Zcash (ZEC) Price Loses A Chunk of Its 1,442% Rise, Was It A Bubble?

Zcash is facing one of its harshest corrections of the year as the altcoin’s price continues to slide, erasing a major portion of its October surge. The sharp drop has raised an important question among investors: was the recent “privacy tokens” hype an unsustainable bubble, or is there still long-term value behind ZEC’s fundamentals? Zcash

Zcash is facing one of its harshest corrections of the year as the altcoin’s price continues to slide, erasing a major portion of its October surge.

The sharp drop has raised an important question among investors: was the recent “privacy tokens” hype an unsustainable bubble, or is there still long-term value behind ZEC’s fundamentals?

Zcash Suffers Losses

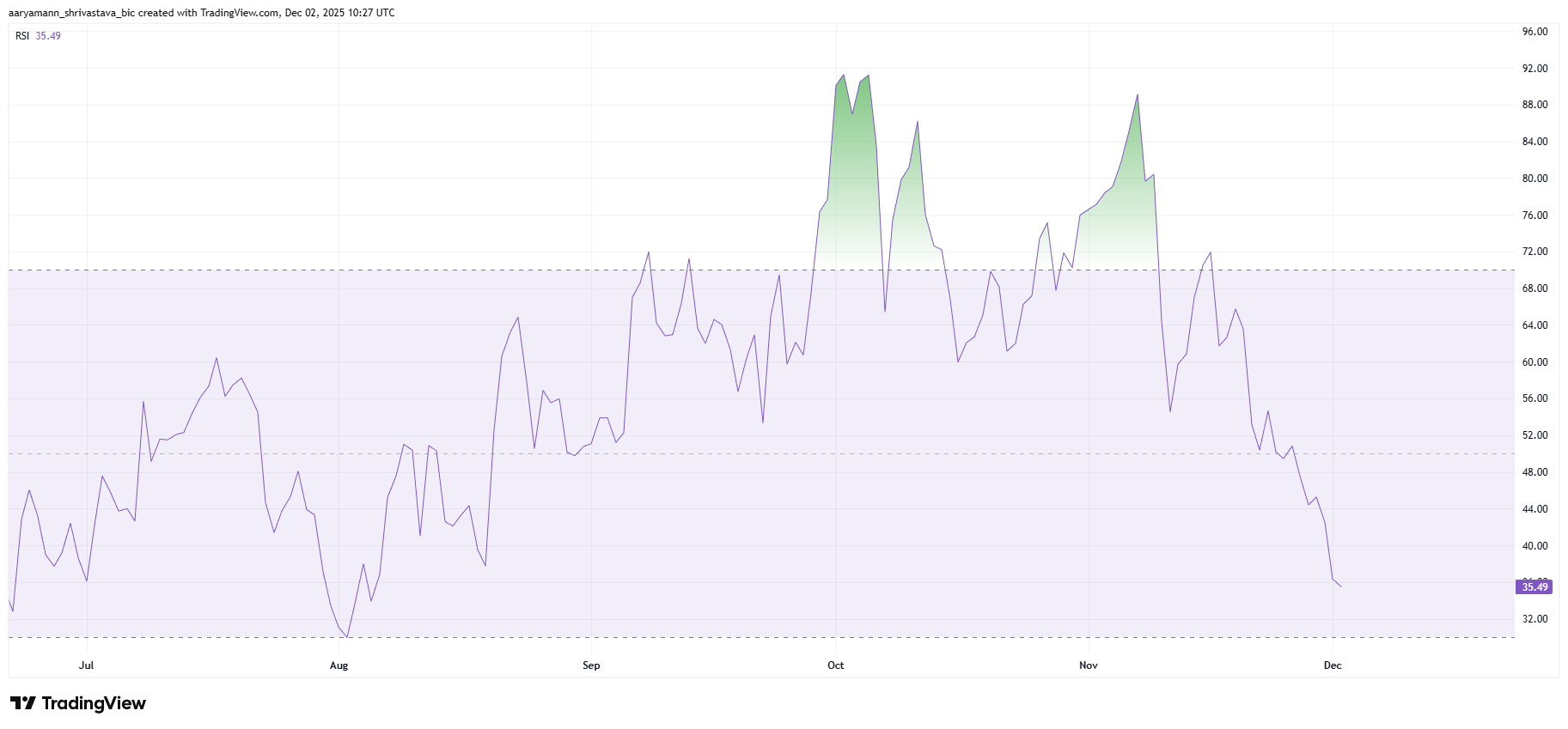

The Relative Strength Index (RSI) reflects the heavy bearish pressure surrounding Zcash. The indicator has slipped below the neutral 50.0 mark into negative territory, a sign that sellers are firmly in control.

