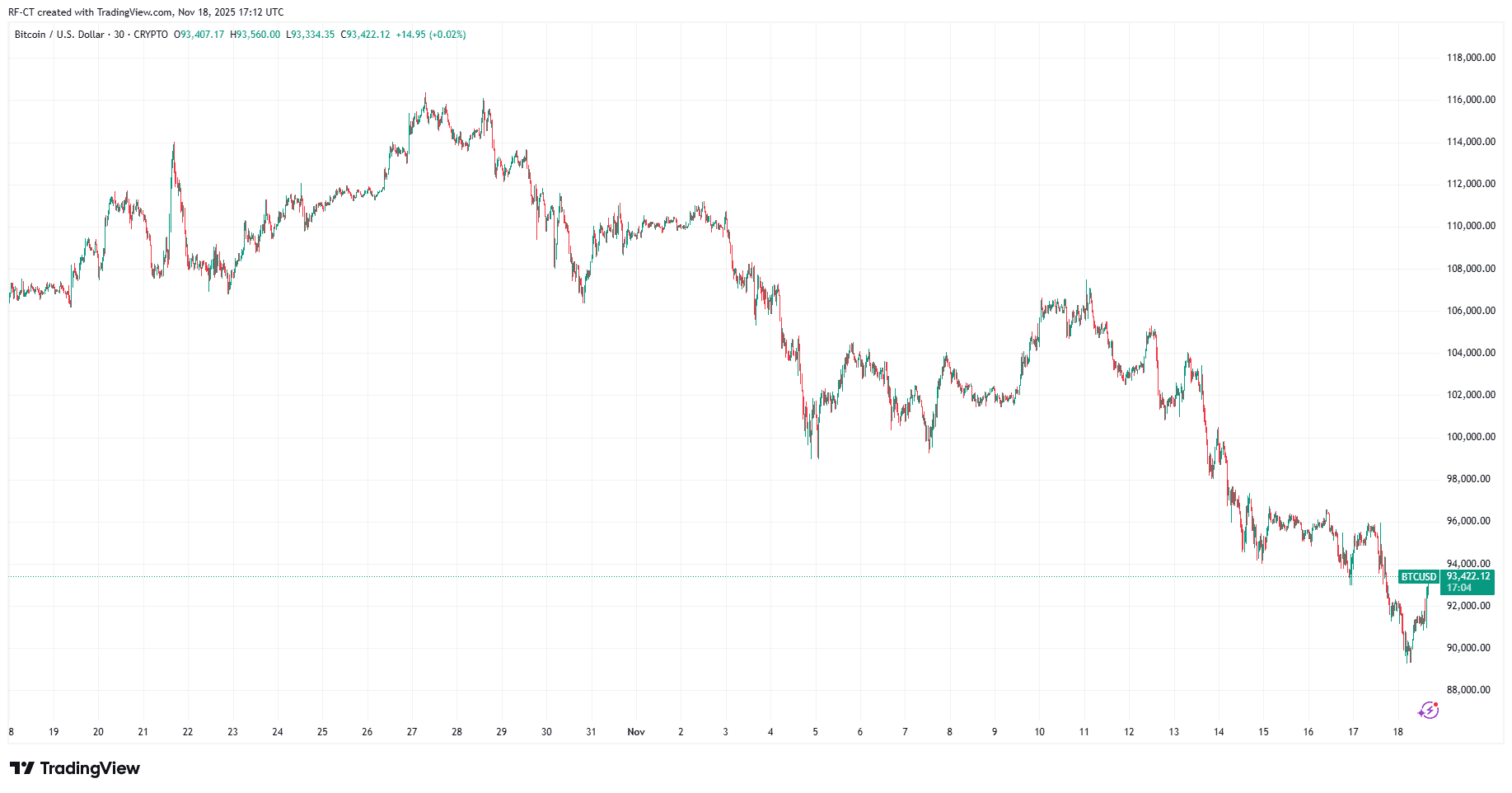

- U.S. stock indexes fell on Nov. 18, 2025, while crypto and AI-linked stocks showed resilience amid broader market weakness. - Nvidia's upcoming earnings and 54% YOY EPS forecast fueled gains in correlated stocks like TSMC (+41% YTD) and SMCI (+15% YTD). - Bitcoin rebounded 1% temporarily, but analysts warned crypto remains vulnerable to inflation fears and $1B+ leveraged liquidations. - Home Depot's 3% premarket drop dragged on the Dow after missing Q3 earnings and slashing profit forecasts amid housing

Solana's Breakthrough: Ushering in a New Age of Fast and Scalable Smart Contracts?

- Solana's 2025 upgrades (Firedancer, Alpenglow) achieved 1M TPS and sub-150ms latency, outperforming Ethereum and Sui . - Enterprise partnerships with Visa , PayPal , and Stripe leverage Solana's speed and low fees for payments and remittances. - Institutional ETF inflows and energy-efficient proof-of-history consensus boost Solana's appeal for green finance. - Challenges include competition from Ethereum upgrades, stablecoin liquidity declines, and regulatory risks.

Trump’s Federal Reserve Shakeup Raises Concerns Over Stagflation and Divides Within GOP

- Trump announced his Fed chair pick but withheld the name, criticizing resistance to removing Powell before his 2026 term ends. - Shortlisted candidates include Waller, Bowman, and Rieder, with Trump hinting at a "standard" choice amid political tensions. - The dispute with Rep. Greene over Epstein files highlights GOP fractures, as Trump accused her of betraying party loyalty. - Critics warn politicizing the Fed risks stagflation, while the Epstein files debate underscores transparency vs. loyalty tensio