Nvidia Earnings Preview: 50% Profit Surge Poised to Move NVDA Stock

As global financial markets struggle under the weight of high interest rates, suppressed economic growth, and investor caution, a new focal point has emerged: Nvidia’s upcoming earnings report. Once a leading chip designer mostly known to gamers, Nvidia (NASDAQ: NVDA) is now the epicenter of artificial intelligence (AI) innovation and perhaps the most critical bellwether for technology-driven growth in today’s stock market.

With Nvidia’s quarterly numbers set for release this week, the stakes have never been higher. Here’s why everyone from Wall Street professionals to retail traders—and even policymakers—are watching Nvidia’s next earnings with unprecedented attention.

Source: Google Finance

Why Nvidia’s Earnings Are a Global Event

A Leader in a Weak Market

After more than a year of tightening monetary policy, volatility and underperformance have plagued traditional sectors like finance, energy, and industrials. Technology—specifically AI—has become the lone beacon of optimism in an otherwise muted global equity landscape. Nvidia’s unique position in the AI semiconductor supply chain has made its earnings a barometer for risk appetite, not only for U.S. tech investors but for the global financial ecosystem.

-

Sector Ripple Effect: In May 2023, Nvidia’s stunning guidance triggered a $184 billion increase in its market cap overnight, catalyzing a broader rally in semiconductor and megacap tech shares.

-

AI’s Poster Child: No other company is as central to the current AI wave. Nvidia supplies advanced GPUs—notably the H100, previous A100, and its new Blackwell architecture—that power foundational models at tech giants like Microsoft, Google, Amazon, Meta, and OpenAI.

A Test for Market Sentiment

Because Nvidia represents both rare, robust growth and massive valuation, its earnings have become the “litmus test” for whether the so-called “AI trade” has staying power—and whether tech leadership can eventually spark a broader market revival.

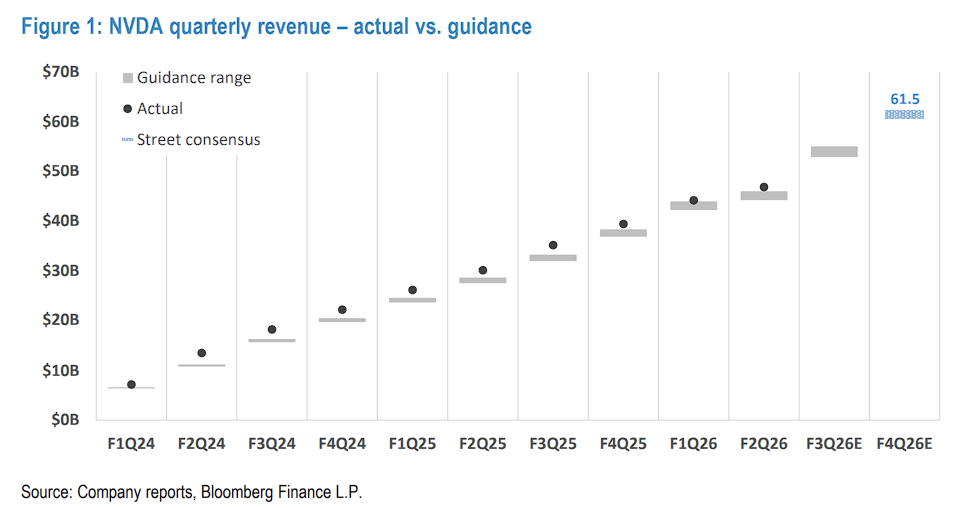

Recent Earnings Performance: How Nvidia Keeps Beating Expectations

Nvidia has consistently delivered impressive growth since AI demand exploded in early 2023. Recent financial tallies highlight its dominance:

-

Q1 Fiscal 2025 Results:

-

Revenue: $26.0 billion (up 262% year-over-year)

-

Earnings Per Share (EPS): $5.98 non-GAAP (vs. $1.09 a year ago)

-

Gross Margin: 78% (up from 66.8% a year ago)

-

Data Center Revenue: $22.6 billion (up 427% YoY), now 86% of total revenue

-

Net income: $14.9 billion

-

Full-Year Fiscal 2024:

-

Revenue: $60.9 billion (up 126% YoY)

-

Net Income: $29.8 billion (up 581% YoY)

-

Market cap surge: From $500B to over $3 trillion in under 18 months, briefly making Nvidia the world’s second-most valuable company

These blowout numbers have repeatedly set off sharp post-report market moves. Nvidia stock has soared more than 5x since the start of 2023, driving bullish sentiment across AI, chip, and growth stock ETFs.

What to Watch in the Upcoming Earnings Report

Revenue and Guidance

Analyst expectations for Q2 fiscal 2025 are extremely high—consensus revenue estimates are in the $28–$29 billion range, which would represent around 120% year-over-year growth. Investors will scrutinize whether Nvidia can extend such hypergrowth, and whether management affirms full-year guidance.

Data Center Segment and AI Chip Demand

All eyes are on the continued traction for the H100 GPU and ramp-up of the Blackwell platform. Major customers like Amazon, Microsoft, Google, and Meta are in an AI “arms race.” Clarity around order books, visibility of supply, and whether customer demand is peaking or just beginning will be crucial.

Gross Margins

Margins have soared thanks to AI chips’ premium pricing and supply/demand imbalance. Any signs that gross margins could compress—due to competition or a normalization of supply—could shake confidence in Nvidia’s pricing power.

Geopolitical and China Exposure

Nvidia faces ongoing export restrictions to China for its highest-end chips, while demand from U.S. hyperscalers remains robust. Management’s commentary on China sales and the effectiveness of alternative “A800”/L40S chips will be watched closely.

Ecosystem Expansion and Partnerships

Progress with cloud companies, software developers (AI Enterprise suite), and sector-specific collaborations (healthcare, automotive, digital twins) may provide insight into Nvidia’s long-term vision past simple hardware sales.

How Might NVDA Stock React?

Nvidia’s share price is notoriously volatile around earnings:

-

Historical Moves: Over the past four quarters, Nvidia has seen after-hours price moves ranging from +10% to +25% immediately following its release.

-

Options Markets: Current implied volatility points to a ~7–10% post-earnings move.

-

Market Impact: Nvidia’s results have triggered multi-hundred-billion-dollar swings in global equity value; after its May 2023 and February 2024 reports, entire semiconductor ETFs and technology indices rallied in sympathy.

Sentiment Risks:

While Nvidia’s core business remains exceptionally strong, any sign of demand “normalizing,” margin erosion, or slower large client purchasing could result in sharp short-term downside—especially given the company’s $3 trillion+ valuation and the crowded long trade.

Conclusion: The “Earnings Anchor” for Markets

With global economic uncertainty persisting, Nvidia’s latest quarterly report will act as an “anchor” for market sentiment around all things AI and technology. Its results—along with its outlook for data center spending, new product adoption, and global chip demand—will likely set the tone for both U.S. tech stocks and the broader risk environment for weeks to come.