Ethereum's "DA Dawn": How the Fusaka Upgrade Could Make Celestia and Avail Seem "Redundant"?

The article discusses the concept of modular blockchains and Ethereum's performance improvement through the Fusaka upgrade. It analyzes the challenges faced by DA layers such as Celestia and highlights Ethereum's advantages. The summary was generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated.

In the crypto space, we have witnessed the rise and fall of countless grand visions. Many teams have tried to carve out a share of Ethereum’s market, always citing the same reasons: the base chain isn’t good enough—too expensive, too slow, not scalable, or too restrictive for developers. Recent examples include Plasma, which launched an independent stablecoin Layer-1 (L1), and Monad, which focuses on high-throughput EVM L1.

But over time, Ethereum has repeatedly disproved these accusations. The Merge upgrade proved that Ethereum could indeed transition to Proof of Stake (PoS); the Dencun upgrade shattered the narrative that Rollups (Layer-2 scaling solutions that help reduce Ethereum network load) would always be too expensive to scale.

Last Thursday, Ethereum officially launched the Fusaka upgrade, powerfully challenging the narrative that “Ethereum cannot meet the high-throughput needs of Rollups”—a premise upon which many modular blockchains depend for survival.

In today’s story, we’ll explore the essence of modular blockchains and what changes the Fusaka upgrade has brought.

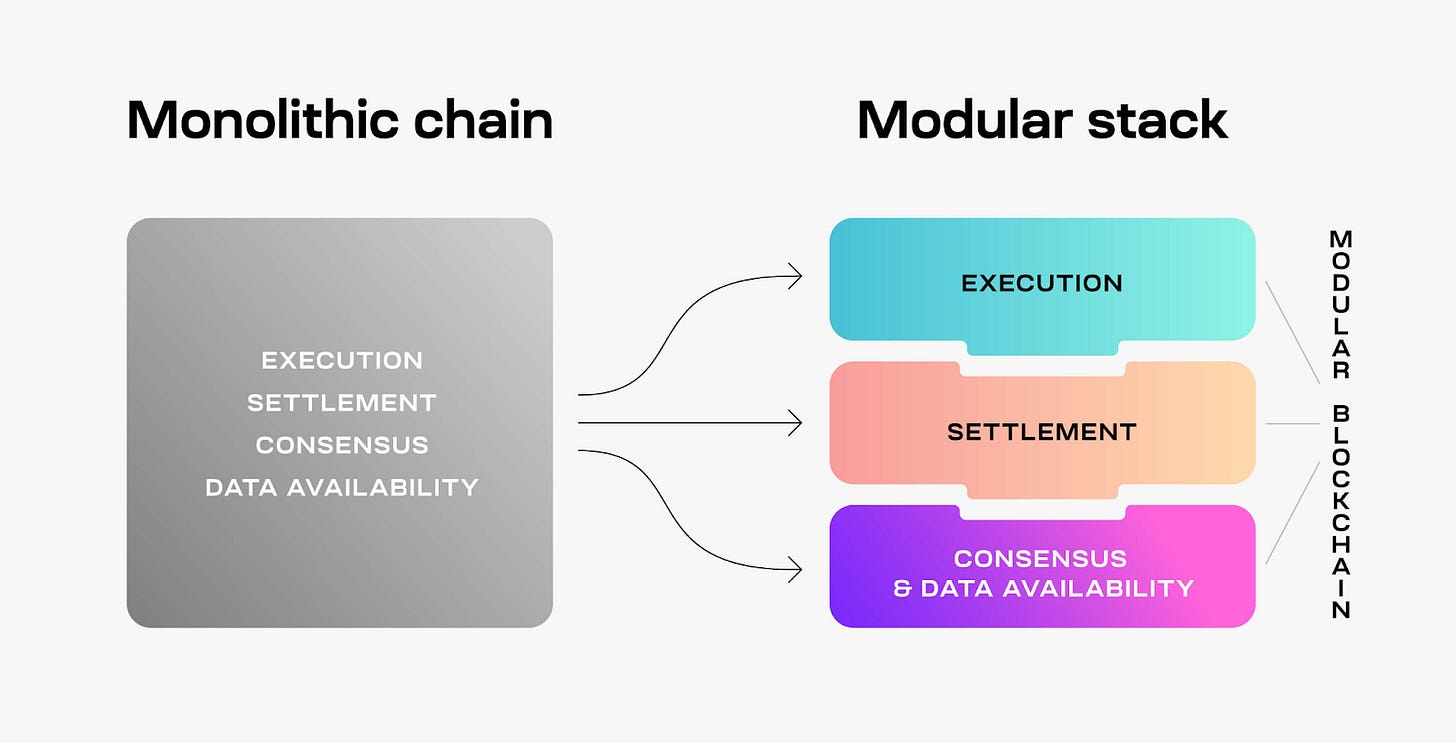

At the end of 2023, a team with deep understanding of distributed systems proposed the concept of “modular blockchains”—building a blockchain composed of three modular components: execution, settlement, and data availability (DA). This team was Celestia.