This downward shift is often associated with weakening recovery potential, especially when momentum continues to build on the bearish side. For ZEC to show any meaningful reversal signal, the RSI would need to hit oversold conditions, where a bounce becomes statistically more likely.

However, ZEC has not yet reached that stage, leaving its trajectory vulnerable to further downside. The lack of clear reversal signals highlights the current uncertainty, suggesting that buyers remain hesitant to re-enter despite the steep discount from recent highs.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ZEC RSI. Source:

ZEC RSI. Source:

ZEC RSI. Source:

ZEC RSI. Source:

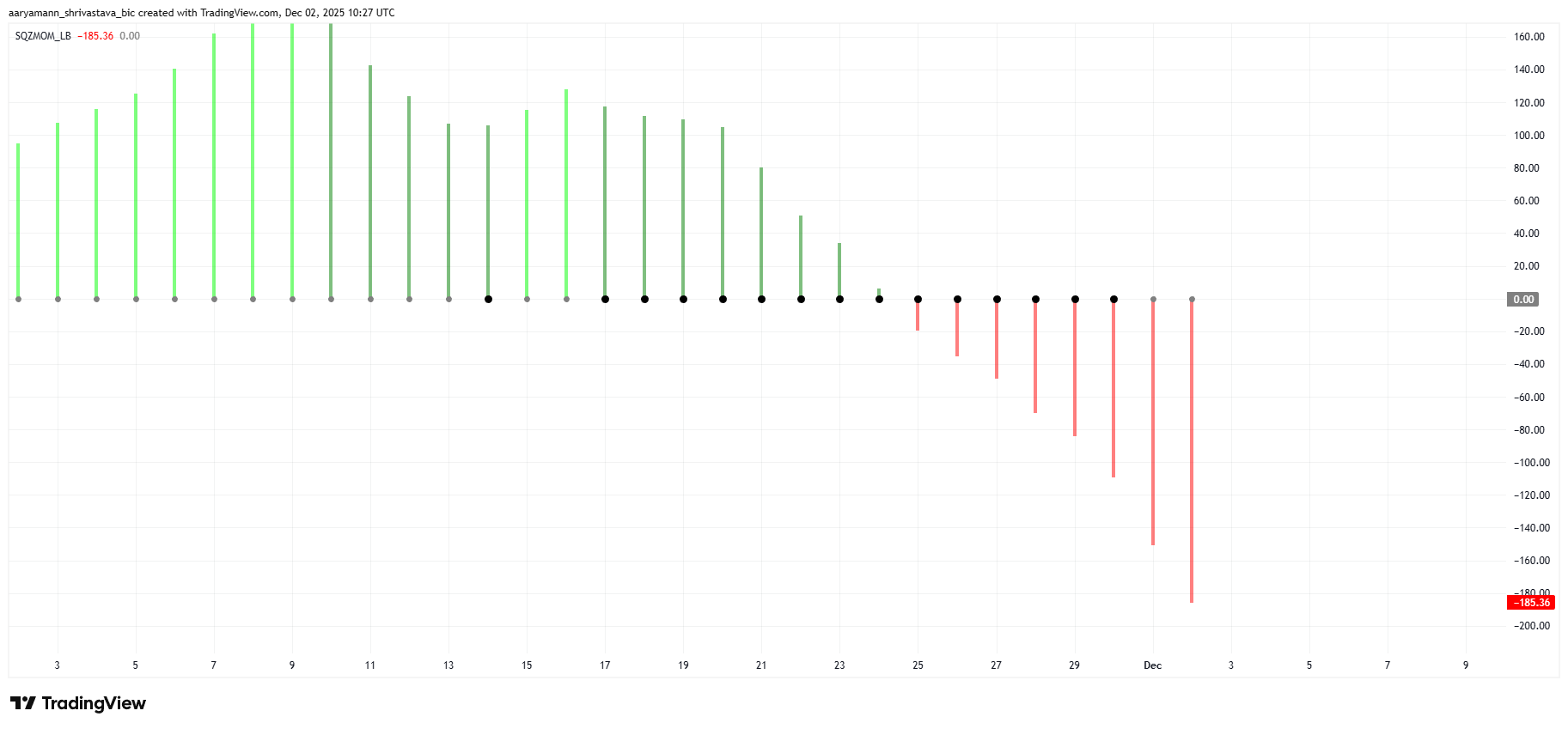

The Squeeze Momentum Indicator adds another layer of concern. Earlier this month, the indicator showed a buildup of compression, typically a prelude to major volatility. That squeeze has now released to the downside, aligning with a strong wave of bearish momentum. When a squeeze release happens during a downtrend, it often accelerates losses rather than stabilizing price action.

This shift confirms that bearish forces are present and also intensifying. Combined with the market-wide cooling of the privacy-coin narrative, the indicator suggests more volatility and downward pressure may lie ahead for Zcash.

ZEC Squeeze Momentum Indicator. Source:

ZEC Squeeze Momentum Indicator. Source:

ZEC Squeeze Momentum Indicator. Source:

ZEC Squeeze Momentum Indicator. Source:

ZEC Price May See Further Declines

ZEC previously posted a massive 1,442% rally during the peak of the privacy-token narrative. That momentum faded at the start of November, and the altcoin has since crashed 56% from its highs.

A staggering 43% of that loss occurred in just the last week, pushing ZEC down to $323. If this trend continues, Zcash is likely to break below the $300 support level and fall toward $260, or even $204, erasing more of its earlier gains.

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

However, Arthur Hayes believes crypto markets follow distinct yearly narratives. According to him, 2025 revolved around AI-linked tokens and the rapid expansion of stablecoins, but 2026 will center on privacy. He says this pivot could spark renewed interest in privacy-driven cryptocurrencies and the underlying tech that supports them.