The Celestia network was designed to provide one piece of the puzzle: data availability (DA). The core of DA is to prove that data has been published to the network. Thus, when a chain produces a new block, nodes verify DA by downloading all the data.

Celestia’s idea is to make it easier for anyone to launch a blockchain by leveraging the “puzzle pieces” of existing infrastructure companies. Project teams can choose Arbitrum Orbit for execution, Ethereum for settlement, and perhaps Celestia, EigenDA, or Avail DA to meet data availability needs.

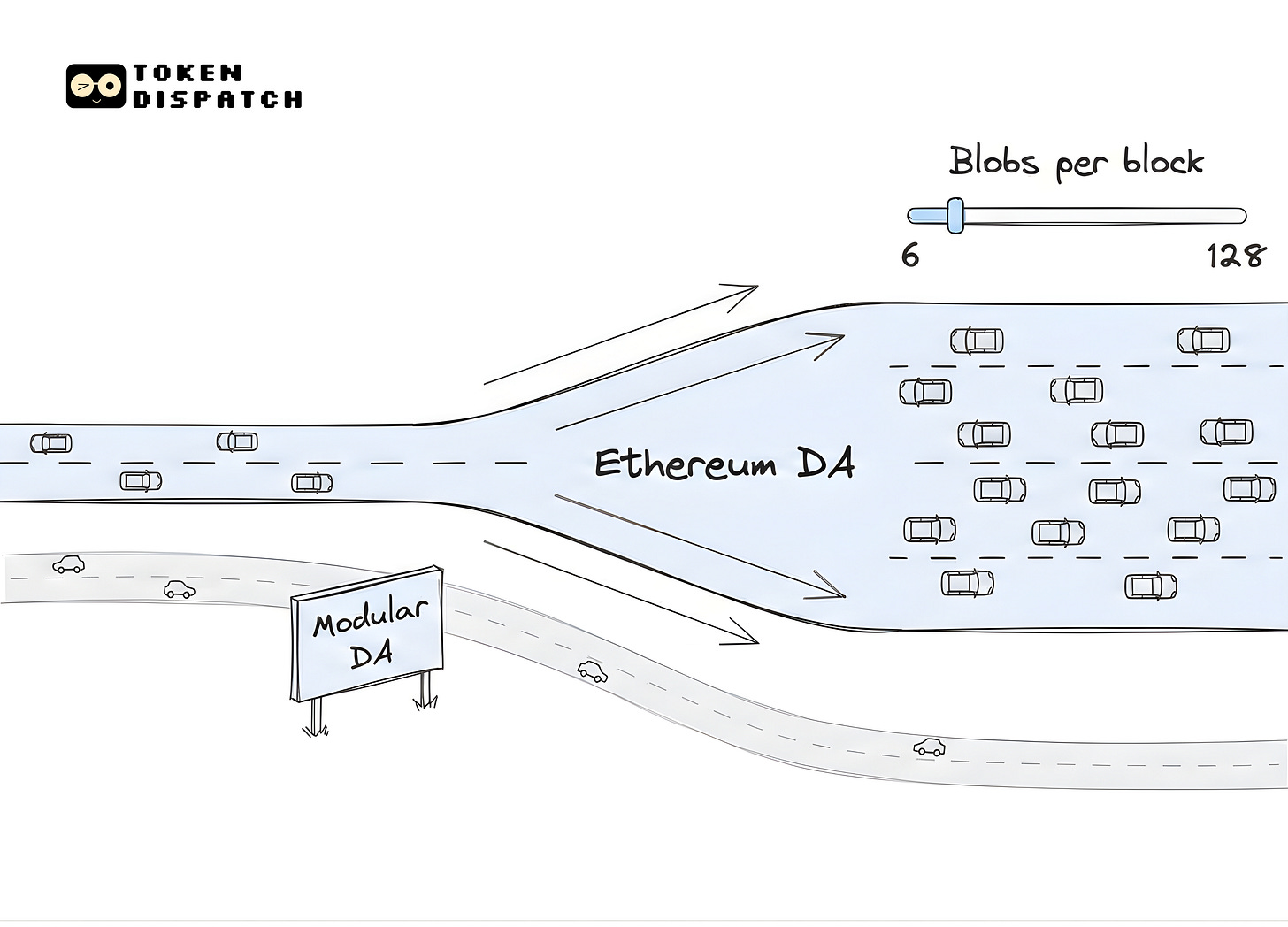

Celestia’s original bet was that in 2023, Ethereum’s low throughput and high gas costs would make it unsuitable for Rollups with high DA throughput requirements.

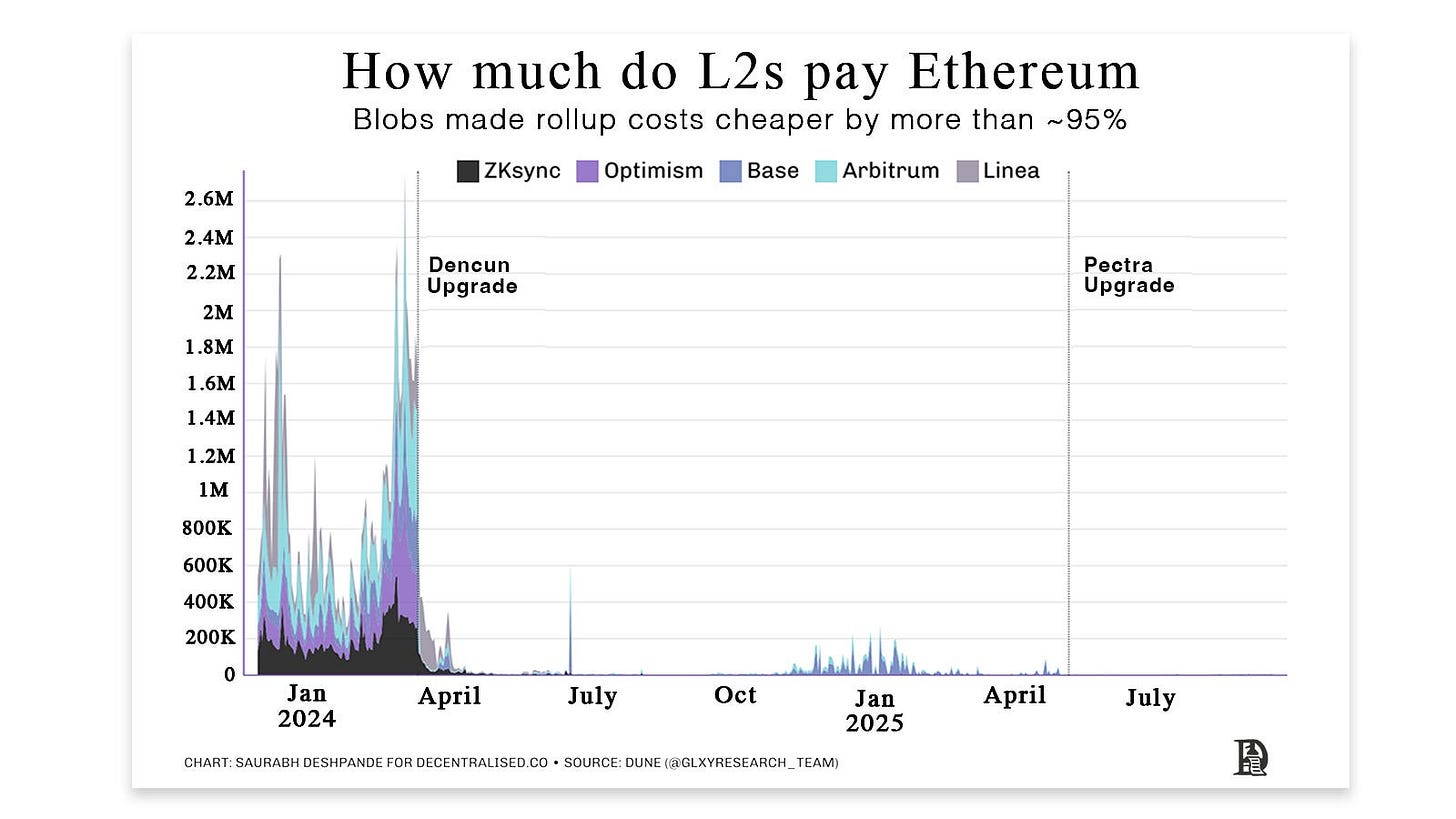

At that time, Rollups on Ethereum had thin profit margins. Teams could often only retain about 20% of the fees they generated, and in some cases, the settlement fees they paid even exceeded the revenue earned from users. The subsequent Dencun and Pectra upgrades changed this equation, lowering settlement costs and improving the economics for Rollup operators.