Thus, if buyers return at these discounted levels, ZEC could attempt a bounce from the $344 area. A recovery toward $442 and eventually $520 would be needed to invalidate the current bearish outlook.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash’s Unpredictable Rise: Immediate Drivers and Future Outlook for Privacy

- Zcash (ZEC) rebounded 20% after a 55% drop, testing $375 as liquidity events and technical indicators fueled short-term optimism. - RSI/MACD signals suggest potential $475 breakout if bulls reclaim $375, though ZEC remains 57% below its 2025 peak. - Institutional adoption grows with Grayscale Zcash Trust assets surging 228%, driven by optional privacy tech attracting both retail and institutional users. - Regulatory scrutiny under MiCA and FinCen rules, plus Zcash's hybrid privacy model vs. Monero/Dash,

Zcash Halving and Its Impact on the Cryptocurrency Market

- Zcash’s 2028 halving will reduce block rewards by 50%, mirroring Bitcoin’s scarcity-driven model. - Historical data shows pre-halving price surges, fueled by FOMO and social media-driven hype cycles. - Behavioral economics highlight crypto markets’ reliance on narratives over fundamentals, with sentiment driving 30% of short-term price swings. - Zcash faces adoption challenges despite robust privacy tech, as regulatory uncertainty and competition limit its market share growth. - The 2028 event tests whet

Algo Slips 0.22% as Market Volatility and Investor Lawsuits Intensify

- ALGO fell 0.22% on Dec 7, 2025, marking a 60.15% annual decline amid broader market turbulence. - Investor lawsuits against Alvotech (ALVO) and agilon health (AGL) triggered 34-51.5% stock drops over alleged misrepresentations. - Rising litigation in healthcare/biotech sectors highlights investor demands for corporate transparency and regulatory compliance. - ALGO's decline reflects sector-wide risk aversion rather than direct legal ties, with analysts predicting prolonged caution until regulatory clarit

The Importance of Teaching Financial Skills Early for Lasting Wealth Accumulation

- Early financial education reduces cognitive biases like anchoring and overconfidence, improving investment decisions and wealth accumulation. - College-level programs enhance critical thinking, leading to measurable outcomes like higher credit scores and reduced debt in states like Georgia and Texas. - Long-term benefits include compounding returns, with Utah and Chile showing increased savings rates and retirement planning due to mandatory financial literacy. - Addressing systemic gaps, educated investo