The Dencun upgrade introduced a new space called Blobs to store Rollup data, replacing the previously used “calldata.” Blobs are about 95% cheaper than calldata. The Dencun upgrade was the first step in making Rollup costs more affordable.

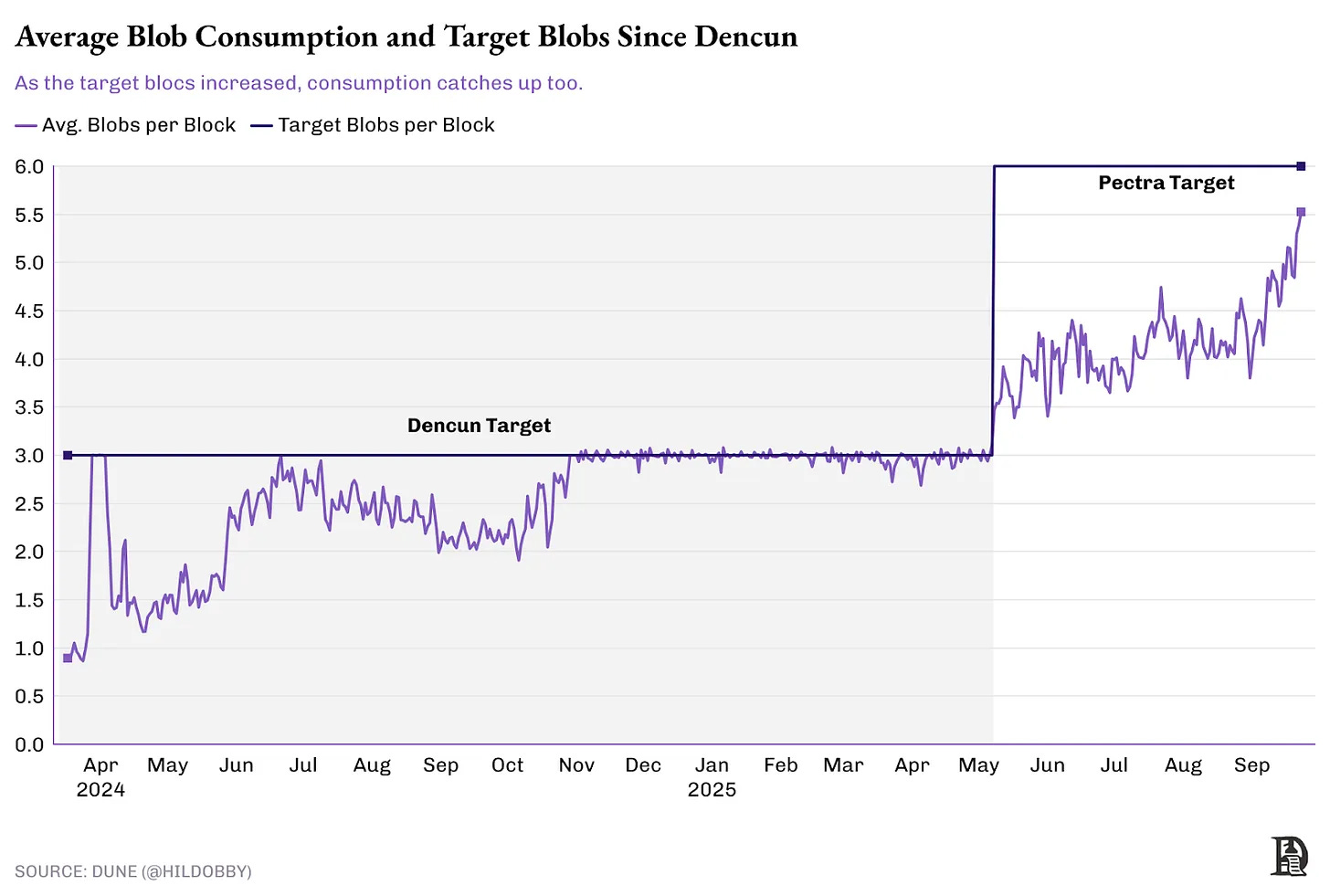

Next came Pectra. This upgrade increased the number of Blobs per block. If the first step was to carve out a dedicated space for Rollup data, the second step was to increase its capacity. With Pectra, the target was raised to 6 Blobs per block.

Rollups passed on the cost savings to users. As a result, L2 transaction costs dropped significantly, from 50 cents to about 3-4 cents.

Celestia’s vision is to separate data availability from execution, enabling easy blockchain scaling by reducing the load on the underlying L1. The future it hopes to see is: multiple Rollups running on a single DA layer.

Although the vision of “multiple Rollups” has come true, this market has been captured by Ethereum. These upgrades have greatly benefited Ethereum, which now provides DA solutions for more than 55 Rollups and supports over 40 billions USD in total value locked (TVL).

Meanwhile, DA layers are now struggling for adoption. In the past 24 hours, Celestia earned only $67 in daily fees, processing 1,600 Blobs; in contrast, Ethereum processed 41,000 Blobs.

@L2Beat

These numbers will soon seem trivial.

With Ethereum’s latest Fusaka upgrade, PeerDAS has been implemented on-chain—a new data sampling method that significantly improves the efficiency of verifying data availability.

Each node checks tiny, random data fragments and collectively ensures the network has the complete data. Through sampling, Ethereum increases its capacity from today’s target of about 6 Blobs per block to about 10-15 Blobs per block, and this mechanism allows for the gradual increase of Blobs per block in the future without requiring a hard fork. Blob capacity will double in a month, and over time will gradually increase from 10 Blobs per block to 128. All of this happens without forcing home stakers (small validators) to upgrade their hardware.

The increase in block space supply lowers Blob prices and L2 operating costs, making it easier to maintain a profitable L2.

This reminds me of 2023, when DA chains like Avail and Celestia would publish comparison charts showing their throughput data outperforming Ethereum’s EIP-4844 Denarius upgrade. At that time, DA layer throughput was indeed much higher than Ethereum’s near-term future. However, with the Fusaka upgrade, Ethereum is expected to reach a cap of 128 Blobs per block, which is about 16MB/block, twice the capacity currently offered by Celestia.

@Availproject

Fusaka marks a significant milestone for Ethereum. The chain has successfully expanded its transaction capacity without squeezing out home stakers by raising hardware requirements, thus avoiding network centralization.

Fusaka is a celebration of Ethereum’s move toward a “Rollup-centric” future. From L2 transaction prices matching other transactions in 2023 to today’s PeerDAS Blobs, the network has come a long way.

Surprisingly, PeerDAS is just one of 13 EIPs (Ethereum Improvement Proposals) implemented in this historic upgrade. In addition to PeerDAS, Fusaka also includes an increase in gas limits and introduces a Blob base fee limited by execution costs, ensuring that Blob fees do not drop to zero. As a result, this may increase validator income per Blob.

Rollups now have a more predictable and scalable data layer, eliminating the fear of network overload during usage peaks. This stability gives teams room to focus on infrastructure upgrades: they can decentralize sequencers, experiment with lower-latency designs, and drive smoother user experiences without worrying that DA costs will suddenly bite them back.

However, it’s worth noting that after Fusaka, Blob capacity starts at 10 per block and is expected to only double monthly through built-in network mechanisms. Whether these monthly increases can be smoothly rolled out will be the real test for PeerDAS in practice. The same goes for Blob pricing. While the new price floor strengthens validator incentives, the impact on the Rollup user experience is not yet fully clear.

In the coming months, I’ll be watching for interesting second-order effects Fusaka has on Rollups and their user experience. Once I have updates, I’ll come back to share them.

Until then, enjoy this holiday season.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | SEC Expected to Issue "Innovation Exemptions" for the Crypto Industry in "About a Month"

The SEC is expected to issue an innovation exemption for the crypto industry. The UK "Digital Assets and Other Property Act" has come into effect. BlackRock's CEO revealed that sovereign wealth funds are buying bitcoin. Bank of America recommends clients allocate to crypto assets. Bitcoin selling pressure is nearing its end. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model continues to iterate.

a16z: Inefficient governance and dormant tokens pose a more severe quantum threat to BTC.

Deep Reflection: I Wasted Eight Years in the Crypto Industry

In recent days, an article titled "I Wasted Eight Years in the Crypto Industry" has garnered over a million views and widespread resonance on Twitter, directly addressing the gambling nature and nihilistic tendencies of cryptocurrencies. ChainCatcher now translates this article for further discussion and exchange.